Next Science (ASX:NXS) shareholders have earned a 15% return over the last year

It hasn't been the best quarter for Next Science Limited (ASX:NXS) shareholders, since the share price has fallen 14% in that time. But at least the stock is up over the last year. But to be blunt its return of 15% fall short of what you could have got from an index fund (around 30%).

With that in mind, it's worth seeing if the company's underlying fundamentals have been the driver of long term performance, or if there are some discrepancies.

View our latest analysis for Next Science

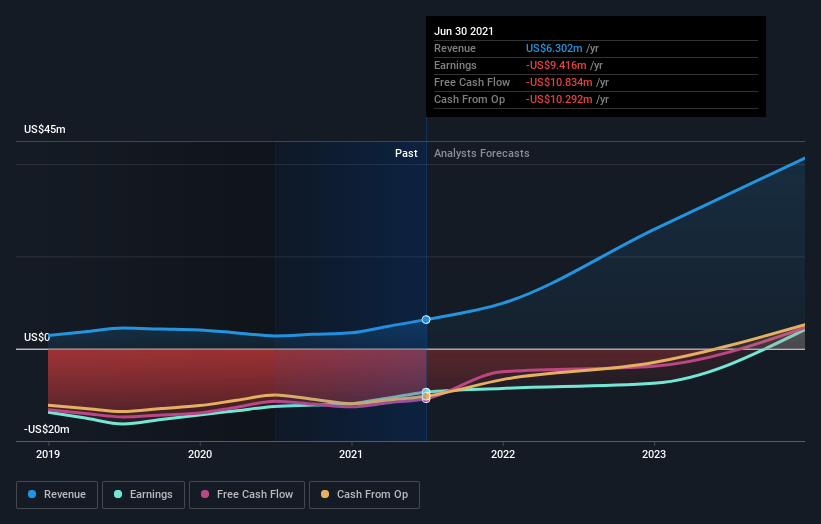

Because Next Science made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually expect strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Next Science grew its revenue by 128% last year. That's stonking growth even when compared to other loss-making stocks. Let's face it the 15% share price gain in that time is underwhelming compared to the growth. When revenue spikes but the share price doesn't we can't help wondering if the market is missing something. It could be that the stock was previously over-hyped, or that losses are causing concern for the market, but this could be an opportunity.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

We consider it positive that insiders have made significant purchases in the last year. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. So it makes a lot of sense to check out what analysts think Next Science will earn in the future (free profit forecasts).

A Different Perspective

Next Science shareholders have gained 15% for the year. The bad news is that's no better than the average market return, which was roughly 30%. The stock trailed the market by 12% in that time, testament to the power of passive investing. But a weak quarter certainly doesn't diminish the longer-term achievements of the business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider for instance, the ever-present spectre of investment risk. We've identified 4 warning signs with Next Science , and understanding them should be part of your investment process.

Next Science is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

Yahoo Finance

Yahoo Finance