Netflix's U.S. Market Share Slips as Competition Looms

Netflix (NASDAQ: NFLX) rattled investors last month when the video-streaming leader disclosed that it had lost subscribers in the core U.S. market for the first time in nearly a decade, although that 2011 subscriber loss was primarily attributable to unbundling streaming from the original DVD-by-mail service. The recent share-price decline was more indicative of broader competitive fears at a time when multiple companies are preparing to enter the video-streaming market with competing services.

The latest estimate of Netflix's market share in the U.S. won't assuage those concerns.

Image source: Netflix.

Rivals are chipping away

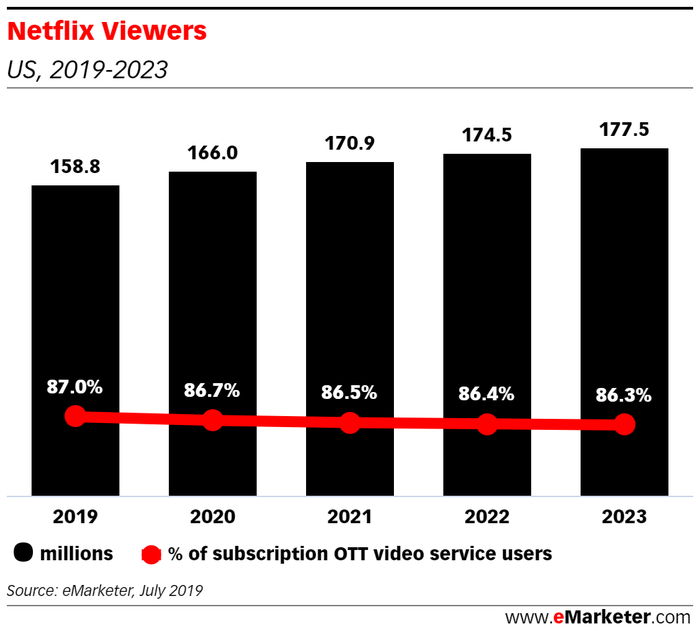

eMarketer released its latest estimates on the U.S. video-streaming market today, which suggest that 182.5 million people in the U.S. -- over 55% of the population -- will view content on over-the-top (OTT) streaming services. Netflix remains the dominant service, with 158.8 million viewers, and eMarketer believes Netflix's subscribers will be able to rebound by year's end thanks to its compelling portfolio of original content.

However, Netflix's share of U.S. viewers has declined, in part a function of its popularity. The company's share is expected to fall to 87% in 2019, down from 90% in 2014, and continue trending modestly lower in the years ahead.

Image source: eMarketer.

"Netflix has faced years of strong competition for viewers, coming from streaming video platforms, pay TV services and even video games," eMarketer forecasting analyst Eric Haggstrom said in a statement. "While there is no true 'Netflix killer' on the market, Disney's upcoming bundle with Disney+, Hulu and ESPN+ probably comes closest."

Hulu, which Disney (NYSE: DIS) now controls, will grow to an estimated 75.8 million viewers (41.5% share) this year, according to eMarketer. On the earnings call earlier this month, Disney CFO Christine McCarthy noted that ESPN+ now has 2.4 million paid subscribers and Hulu has around 28 million. (Netflix has 60 million paid subscribers in the U.S.) CEO Bob Iger also announced on the call that the Disney+, ESPN+, and ad-supported Hulu bundle will cost just $13 per month -- the same price point as Netflix's most popular "Standard" plan.

Amazon.com enjoys the No. 2 spot, with 52.9% share of U.S. viewers for its Prime Video service, which reaches an estimated 96.5 million people. AT&T comes in No. 4, with 23.1 million viewers using its HBO Now service. The forthcoming HBO Max, which is expected to cost more but include even more content than HBO Now, is on track to launch in early 2020.

Viewer figures differ from subscriber metrics because many households share a single subscription among multiple users. Many people also share accounts with friends and family outside of their immediate households, a problem that the industry will want to address, as this behavior could translate into $12.5 billion in lost revenue by 2024, according to recent estimates from Parks Associates.

More From The Motley Fool

John Mackey, CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool's board of directors. Evan Niu, CFA owns shares of AMZN, Netflix, and Walt Disney. The Motley Fool owns shares of and recommends AMZN, Netflix, and Walt Disney. The Motley Fool has the following options: long January 2021 $60 calls on Walt Disney and short October 2019 $125 calls on Walt Disney. The Motley Fool has a disclosure policy.

This article was originally published on Fool.com

Yahoo Finance

Yahoo Finance