Nokia (NOK) Upgrades AVA Energy Software for Lower Power Usage

Nokia Corporation NOK recently upgraded its AVA Energy efficiency software to help reduce energy consumption in communication networks. The deal is likely to help operators improve network diagnosis and troubleshooting processes by reducing unnecessary manual fixes, lower overall electricity bills and address environmental sustainability issues through lower carbon footprint.

Leveraging ML and AI techniques, the software will facilitate carriers to augment network monitoring endeavors and boost customer experience. This technology and vendor-agnostic software will enable decentralized data management for disruptive innovation and new value creation.

The improved software will enable operators to enforce shutdown of idle and unused equipment automatically through specified algorithms. The carriers will also have the option to completely disconnect hardware through remote power control modules for redundancy or non-usage. The upgraded software reportedly helps to reduce power usage by up to 30%, which is about 10 percentage points higher compared to the original software.

By unlocking network efficiencies with a software upgrade, Nokia has reduced the total cost of ownership for mobile operators. The company is well-positioned for the ongoing technology cycle, given the strength of its end-to-end portfolio.

The company is driving the transition of global enterprises into smart virtual networks by creating a single network for all services, converging mobile and fixed broadband, IP routing and optical networks with the software and services to manage them. Leveraging state-of-the-art technology, Nokia is transforming the way people and things communicate and connect with each other. These include a seamless transition to 5G technology, ultra-broadband access, IP and Software Defined Networking, cloud applications and the Internet of Things.

Nokia enables its customers to move away from an economy-of-scale network operating model to demand-driven operations by offering easy programmability and flexible automation needed to support dynamic operations, reducing complexity and improving efficiency. The company remains focused on building a robust, scalable software business and expanding it to structurally attractive enterprise adjacencies. It has inked more than 269 commercial 5G contracts across the globe.

The company’s end-to-end portfolio includes products and services for every part of a network, which are helping operators to enable key 5G capabilities, such as network slicing, distributed cloud, and industrial IoT. Accelerated strategy execution, sharpened customer focus and reduced long-term costs are expected to position the company as a global leader in the delivery of end-to-end 5G solutions.

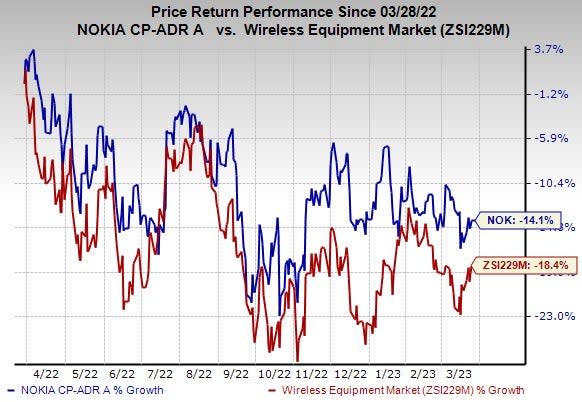

The stock has lost 14.1% in the past year compared with the industry’s decline of 18.4%.

Image Source: Zacks Investment Research

Nokia carries a Zacks Rank #3 (Hold) currently.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Key Picks

Arista Networks, Inc. ANET, sporting a Zacks Rank #1, is likely to benefit from strong momentum and diversification across its top verticals and product lines. The company has a software-driven, data-centric approach to help customers build their cloud architecture and enhance their cloud experience. Arista has a long-term earnings growth expectation of 14.2% and delivered an earnings surprise of 14.2%, on average, in the trailing four quarters.

It holds a leadership position in 100-gigabit Ethernet switching share in port for the high-speed datacenter segment. Arista is increasingly gaining market traction in 200- and 400-gig high-performance switching products and remains well-positioned for healthy growth in data-driven cloud networking business with proactive platforms and predictive operations.

Juniper Networks, Inc. JNPR carries a Zacks Rank #2 (Buy). It has a long-term earnings growth expectation of 7% and delivered an earnings surprise of 1.6%, on average, in the trailing four quarters.

Juniper is leveraging the 400-gig cycle to capture hyperscale switching opportunities inside the data center. The company is set to capitalize on the increasing demand for data center virtualization, cloud computing and mobile traffic packet/optical convergence.

Ubiquiti Inc. UI, carrying a Zacks Rank #2, offers a comprehensive portfolio of networking products and solutions for service providers and enterprises. Ubiquiti’s excellent global business model, which is flexible and adaptable to evolving changes in markets, helps it to beat challenges and maximize growth.

Ubiquiti boasts a proprietary network communication platform that is well-equipped to meet end-market customer needs. In addition, the company is committed toward reducing its operational costs by using a self-sustaining mechanism for rapid product support and dissemination of information by leveraging the strength of the Ubiquiti Community.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Nokia Corporation (NOK) : Free Stock Analysis Report

Juniper Networks, Inc. (JNPR) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report

Ubiquiti Inc. (UI) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance