MYOB Can Do Better than KKR's Bid. But It Won't

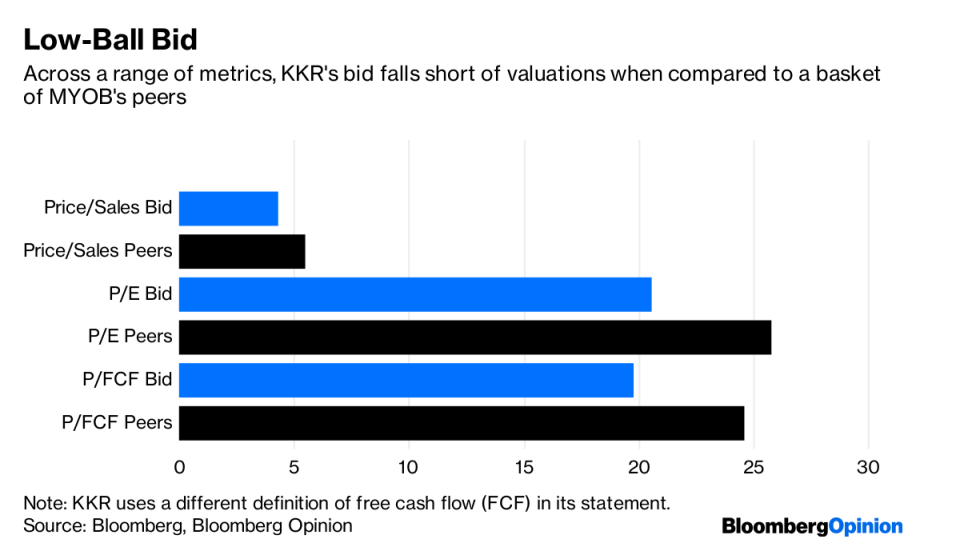

(Bloomberg Opinion) -- KKR & Co. looks like it’s low-balling MYOB Group Ltd.

Having initially offered A$3.70 per share for the Australian accounting-software maker, the private equity firm cut its bid to A$3.40. That’s still a premium to recent trading prices and the A$3.15 it paid to acquire a 17.6 percent stake.

Yet it’s a discount to peers.

KKR’s A$2 billion ($1.4 billion) offer prices MYOB at about 4.5 times sales, compared with the 5.5 times median for a group of peers such as Intuit Inc. and Xero Ltd. The bid, at 20.6 times estimated current-year earnings, also falls short of the 25.8 median of others in the sector. Price to free cash flow, a metric touted in Monday’s statement, also trails.

All these numbers indicate that shareholders ought to hope for more. The problem is, they’re unlikely to get it.

With Bain Capital already selling most of its stake – it still holds around 6 percent – there aren’t many private-equity firms left that are likely to show interest. The prospect of a bidding war is unrealistic. KKR cutting its own offer by 8 percent is unfortunate price-signalling for shareholders.

There’s also the fact that MYOB’s board changed its mind on the lower bid. Initially it said it wasn’t in a position to recommend this revised offer, before telling shareholders on Christmas Eve that they should vote in favor of it. Chairman Justin Milne’s explanation doesn’t exactly inspire confidence.

“Having regard to market uncertainty and the longer term nature of the strategic growth plan the Company has embarked upon.”

The two-month “go shop” provision built into the deal appears to tick the box that says the board is supposed to look after shareholders’ interests, but don’t expect them to work the phones over the Christmas-New Year break, or into the Australian summer, hustling for a better offer.

If there is a competing bid, it may come from a strategic rather than a financial investor. Any company looking to add accounting to its suite of software or cloud offerings could do worse than MYOB, especially given its solid brand name and track record in Australia and New Zealand. Yet its decidedly domestic focus also makes major international players – the Googles and Microsofts of the world – unlikely to bother.

So while KKR’s bid leaves money on the table, that doesn’t mean shareholders can count on getting it.

To contact the author of this story: Tim Culpan at tculpan1@bloomberg.net

To contact the editor responsible for this story: Matthew Brooker at mbrooker1@bloomberg.net

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

Tim Culpan is a Bloomberg Opinion columnist covering technology. He previously covered technology for Bloomberg News.

For more articles like this, please visit us at bloomberg.com/opinion

©2018 Bloomberg L.P.

Yahoo Finance

Yahoo Finance