Newell (NWL) to Post Q4 Earnings: What's in the Offing?

Newell Brands Inc. NWL is slated to report fourth-quarter 2019 results on Feb 14, before the opening bell. In the last reported quarter, the company delivered a positive earnings surprise of 30.4%. In fact, Newell boasts a splendid earnings surprise history. The company’s earnings outperformed the Zacks Consensus Estimate by 50.8%, on average, in the trailing four quarters.

The Zacks Consensus Estimate for fourth-quarter earnings has been steady at 39 cents over the past 30 days. This suggests a decline of 17% from the year-ago period’s reported figure. Further, the consensus mark for revenues is pegged at $2,574 million, indicating growth of around 10% from the figure reported in the year-ago quarter.

Key Factors to Note

Newell has been gaining from its Transformation Plan. The company’s transformation efforts have enabled it to deliver growth via improving market share gains, point of sale growth, innovation and e-commerce, as well as cost-saving plans.

Also, the company has been divesting underperforming and non-core brands, and simplifying operations to reshape the business portfolio and improve operational efficiency. These apart, Newell decided to retain the Mapa/Spontex and Quickie businesses on solid prospects, which are likely to get reflected in cash flows and operating margin gains for the Food and Commercial segment.

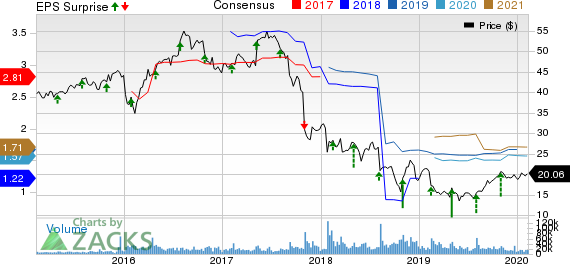

Newell Brands Inc. Price, Consensus and EPS Surprise

Newell Brands Inc. price-consensus-eps-surprise-chart | Newell Brands Inc. Quote

However, the company has been witnessing soft core sales and unfavorable currency movements for a while now. On the last earnings call, management guided net sales of $2.5-$2.6 billion for fourth-quarter 2019 and core sales decline of 2-4%. The company anticipated normalized operating margin contraction of 10-50 basis points to 11-11.4%. Also, it projected normalized earnings per share of 35-40 cents for the quarter under review.

What the Zacks Model Unveils

Our proven model doesn’t predict an earnings beat for Newell this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. But that’s not the case here.

Newell carries a Zacks Rank #4 (Sell) and has an Earnings ESP of 0.00%. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Stocks With Favorable Combinations

Here are some companies you may want to consider, as our model shows that these have the right combination of elements to post an earnings beat:

Coca-Cola FEMSA, S.A.B. de C.V. KOF currently has an Earnings ESP of +5.47% and a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Sanderson Farms, Inc. SAFM presently has an Earnings ESP of +64.29% and a Zacks Rank #3.

The Kraft Heinz Company KHC currently has an Earnings ESP of +1.33% and a Zacks Rank #3.

The Hottest Tech Mega-Trend of All

Last year, it generated $24 billion in global revenues. By 2020, it's predicted to blast through the roof to $77.6 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Newell Brands Inc. (NWL) : Free Stock Analysis Report

Coca Cola Femsa S.A.B. de C.V. (KOF) : Free Stock Analysis Report

Sanderson Farms, Inc. (SAFM) : Free Stock Analysis Report

The Kraft Heinz Company (KHC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance