Nektar's Shares Drop on Rating Downgrade by Goldman Sachs

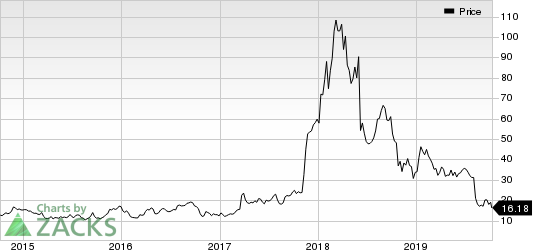

Nektar Therapeutics NKTR shares declined more than 13% on Oct 8, following a rating downgrade by The Goldman Sachs Group, Inc. GS. A day earlier an analyst at Goldman Sachs had downgraded Nektar two notches from “Buy” to “Sell” on negative developments seen so far in 2019. The price target was also reduced significantly from $54 to $16.

Execution missteps related to use of sub-optimal lots of its immuno-oncology candidate, bempegaldesleukin, in earlier stages of developments, have shaken investors’ confidence and have overshadowed previous positive clinical developments of the candidate. This was the major reason for the downgrade as it is likely to delay bempegaldesleukin’s commercial foray. Nektar is developing bempegaldesleukin, in combination with Bristol-Myers’ BMY PD-1 inhibitor, Opdivo (nivoumab), for several cancer indications under PIVOT program.

Last month, Nektar faced a setback when preliminary efficacy data from a study evaluating the combination regimen in patients with advanced or metastatic triple-negative breast cancer failed to meet market expectations. The company is developing bempegaldesleukin in combination with Takeda’s TAK-659 and Pfizer’s PFE Bavencio among others.

Moreover, regulatory delay related to approval for Nektar’s pain candidate, NKTR-181, has also been cited as a concern by Goldman Sachs. The delay was due to a number of scientific and policy issues relating to opioid analgesics. The rating company also stated that development in the immuno-oncology field is plateauing, suggesting regimens with immuno-oncology drug/candidates may not result in significant improvements in patients. This also raises concerns for bempegaldesleukin’s development. Without showing significant benefits in patients, bempegaldesleukin will not be able to reach a broader patient population which will impact its potential sales. Currently, investors are focused on scalability of bempegaldesleukin in a larger patient population in phase III development.

Shares of Nektar have declined 50.8% in the past year compared with the industry’s decrease of 2.4%. The significant decline in share price can be attributed to the abovementioned setbacks.

Moreover, the decline in share price also led to exclusion of the company from the S&P 500 Index. The company has, however, been included in the S&P MidCap 400 Index starting October 2.

Nektar Therapeutics Price

Nektar Therapeutics price | Nektar Therapeutics Quote

Zacks Rank

Nektar currently carries a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2018, while the S&P 500 gained +15.8%, five of our screens returned +38.0%, +61.3%, +61.6%, +68.1%, and +98.3%.

This outperformance has not just been a recent phenomenon. From 2000 – 2018, while the S&P averaged +4.8% per year, our top strategies averaged up to +56.2% per year.

See their latest picks free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Pfizer Inc. (PFE) : Free Stock Analysis Report

Bristol-Myers Squibb Company (BMY) : Free Stock Analysis Report

The Goldman Sachs Group, Inc. (GS) : Free Stock Analysis Report

Nektar Therapeutics (NKTR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance