Neurotech International's (ASX:NTI) investors will be pleased with their massive 340% return over the last five years

For many, the main point of investing in the stock market is to achieve spectacular returns. While the best companies are hard to find, but they can generate massive returns over long periods. Just think about the savvy investors who held Neurotech International Limited (ASX:NTI) shares for the last five years, while they gained 340%. And this is just one example of the epic gains achieved by some long term investors. On top of that, the share price is up 86% in about a quarter. This could be related to the recent financial results, released recently - you can catch up on the most recent data by reading our company report.

So let's assess the underlying fundamentals over the last 5 years and see if they've moved in lock-step with shareholder returns.

Check out our latest analysis for Neurotech International

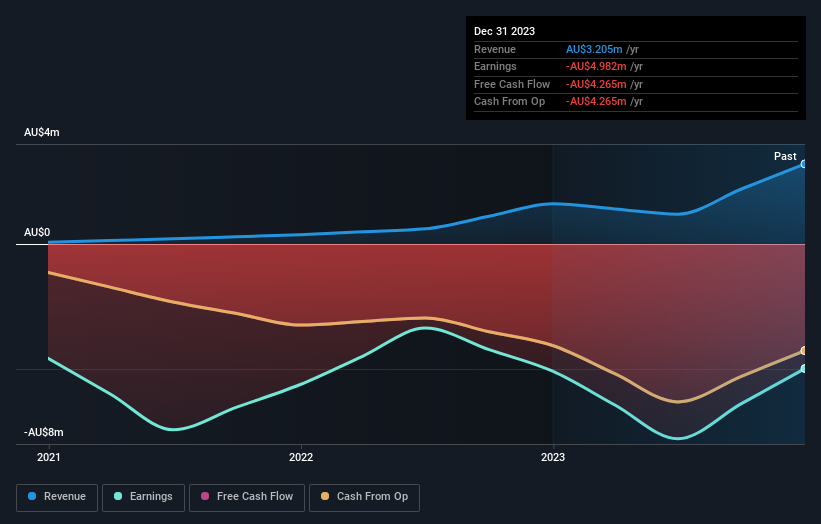

Given that Neurotech International didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually expect strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last 5 years Neurotech International saw its revenue grow at 64% per year. That's well above most pre-profit companies. Fortunately, the market has not missed this, and has pushed the share price up by 34% per year in that time. Despite the strong run, top performers like Neurotech International have been known to go on winning for decades. So we'd recommend you take a closer look at this one, but keep in mind the market seems optimistic.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

It's good to see that Neurotech International has rewarded shareholders with a total shareholder return of 116% in the last twelve months. That gain is better than the annual TSR over five years, which is 34%. Therefore it seems like sentiment around the company has been positive lately. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Even so, be aware that Neurotech International is showing 4 warning signs in our investment analysis , and 1 of those shouldn't be ignored...

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Australian exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Finance

Yahoo Finance