NortonLifeLock (NLOK) Q1 Earnings Beat Estimates, Sales Miss

NortonLifeLock Inc. NLOK reported mixed first-quarter fiscal 2023 results, wherein earnings surpassed the Zacks Consensus Estimate but revenues missed the same. However, both the top and bottom lines improved on a year-over-year basis.

The consumer cyber safety provider reported non-GAAP earnings of 45 cents per share, beating the Zacks Consensus Estimate by three cents. The bottom line improved by 7% from the year-ago quarter’s earnings of 42 cents per share.

The company’s quarterly non-GAAP revenues increased 2% year over year to $707 million, which missed the Zacks Consensus Estimate of $711.3 million. Constant currency-adjusted revenues on a non-GAAP basis were $735 million, 6% higher than the year-ago quarter’s reported figure.

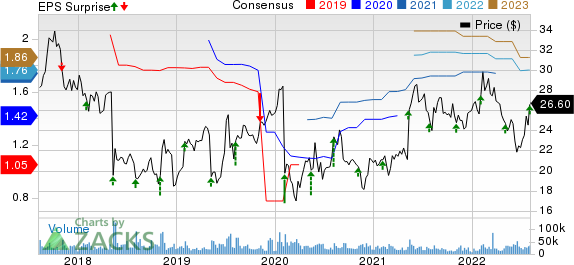

NortonLifeLock Inc. Price, Consensus and EPS Surprise

NortonLifeLock Inc. price-consensus-eps-surprise-chart | NortonLifeLock Inc. Quote

Revenues were primarily driven by improved customer experiences. The international business expansion contributed to the quarterly results.

Direct customer revenues increased to $620 million from the $611 million reported in the year-ago quarter. Partner revenues improved by 10% to $88 million from the $80 million reported a year ago.

Leveraging Avira's freemium model helped the company expand the customer reach globally while accelerating customers’ free-to-paid conversion with the use of marketing capabilities.

In its quarterly result announcement, NortonLifeLock revealed that it received provisional approval from the U.K. Competition and Markets Authority for its pending acquisition of Avast Plc. The company now expects to complete the acquisition between mid-September and early-October.

The two companies entered into a merger agreement in August 2021 under which NLOK would acquire U.K.-based Avast in a cash-and-stock deal. The merger agreement values Avast’s entire ordinary share capital between $8.1 billion and $8.6 billion, subject to its shareholders’ elections.

Quarterly Details

The monthly direct average revenue per user decreased to $8.82 from $8.84 in the year-ago quarter. The continued stabilization of the direct customer count was an upside. The quarterly bookings increased 1% on a year-over-year basis to $663 million.

NortonLifeLock’s average direct customer count increased to 23.3 million from 23.1 million in the year-ago quarter. The customer retention rate was slightly more than 85% as new initiatives were launched for the improvement of overall retention and within specific products and customer cohorts.

The non-GAAP gross profit grew 2% year over year to $612 million from $599 million. However, the gross margin contracted by 30 basis points (bps) to 86.4%.

The non-GAAP operating income for the first quarter of fiscal 2023 totaled $380 million, up 7% year over year. The non-GAAP operating margin expanded by 250 bps to 53.7%, mainly due to a reduction in operating expenses. Non-GAAP operating expenses declined 5% year over year to $232 million, while as a percentage of revenues, it reduced 270 bps to 32.8% from 35.5% in the year-ago quarter.

Non-GAAP EBITDA plunged 10.3% year over year to $287 million, while non-GAAP reported EBITDA increased 7% to $383 million.

Balance Sheet & Other Details

NortonLifeLock exited the first quarter with cash and cash equivalents of $1.29 billion compared with the previous quarter’s $1.89 billion. The long-term debt was $2.71 billion, down from $2.74 billion in the previous quarter.

The company generated cash worth $215 million through operating activities and free cash flow of $213 million in the first quarter.

NortonLifeLock authorized a quarterly cash dividend of $0.125 per share, payable on Aug 22, 2022 to shareholders of record as of Sep 14.

Second-Quarter Fiscal 2023 Guidance

For the second quarter of fiscal 2023, NLOK anticipates revenues in the band of $695-$705 million, suggesting mid-single-digit year-over-year growth on a constant-currency basis, with more than 4% of forex headwinds.

NortonLifeLock projects non-GAAP earnings between 44 cents and 46 cents in the second quarter, including the assumptions of a negative impact of 3 cents from forex headwinds.

Zacks Rank & Stocks to Consider

NortonLifeLock currently carries a Zacks Rank #3 (Hold). Shares of NLOK have increased 2.4% year to date (“YTD”).

Some better-ranked stocks worth considering from the broader technology sector are Cadence Design Systems CDNS, Manhattan Associates MANH and 8x8, Inc. EGHT. Cadence Design Systems and Manhattan Associates each sport a Zacks Rank #1 (Strong Buy), while 8x8 carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Cadence Design Systems' third-quarter 2022 earnings has been revised upward by nine cents to 97 cents per share over the past 30 days. For 2022, earnings estimates have moved north by 5.7% to $4.11 per share in the past 30 days.

Cadence Design Systems' earnings beat the Zacks Consensus Estimate in each of the preceding four quarters, the average surprise being 9.8%. Shares of CDNS have decreased 0.4% YTD.

The Zacks Consensus Estimate for Manhattan Associates' third-quarter 2022 earnings has been revised upward by a penny to 57 cents per share in the past 30 days. For 2022, earnings estimates have moved south by 18 cents to $2.38 per share in the past 30 days.

Manhattan Associates' earnings beat the Zacks Consensus Estimate in the preceding four quarters, the average surprise being 30.3%. Shares of MANH have plunged 7.6% YTD.

The Zacks Consensus Estimate for 8x8's second-quarter fiscal 2023 earnings has been revised upward by a penny to four cents per share over the past seven days. For fiscal 2023, the Zacks Consensus Estimate for 8x8's earnings has moved north by 13 cents to 26 cents per share in the past seven days.

8x8's earnings beat the Zacks Consensus Estimate thrice in the preceding four quarters while matching the same in one, the average surprise being 175%. Shares of EGHT have plunged 73.3% YTD.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Cadence Design Systems, Inc. (CDNS) : Free Stock Analysis Report

Manhattan Associates, Inc. (MANH) : Free Stock Analysis Report

8x8 Inc (EGHT) : Free Stock Analysis Report

NortonLifeLock Inc. (NLOK) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance