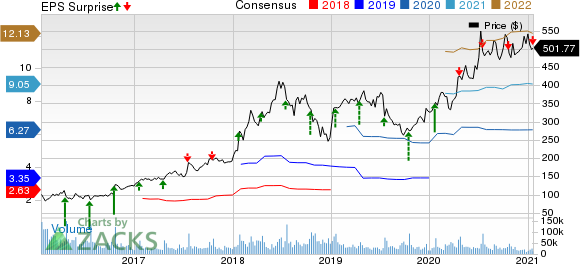

Netflix (NFLX) Q4 Earnings Miss, User Growth Drives Top Line

Netflix NFLX reported fourth-quarter 2020 earnings of $1.19 per share, missing the Zacks Consensus Estimate by 13.8% and the company’s guidance of $1.35. Moreover, the figure decreased 18.4% year over year.

Revenues of $6.64 billion increased 21.5% year over year and also beat the consensus mark by 0.3%. Average revenue per membership was flat year over year both on a reported and foreign-exchange neutral basis.

The streaming giant added 8.51 million paid subscribers globally, which declined 2.9% year over year but beat its guidance of 6 million paid-subscriber addition.

At the end of the fourth quarter, Netflix had 203.66 million paid subscribers globally, up 21.9% from the year-ago quarter, beating management’s expectation of 201.15 million paid subscribers.

The strong growth reflects Netflix’s solid content portfolio amid growing competition from services launched by Apple AAPL, Disney DIS, ViacomCBS, AT&T T, Discovery and Comcast.

Notably, this Zacks Rank #3 (Hold) company now expects paid net additions to be 6 million compared with the year-ago quarter’s 15.77 million for the first quarter of 2021, reflecting stiff competition. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Shares of Netflix were up almost 14% in pre-market trading following the results.

Segmental Revenue Details

United States and Canada (UCAN) reported revenues of $2.98 billion, which rose 11.5% year over year and accounted for 44.8% of total revenues. ARPU grew 2% from the year-ago quarter on a foreign-exchange neutral basis.

Paid-subscriber base increased 9.3% from the year-ago quarter to 73.94 million. The company added 0.86 million paid subscribers, up 56.4%year over year.

Europe, Middle East & Africa (EMEA) reported revenues of $2.14 billion, which surged 36.7% year over year and accounted for 32.2% of total revenues. ARPU grew 3% from the year-ago quarter on a foreign-exchange neutral basis.

Paid-subscriber base increased 28.8% from the year-ago quarter to 66.70 million. The company added 4.46 million paid subscribers, up0.9% year over year.

Latin America’s (LATAM) revenues of $789 million increased 5.8% year over year, contributing 11.9% of total revenues. ARPU grew 4% from the year-ago quarter on a foreign-exchange neutral basis.

Paid-subscriber base rose 19.5% from the year-ago quarter to 37.54 million. The company added 1.21 million paid subscribers, down 40.7% year over year.

Asia Pacific’s (APAC) revenues of $685 million soared 63.9% year over year and accounted for 10.3% of total revenues. ARPU was flat year over year on a foreign-exchange neutral basis.

Paid-subscriber base jumped 57.1% from the year-ago quarter to 25.49 million. The company added 1.99 million paid subscribers, up13.7% year over year.

Content Details

Netflix’s fourth-quarter content slate included the new season of The Crown as well as Bridgerton and The Queen’s Gambit. Regional content included Barbarians (Germany), Sweet Home (Korean), Selena: The Series and Alice in Borderland (Japan).

Netflix released its original film The Midnight Sky in the reported quarter. Other movies included Over the Moon, We Can Be Heroes, Holidate and The Christmas Chronicles: Part Two.

Netflix’s first Portuguese language holiday film from Brazil, Just Another Christmas, was also a big hit in the reported quarter.

Markedly, Netflix plans to release at least one new original film every week in 2021. Netflix’s releases for the first quarter of 2021 include season 3 of Cobra Kai, Lupin as well as To All the Boys I’ve Loved Before 3, the finale of the trilogy.

Moreover, content portfolio includes Fate: The Winx Saga, Yes Day, Sky Rojo and Space Sweepers.

Operating Details

Marketing expenses declined 13.2% year over year to $762.6 million. As a percentage of revenues, marketing expenses decreased 460 basis points (bps) to 11.5%.

Moreover, consolidated operating income surged 108.1% year over year to $954.3 million, driven by higher-than-expected revenue and subscriber growth. Consolidated operating margin expanded 600 bps on a year-over-year basis to 14.4%.

Balance Sheet & Free Cash Flow

Netflix had $8.21 billion of cash and cash equivalents as of Dec 31, 2020, compared with $8.39billion as of Sep 30, 2020.

Long-term debt was $15.8 billion as of Dec 31, 2020, up from $15.5 billion as of Sep 30, 2020. Streaming content obligations were $19.2 billion, unchanged sequentially.

Netflix reported free cash outflow of $284 million against free cash outflow of $1.67 billion in the year-ago quarter.

Guidance

For the first quarter of 2021, Netflix forecasts earnings of $2.97 per share, indicating year-over-year growth of 89.2%. The Zacks Consensus Estimate is pegged at $2.12 per share, lower than the company’s expectation, indicating growth of 35% from the figure reported in the year-ago quarter.

Netflix expects to end the first quarter of 2021 with 209.66 million paid subscribers globally, indicating growth of 14.7% from the year-ago quarter.

Total revenues are anticipated to be $7.13 billion, suggesting growth of 23.6% year over year. The Zacks Consensus Estimate for revenues stands at $6.91 billion, lower than the company’s expectation.

Operating margin is projected at 25% compared with 16.6% in the year-ago quarter.

Breakout Biotech Stocks with Triple-Digit Profit Potential

The biotech sector is projected to surge beyond $775 billion by 2024 as scientists develop treatments for thousands of diseases. They’re also finding ways to edit the human genome to literally erase our vulnerability to these diseases.

Zacks has just released Century of Biology: 7 Biotech Stocks to Buy Right Now to help investors profit from 7 stocks poised for outperformance. Our recent biotech recommendations have produced gains of +50%, +83% and +164% in as little as 2 months. The stocks in this report could perform even better.

See these 7 breakthrough stocks now>>

Click to get this free report AT&T Inc. (T) : Free Stock Analysis Report Apple Inc. (AAPL) : Free Stock Analysis Report The Walt Disney Company (DIS) : Free Stock Analysis Report Netflix, Inc. (NFLX) : Free Stock Analysis Report To read this article on Zacks.com click here. Zacks Investment Research

Yahoo Finance

Yahoo Finance