Netflix user growth beats expectations, shares spike

Netflix (NFLX) reported quarterly user growth that exceeded Wall Street expectations. The news underscores a recovery for the online streamer following a rare miss in new user additions last quarter.

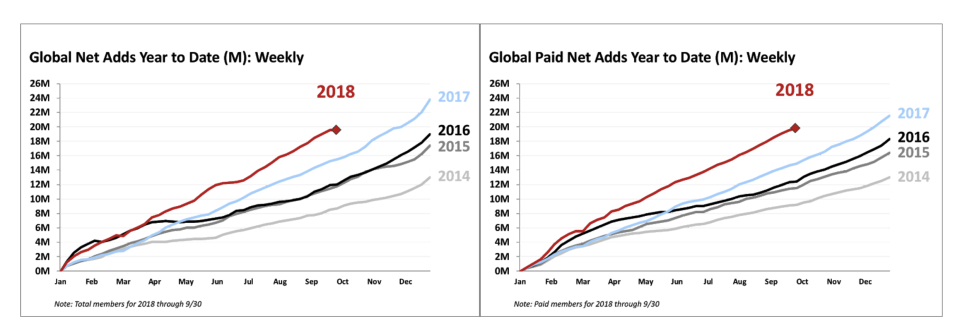

The Los Gatos, California-based company brought on 6.96 million total new streamers, beating its own guidance of 5 million total member additions for the quarter. Wall Street had anticipated net additions of 5.069 million for the quarter. The company issued guidance that it would add 9.4 million new members in the fourth quarter of 2018.

Netflix reported earnings of 89 cents per share on revenue of $4 billion, in line with average analysts’ revenue estimates while handedly beating earnings expectations of 68 cents per share. Streaming revenue grew 36% year-over-year, while global users breached 130 million paid and 137 million total members.

Netflix’s stock rose 6.39% to $368.52 per share as of 10:12 a.m. Wednesday. Shares of peer internet stocks Facebook (FB) and Amazon (AMZN) each posted gains shortly after market open following Netflix’s earnings beat.

The streaming giant’s free cash flow in the third quarter was negative $859 million versus negative $465 million in the year-ago quarter, which the company emphasized in its shareholder letter was due to a “growing mix of self-produced content, which requires us to fund content during the production phase prior to its release on Netflix.” This has created a gap between positive net income and free cash flow net deficit, the company said.

Netflix expects its free cash flow to be closer to negative $3 billion than to negative $4 billion for the full year of 2018. The company’s year-to-date free cash flow is negative $1.7 billion.

Netflix underwhelmed last quarter after the company reported in July it had attracted one million fewer subscribers than expected, with net membership additions coming in at 5.15 million versus 5.2 million from the year-ago quarter. The stock had been up 106% year-to-date prior to its second-quarter earnings release. Shares of Netflix are down about 15% over the past three months, and the stock sank along with the broader market selloff last week.

Netflix remains a juggernaut for online streaming, and the platform accounts for 15% of all internet traffic globally, according to a recent report from Sandvine. This comes amidst increasing competition from streamers including Hulu and Amazon, which also produce original content. New online video services from WarnerMedia, Viacom, WalMart, Costco, Quibi and Apple have also been reported.

But company executives shrugged off concerns of competition in a recorded interview following Netflix’s third-quarter results.

“Someday there will have to be competition for wallet share – we’re not naïve about that – but it seems very far off from everything we’ve seen,” Netflix CEO Reed Hastings said.

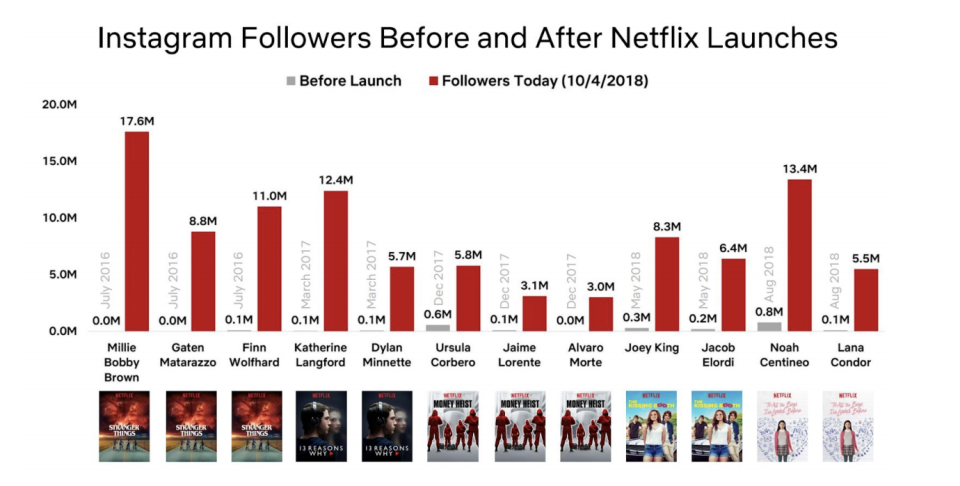

Netflix Chief Content Officer Ted Sarandos added that studios and partners “want their content to be seen, and the best chance of doing that is doing it with Netflix. You see in the long list of content brands and newly minted stars out of Netflix just this quarter, you can see what we’re talking about putting content into the culture and into the zeitgeist.”

In its shareholder letter, the company included a chart of celebrities’ Instagram followers before and after Netflix show launches, highlighting the platform’s pop culture clout.

But not all analysts have been so optimistic on the stock following its disappointing results in July. Several major firms – and historic Netflix bulls – slashed their price targets for the stock ahead of earnings, citing global trends including a strong dollar and rising interest rates. Goldman Sachs’s Heath Terry said in a note on Monday he was lowering the 12-month price target to $430 from $470 “to reflect the contraction in broader internet multiples.” Longstanding Netflix bear Michael Pachter of WedBush Securities offered a 12-month price target of $125 for the stock ahead of earnings in light of the company’s cash burn from content spend.

“We believe that Netflix’s valuation is unwarranted. We expect the company to continue to increase its marketing and content spending over the next several years in order to maintain the pace of its subscriber growth,” Pachter wrote in a note ahead of earnings. “Should quarterly cash burn continue to deteriorate throughout 2018 and 2019 (as it has for the last five years), we are prepared to stay the course and to maintain our UNDERPERFORM rating.”

Netflix’s earnings beat led Morgan Stanley to reverse its price target for Netflix to $475 per share from $450 per share on Wednesday. Just a day earlier, Morgan Stanley had cut the price target for the first time in three months, to $450 a share from $480.

This post has been updated to reflect trading prices for Netflix shortly after market open on Wednesday. An earlier version of this story was published Tuesday.

—

Emily McCormick is a reporter for Yahoo Finance. Follow her on Twitter: @emily_mcck

Read more from Emily:

Weed stock Tilray is sending investors on an incredible ride

Tilray shares jump as company says it’s exporting cannabis to sick children in Australia

A trade war won’t rattle the ‘white hot’ US economy

White House economist: Tariffs are hurting China much more than the US

Yahoo Finance

Yahoo Finance