NCR Corporation (NCR) Q1 Earnings & Revenues Miss Estimates

NCR Corporation NCR reported first-quarter 2022 non-GAAP earnings of 33 cents, missing the Zacks Consensus Estimate of 64 cents per share.

The enterprise technology provider’s bottom line plunged 35.3% from 51 cents per share reported in the year-ago quarter.

For the first quarter of 2022, the company reported revenues of $1.86 billion, lagging the consensus mark of $1.92 billion. The top line witnessed a year-over-year surge of 21%, driven by contributions from the Cardtronics business, and solid growth across the company’s Payments, Digital Banking and Hospitality segments.

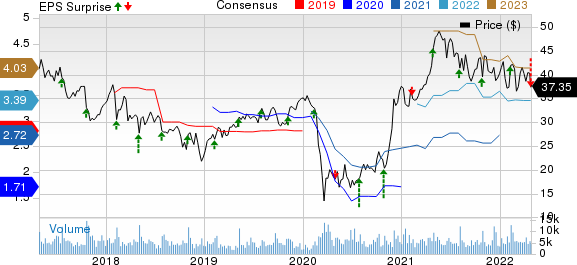

NCR Corporation Price, Consensus and EPS Surprise

NCR Corporation price-consensus-eps-surprise-chart | NCR Corporation Quote

NCR progressed significantly with its strategic growth initiatives, which are transforming it into a software platform and payments company. The company’s recurring revenues improved 35% to $1.18 billion in the quarter under review.

However, the Russia-Ukraine conflict, inflation and the Omicron wave remained headwinds.

Quarterly Details

From first-quarter 2022, NCR changed its reporting segments to correspond with changes to its operating model, management structure and organizational responsibilities. The new reportable revenue segments are: Payments & Network, Digital Banking, Self-Service Banking, Retail, and Hospitality.

Payments & Network revenues climbed 12% year over year to $299 million, primarily driven by merchant acquiring and Allpoint network (including the contributions of Cardtronics and newly acquired LibertyX business).

During the first quarter, Self-Service Banking revenues declined 3% to $611 million. The segment continued to witness strong momentum as a result of accelerated transformation toward adopting software-based solutions like ATM as-a-service solution.

Retail revenues rose 5% to $546 million, primarily on higher self-checkout revenues and point-of-sale revenues across its food-drug-merchandise and convenience-fuel-retail customers.

Hospitality revenues climbed 18% to $211 million, mainly driven by an increase in point-of-sale revenues across the company’s enterprise and small-and-medium business customers.

NCR’s Digital Banking Solution continued witnessing solid momentum, with revenues increasing 11% year over year to $136 million. Digital banking registered users remained flat year over year at 25.3 million.

Operating Details

Non-GAAP gross margin of $449 million was up 5.6% year over year. Non-GAAP gross margin rate contracted 340 basis points (bps) to 24.1%, primarily due to elevated component and freight costs, partially offset by price hikes.

Non-GAAP operating expenses increased 17% year on year to $325 million, mainly due to the company’s planned increase in research and development costs related to higher strategic investments and inclusion of Cardtronics expenses.

Adjusted EBITDA increased 5% year over year to $271 million. The adjusted EBITDA margin contracted 220 bps to 14.5%.

Non-GAAP operating income decreased to $124 million from the year-ago quarter’s $148 million. Non-GAAP operating margin contracted 290 bps to 6.7% from the year-earlier quarter’s 9.6%.

Balance Sheet & Other Details

NCR exited the March-end quarter with cash and cash equivalents of $412 million compared with $447 million reported during the December-end quarter.

Free cash outflow totaled $10 million compared with the prior quarter’s cash inflow of $100 million. Net cash provided by operating activities was $38 million in the first quarter.

Guidance

For the full-year 2022, NCR now anticipates revenues of approximately $8 billion, compared with the earlier guidance of $8-$8.2 billion.

The company now expects adjusted EBITDA in the band of $1.4-$1.5 billion, lower than the previous estimate of $1.5-$1.575 billion.

Non-GAAP diluted earnings are now projected to be $2.70-$3.20. compared with the prior range of $3.25-$3.55 per share.

Zacks Rank & Key Picks

NCR currently carries a Zacks Rank #3 (Hold). Shares of NCR have fallen 11.7% in the past year.

Some better-ranked stocks from the broader Computer and Technology sector are Yelp YELP sporting a Zacks Rank #1 (Strong Buy), Gogo GOGO and Analog Devices ADI, both carrying a Zacks Rank of 2 (Buy). You can see the complete list of today's Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Yelp's first-quarter 2022 loss has been revised a couple of cents southward to 11 cents per share over the past 60 days. For 2022, earnings estimates have moved north by 53.6% to $1.06 per share in the past 60 days.

Yelp's earnings beat the Zacks Consensus Estimate in the preceding four quarters, the average surprise being 632.9%. Shares of YELP have fallen 18.8% in the past year.

The Zacks Consensus Estimate for Gogo's first-quarter 2022 earnings has been revised downward by a penny to 13 cents per share over the past 30 days. For 2022, Gogo's earnings estimates have moved north by 25% to 65 cents per share in the past 60 days.

Gogo's earnings beat the Zacks Consensus Estimate in each of the preceding four quarters, the average surprise being 65%. Shares of GOGO have soared 71.8% in the past year.

The Zacks Consensus Estimate for Analog Devices' second-quarter fiscal 2022 earnings has been revised upward by 4 cents to $2.12 per share over the past 30 days. For fiscal 2022, earnings estimates have moved north by 11 cents to $8.43 per share in the past 30 days.

Analog Devices' earnings beat the Zacks Consensus Estimate in each of the preceding four quarters, the average surprise being 6%. Shares of ADI have decreased 2.1% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Analog Devices, Inc. (ADI) : Free Stock Analysis Report

NCR Corporation (NCR) : Free Stock Analysis Report

Yelp Inc. (YELP) : Free Stock Analysis Report

Gogo Inc. (GOGO) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance