NCR Corporation (NCR) Beats on Q2 Earnings & Revenue Estimates

NCR Corporation NCR delivered outstanding second-quarter 2022 results, with strong revenue growth and increased profitability despite the challenging macroeconomic environment. The enterprise technology provider’s second-quarter non-GAAP earnings jumped 15% year over year to 71 cents per share and surpassed the Zacks Consensus Estimate of 61 cents.

Increased revenues mainly drove the company’s bottom line higher. However, the strong U.S. dollar against major currencies reduced non-GAAP earnings per share by seven cents.

For the second quarter of 2022, the company reported revenues of $2 billion, surpassing the consensus mark of $1.96 billion. The top line witnessed a year-over-year surge of 19%, driven by strong execution, contribution from the last year’s Cardtronics acquisition and solid growth across the company’s Payments & Networks, Self-Service Banking and Hospitality segments.

Additionally, NCR stated that supply-chain challenges eased in the quarter, highlighting that component and transportation costs didn’t worsen as expected during the first-quarter earnings release. An improvement in component availability and transportation helped the company ship more finished goods, thereby boosting hardware sales in the second quarter.

NCR progressed significantly with its strategic growth initiatives, which are transforming it into a software platform and payments company. The company’s recurring revenues improved 31% to $1.22 billion in the quarter under review.

However, the Russia-Ukraine conflict, inflationary pressure and rising interest rates remained headwinds. Also, the unfavorable foreign currency exchange rate reduced total revenues by $50 million.

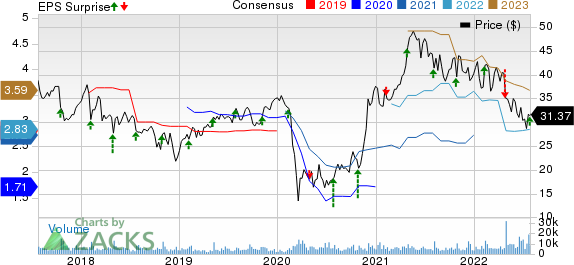

NCR Corporation Price, Consensus and EPS Surprise

NCR Corporation price-consensus-eps-surprise-chart | NCR Corporation Quote

Segment Details

From the first quarter of 2022, NCR changed its reporting segments to correspond with changes to its operating model, management structure and organizational responsibilities. The new reportable revenue segments are Payments & Network, Digital Banking, Self-Service Banking, Retail and Hospitality.

Payments & Network revenues soared more than six times to $332 million from the mere $54 million in the year-ago quarter, primarily driven by merchant acquiring and the Allpoint network (including the contributions of Cardtronics and the newly acquired LibertyX business).

NCR’s Digital Banking Solution revenue growth slowed down in the quarter, with sales increasing 2% to $131 million. The soft quarterly performance was mainly due to a decline of 3% in registered users and 5% in active users.

During the second quarter, Self-Service Banking revenues increased 5% to $679 million. The segment continued to witness strong momentum as a result of the accelerated transformation toward adopting software-based solutions like the ATM as-a-service solution.

Retail revenues were flat at $562 million. The company noted that order activity in this business remained strong.

Hospitality revenues climbed 11% to $238 million, mainly driven by an increase in point-of-sale revenues across the company’s enterprise and small-and-medium business customers. The reopening of restaurants and business activities drove the segment’s revenues higher.

Operating Details

Non-GAAP gross profit of $511 million was up 8% year over year. However, the non-GAAP gross margin rate contracted 240 basis points (bps) to 25.7%, primarily due to elevated component and freight costs, partially offset by price hikes.

Non-GAAP operating expenses increased 5% year over year to $313 million.

Adjusted EBITDA increased 21% year over year to $339 million, despite a negative impact of $15 million due to the unfavorable foreign currency exchange rate. The adjusted EBITDA margin expanded 20 bps to 17%.

Non-GAAP operating income increased to $198 million from the year-ago quarter’s $173 million. The non-GAAP operating margin contracted 40 bps to 9.9% from the year-earlier quarter’s 10.3%.

Balance Sheet & Other Details

NCR exited the June-end quarter with cash and cash equivalents of $398 million compared with the $412 million reported during the March-end quarter.

Net cash provided by operating activities was $80 million in the second quarter. The free cash flow was break-even compared with the prior quarter’s cash flow of $142 million.

Reiterated FY22 Guidance

NCR reaffirmed its guidance for the full year of 2022, which it provided during the first-quarter earnings release. For full-year 2022, NCR continues anticipating revenues of approximately $8 billion. The company expects unfavorable currency exchange rates to negatively impact second-half revenues by $170 million.

The company projects adjusted EBITDA in the band of $1.4-$1.5 billion. Non-GAAP diluted earnings are still projected between $2.70 and $3.20 per share.

Zacks Rank & Stocks to Consider

Currently, NCR carries a Zacks Rank #3 (Hold). Shares of NCR have plunged 22% year to date (“YTD”).

Some better-ranked stocks worth considering from the broader technology sector are Intuit INTU, Synopsys SNPS and CrowdStrike CRWD, each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for Intuit's fourth-quarter fiscal 2022 earnings has been revised upward by two cents to 99 cents per share over the past 60 days. For fiscal 2022, the Zacks Consensus Estimate for Intuit's earnings has moved north by four cents to $11.72 per share in the past 60 days.

Intuit's earnings beat the Zacks Consensus Estimate thrice in the preceding four quarters while missing the same on one occasion, the average surprise being 16.8%. Shares of INTU have plunged 32.7% YTD.

The Zacks Consensus Estimate for Synopsys' third-quarter fiscal 2022 earnings has been revised upward by 35% to $2.04 per share over the past 90 days. For fiscal 2022, earnings estimates have moved north by 9.7% to $8.67 per share in the past 90 days.

Synopsys' earnings beat the Zacks Consensus Estimate in each of the preceding four quarters, the average surprise being 2.7%. Shares of SNPS have decreased 4.1% YTD.

The Zacks Consensus Estimate for CrowdStrike's second-quarter fiscal 2023 earnings has been revised upward by three cents to 29 cents per share in the past 60 days. For fiscal 2023, earnings estimates have moved north by 11 cents to $1.23 per share in the past 60 days.

CrowdStrike's earnings beat the Zacks Consensus Estimate in the preceding four quarters, the average surprise being 44.3%. Shares of CRWD have plunged 13.6% YTD.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

NCR Corporation (NCR) : Free Stock Analysis Report

Intuit Inc. (INTU) : Free Stock Analysis Report

Synopsys, Inc. (SNPS) : Free Stock Analysis Report

CrowdStrike (CRWD) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance