What would a zero or negative interest rate in Australia look like?

Stephen Koukoulas will be speaking on economic headwinds at Yahoo Finance's All Markets Summit on the 26th of September. Join us for this groundbreaking event.

The Reserve Bank of Australia’s placed the cash rate on hold at a record-low 1 per cent for August, after cutting for two consecutive months in June and July.

Also read: The world’s most disruptive innovator hates innovation

Also read: Will full-time work be ancient history? Freelancer.com’s CEO thinks so

Also read: Coffee shop to billion-dollar startup: Lucy Liu shares the Airwallex story

The decision to keep the interest rate stagnant wasn’t a surprise to economists, but many experts are predicting a further cut later this year.

Can interest rates hit zero, or go negative?

Of course.

In fact, market economist, Stephen Koukoulas pointed out that around a third of the world’s interest rates are at zero or in negative territory.

“They're negative in Japan, Europe, Switzerland, Sweden - even parts of Germany have got negative yield,” he said.

While he admits it’s “an unusual issue”, Koukoulas said Reserve Banks will do whatever it takes to keep their economies growing.

“You'd probably prefer to see interest rates higher because that would mean the economy was stronger, but obviously the Reserve Bank has to throw everything at the economy while it’s currently going through this soft patch.”

What will a zero or negative interest rate environment look like?

For one, it will mean the economy is weak, Koukoulas said.

“It will mean the economy isn’t good, so it probably means unemployment will be a little bit higher than it would normally be,” he said.

“And, it would probably mean that wage growth is still very low.”

But, if you’ve got a job and a mortgage, Koukoulas said interest rates going even lower is “obviously fantastic” for your ability to borrow money and make your monthly repayments.

“And also for the business sectors, you're a business operator, a small-medium business and you've got an overdraft, those interest rates also decline when official rates are cut. It's actually a beneficial issue for you as well,” he said.

Are interest rate cuts good for us?

Interest rate cuts are publicised for their effect on variable rate home loans, which is positive, given it means homeowners pay less interest on their repayments.

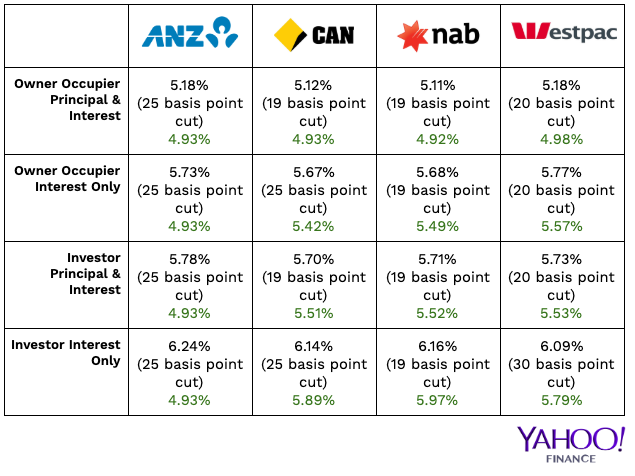

After the July cut, this is what variable rate home loans are each of the big four banks looked like:

And this is what the monthly and annual savings looked like on standard variable rate home loans after the cut:

But Koukoulas, says there are some losers from these low interest rates.

“People with savings will lose,” he said.

“We hear a lot from retirees who have a little bit of money in a term deposit, and of course they are getting a rotten return, very low interest rate on their savings and that is an important issue.”

Are interest rate cuts good for the economy?

Koukoulas, told Yahoo Finance that the RBA’s decision to make rates low would add a little bit more to businesses and consumer confidence in terms of borrowing money and ramping up spending.

But, Koukoulas says while the effect of RBA cuts will be positive, it’s not a positive sign.

“It's a sign the economy is weak, there's no question,” he said.

“You don't get interest rates at these levels if your economy is doing really well and growing and expanding, so it is really a reaction to the very subdued growth of inflation and wages performance that we have seen.”

Stephen Koukoulas will be speaking on economic headwinds at Yahoo Finance's All Markets Summit on the 26th of September. Join us for this groundbreaking event.

Yahoo Finance

Yahoo Finance