Nektar (NKTR) Q3 Earnings & Revenues Top Estimates, Stock Up

Nektar Therapeutics NKTR reported a loss of 56 cents per share for the third quarter of 2019, narrower than the Zacks Consensus Estimate of a loss of 73 cents but flat year over year.

Quarterly revenues were up 5% year over year to $29.2 million, which beat the Zacks Consensus Estimate of $26.21 million.

Nektar’s shares were up 5.5% in after-market trading on Nov 6, following the earnings release. However, the stock has declined 44.9% so far this year against the industry’s increase of 4.2%.

Quarter in Detail

Nektar’s top line comprises product sales, royalty revenues, non-cash royalty revenues besides license, collaboration and other revenues.

In the third quarter, product sales increased 30.6% from the year-ago period to $5.6 million. Non-cash royalty revenues were up 22.6% to $10.3 million.

Nektar’s royalty revenues remained almost flat year over year at $10.3 million in the quarter.

License, collaboration and other revenues came in at $3.1 million, registering a decline of 36% year over year.

Research and development expenses declined 3.8% to $99 million, primarily due to lower expense related to clinical development of bempegaldesleukin (earlier NKTR-214).

General and administrative expenses were up 28.3% to $24 million in the reported quarter, primarily due to costs related to commercialization initiatives to support launch of NKTR-181 upon potential approval and higher stock-based compensation expenses.

Pipeline Update

Nektar is developing several candidates across important therapeutic areas including Onzeald in breast cancer, NKTR-358 in inflammatory disease and NKTR-255 in virology and oncology indications. The company is also developing several immuno-oncology candidates, with bempegaldesleukin being its primary candidate.

Nektar is developing bempegaldesleukin in combination with Bristol-Myers’ BMY PD-1 inhibitor, Opdivo, in several registrational studies, as a potential treatment for melanoma, urothelial cancer and renal cell carcinoma. The companies are on track to start new registrational studies to evaluate the combination regimen in non-small cell lung cancer (NSCLC). Meanwhile, a phase I/II PROPEL study evaluating bempegaldesleukin in combination with Merck’s MRK PD-1 inhibitor, Keytruda, is currently enrolling first-line NSCLC patients. The study will evaluate the combination in other oncology indications as well.

Nektar is evaluating NKTR-358 in partnership with Eli Lilly LLY in three separate early-stage studies in patients with lupus, psoriasis and atopic dermatitis. Clinical studies evaluating the candidate for psoriasis and atopic dermatitis were initiated in October. Meanwhile, the companies expect to complete the lupus study by the end of 2019 and data to be presented at an upcoming medical meeting in 2020. All these studies are sponsored by Eli Lilly.

Last month, the company initiated a phase I study to evaluate NKTR-255 as monotherapy in patients with relapsed, refractory non-Hodgkin lymphoma or multiple myeloma.

On its third-quarter earnings call, Nektar stated that the FDA is actively working on scheduling an advisory committee meeting to discuss the new drug application for opioid analgesic candidate, NKTR-181. The NDA is seeking approval for NKTR-181 for treating chronic pain. However, no timeline was fixed and the meeting with the FDA might take next several months.

Please note that, in July, the company received a letter from the FDA stating that the product-specific advisory committee meetings for opioid analgesics, previously slated to be held on Aug 21, were postponed due to a number of scientific and policy issues relating to this class of drugs. This delayed a decision on the new drug application for NKTR-181, previously expected on Aug 29.

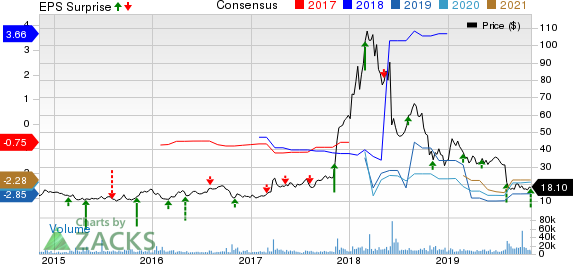

Nektar Therapeutics Price, Consensus and EPS Surprise

Nektar Therapeutics price-consensus-eps-surprise-chart | Nektar Therapeutics Quote

Zacks Rank

Nektar currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Wall Street’s Next Amazon

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Click for details >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Merck & Co., Inc. (MRK) : Free Stock Analysis Report

Eli Lilly and Company (LLY) : Free Stock Analysis Report

Bristol-Myers Squibb Company (BMY) : Free Stock Analysis Report

Nektar Therapeutics (NKTR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance