How the new credit reporting rules could help you get a cheaper loan

The rules of the credit game are a’changin’: Australians will now be able to wrangle better deals on their loans and pay less for their internet, phone and power bills.

Aussie banks are now reporting your positive credit history in addition to your negative history, thanks to new changes the banks rolled out at the end of September.

Also read: Are the Big Four banks the next Telstra?

“Australians’ credit history used to only be all about the bad things, such as neglecting to pay a bill,” said the CEO of credit score company Credit Simple, David Scognamiglio.

“But with the Comprehensive Credit Reporting (CCR) system, your ‘good’ actions such as regularly making payments will also start to go onto your credit file.

“This all helps to build a more thorough picture of how you handle credit and make payments, giving credit providers a better idea of how much they should lend to you, and on what terms.”

Banks will now provide information to lending agencies on your monthly repayment history on credit cards and loan products. And if you’ve got a good track record, that will count in your favour.

“This means consumers won’t necessarily be penalised as harshly for past one-off defaults or missed payments if their overall repayment history and general credit information is in good shape,” Scognamiglio said.

The CCR is touted to increase competition between lenders – which means Aussies will have greater negotiating power. This might mean cheaper loans – or being considered for a loan you might have otherwise been knocked back for before.

Also read: Australian dollar slammed after U.S. bond yields surge higher

1. In a nutshell, what’s changed?

Your credit report will now give a fuller, more accurate picture of your credit history. Previously, only mostly negative information would make it onto your credit report – now, information such as the type of credit you hold and your timely payments will be included.

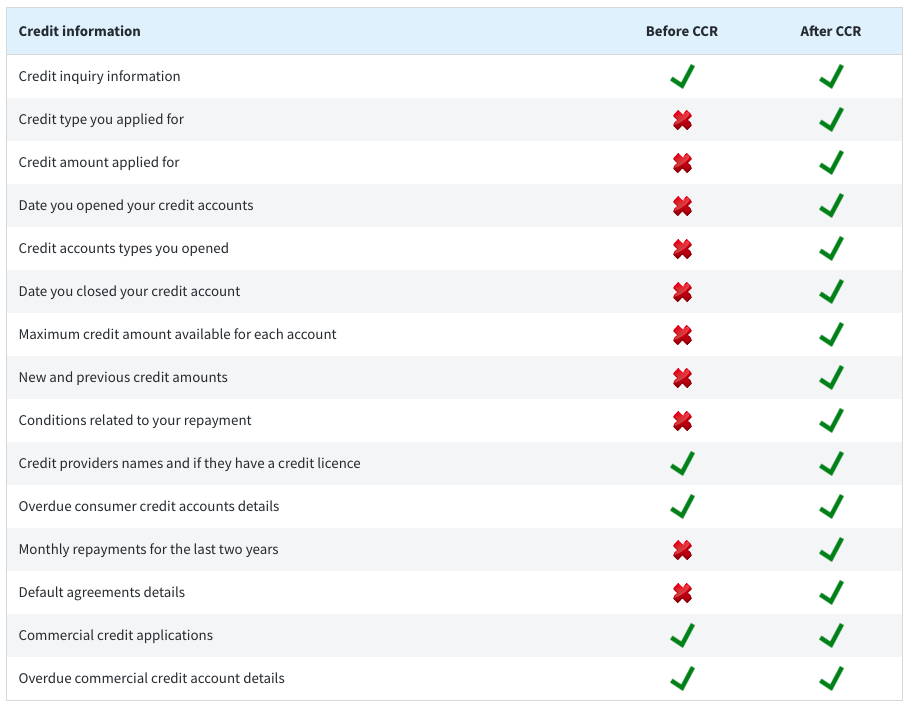

2. What information will the banks now have to release?

This is the information the CCR will have your banks reveal to lenders:

But note that you might not see all of these changes appear immediately. By the end of September 2019, though, they should all show up on your credit file.

3. How will this affect my credit score?

Data from Equifax shows that your credit score generally improves because it is positively influenced by the new information that shows you’re making timely repayments.

Also read: Why 200,000 Aussies could lose their tax refund

As the chief risk officer of lending platform MoneyPlace Paul Abbey tells Canstar: “New customers that were previously categorised by a credit bureau as ‘very good’ before getting a MoneyPlace loan have now improved to ‘excellent’ simply because they have made their scheduled repayments on time.”

Hurrah!

4. What can I do to improve my credit score?

Monitor your credit score – and pay your bills on time!

Yahoo Finance

Yahoo Finance