National Fuel Gas' (NFG) Board Approves 4% Dividend Hike

National Fuel Gas Company NFG announced that its board of directors has approved a 4% increase in its quarterly dividend rate. The company has paid dividends for 122 consecutive years, and this marks its annual dividend hike for 54 consecutive years. The new dividend rate will be 51.5 cents per share compared with the previous quarter’s 49.5 cents, payable on Jul 15, 2024, to stockholders of record as of Jun 28.

This increase resulted in an annualized dividend of $2.06 per share compared with the previous level of $1.98. National Fuel Gas’ current dividend yield is 3.6%, higher than the Zacks S&P 500 composite's average of 1.36%.

Can NFG Sustain Dividend Hikes?

The company’s systematic capital spending to strengthen its natural gas and oil operations is positively impacting its total production. It has been consistently increasing its total production since fiscal 2015. Also, National Fuel Gas’ acquisition of Royal Dutch Shell’s upstream and midstream assets in Pennsylvania for $500 million boosted its earnings and production.

Since 2010, National Fuel Gas Company has invested $2.7 billion in midstream operations to expand and modernize its pipeline infrastructure to gain access to Appalachian production. The company has more than $500 million in investment planned over the next five years for the modernization of pipeline transportation and distribution systems.

At present, its midstream operation has 4.5 million dekatherms of daily interstate pipeline capacity under contract. On completion, these projects are expected to further boost the pipeline capacity and annual revenues of the company.

NFG has the potential to expand and improve even further, which suggests that management will have sufficient funds to continue with its shareholder-friendly activities in the future.

Legacy of Dividend Payment

Companies involved in utility services generally have stable operations and earnings. Consistent performance, regulated returns and the ability to generate cash flows allow utilities to reward shareholders with regular dividends.

In the past few months, Chesapeake Utilities Corp. CPK, The Southern Company SO and FirstEnergy FE have raised their quarterly dividend rate by 8.5%, 2.9% and 3.6%, respectively.

The Zacks Consensus Estimate for Chesapeake Utilities’ 2024 earnings is pegged at $5.41 per share, implying a year-over-year increase of 1.9%. CPK’s current dividend yield is 2.21%.

The Zacks Consensus Estimate for Southern Company’s 2024 earnings is pegged at $3.99 per share, implying a year-over-year increase of 9.3%. SO’s current dividend yield is 3.66%.

The Zacks Consensus Estimate for FirstEnergy’s 2024 earnings is pegged at $2.68 per share, implying a year-over-year increase of 4.7%. FE’s current dividend yield is 4.4%.

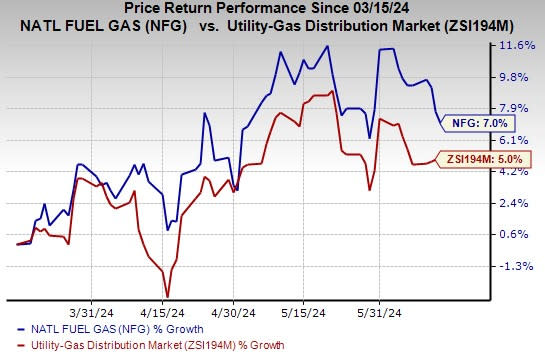

Price Performance

In the past three months, National Fuel Gas’ shares have risen 7% compared with the industry’s growth of 5%.

Image Source: Zacks Investment Research

Zacks Rank

National Fuel Gas currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Southern Company (The) (SO) : Free Stock Analysis Report

FirstEnergy Corporation (FE) : Free Stock Analysis Report

Chesapeake Utilities Corporation (CPK) : Free Stock Analysis Report

National Fuel Gas Company (NFG) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance