National Fuel Gas (NFG) Q3 Earnings Top Estimates, Sales Lag

National Fuel Gas Company NFG posted third-quarter fiscal 2019 operating earnings of 71 per share, beating the Zacks Consensus Estimate of 63 cents by nearly 12.7% but declining 2.7% from the year-ago figure of 73 cents.

Total Revenues

Total revenues of $357.2 million missed the Zacks Consensus Estimate of $398 million by 10.3%. However, the top line increased 4.2% from the prior-year figure of $342.9 million.

The year-over-year improvement was primarily due to strong contribution from Exploration and Production, and Other segments. However, lower contribution from Utility, Energy Marketing and Pipeline, and Storage and Gathering segments marginally offset the positives.

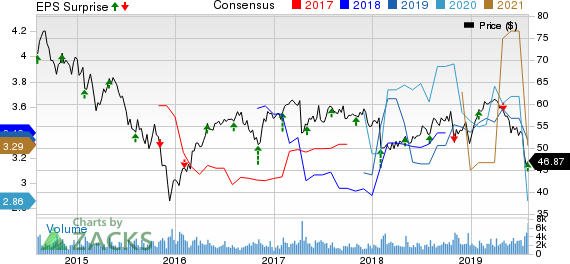

National Fuel Gas Company Price, Consensus and EPS Surprise

National Fuel Gas Company price-consensus-eps-surprise-chart | National Fuel Gas Company Quote

Highlights of the Release

Total operating costs in the reported quarter increased 6.8% from the year-ago period to $244.4 million, owing to rise in operating and maintenance expenses, along with higher taxes.

Total gas production in the reported quarter was 51,260 million cubic feet (MMcf), up from the year-ago figure of 40,970 MMcf, primarily due to higher production from the Appalachia region. Oil production was 576,000 barrels, down 4.2% from the year-ago level due to lower production from the West Coast region.

Operating income in the reported quarter was down nearly 1% year over year to $112.9 million.

The company incurred interest expenses of $26.5 million, down 5.7% from the year-ago period.

Financial Highlights

On Jun 30, 2019, National Fuel Gas had cash and cash equivalents of $87.5 million compared with $229.6 million as of Sep 30, 2018.

Long-term debt (excluding current maturities) was $2,133.1 million as of Jun 30, 2019 compared with the Sep 30, 2018 level of $2,131.4 million.

The company’s cash flow from operating activities in the first nine months of fiscal 2019 was $570.6 million, up from $518.1 million recorded in the comparable prior-year period.

Total capital expenditure in the first nine months of fiscal 2019 was $587.4 million, higher than $403.9 million in the comparable year-ago period.

Guidance

National Fuel Gas downwardly revised its fiscal 2019 earnings guidance to the range of $3.40- $3.50 from earlier expectation of $3.45-$3.65. The company expects fiscal 2020 earnings in the range of $3.25-$3.55 per share.

It reiterated the Exploration and Production segment’s fiscal 2019 net production guidance in the range of 205-215 billion cubic feet equivalent (Bcfe). For Fiscal 2020, production is expected in the range of 235-245 Bcfe.

Other Releases

MDU Resources Group Inc. MDU reported second-quarter 2019 operating earnings of 32 cents per share, which beat the Zacks Consensus Estimate of 25 cents by 28%.

ONE Gas, Inc. OGS recorded second-quarter 2019 operating earnings of 46 cents per share, which beat the Zacks Consensus Estimate of 41 cents by 12.2%.

ONEOK Inc. OKE reported second-quarter 2019 operating earnings of 75 cents per share, which surpassed the Zacks Consensus Estimate of 70 cents by 7.14%.

Zacks Rank

National Fuel Gas currently carries a Zacks Rank #5 (Strong Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Breakout Biotech Stocks with Triple-Digit Profit Potential

The biotech sector is projected to surge beyond $775 billion by 2024 as scientists develop treatments for thousands of diseases. They’re also finding ways to edit the human genome to literally erase our vulnerability to these diseases.

Zacks has just released Century of Biology: 7 Biotech Stocks to Buy Right Now to help investors profit from 7 stocks poised for outperformance. Our recent biotech recommendations have produced gains of +98%, +119% and +164% in as little as 1 month. The stocks in this report could perform even better.

See these 7 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

MDU Resources Group, Inc. (MDU) : Free Stock Analysis Report

ONE Gas, Inc. (OGS) : Free Stock Analysis Report

ONEOK, Inc. (OKE) : Free Stock Analysis Report

National Fuel Gas Company (NFG) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance