How Much is Platinum Investment Management's (ASX:PTM) CEO Getting Paid?

Andrew Clifford has been the CEO of Platinum Investment Management Limited (ASX:PTM) since 2018, and this article will examine the executive's compensation with respect to the overall performance of the company. This analysis will also assess whether Platinum Investment Management pays its CEO appropriately, considering recent earnings growth and total shareholder returns.

View our latest analysis for Platinum Investment Management

How Does Total Compensation For Andrew Clifford Compare With Other Companies In The Industry?

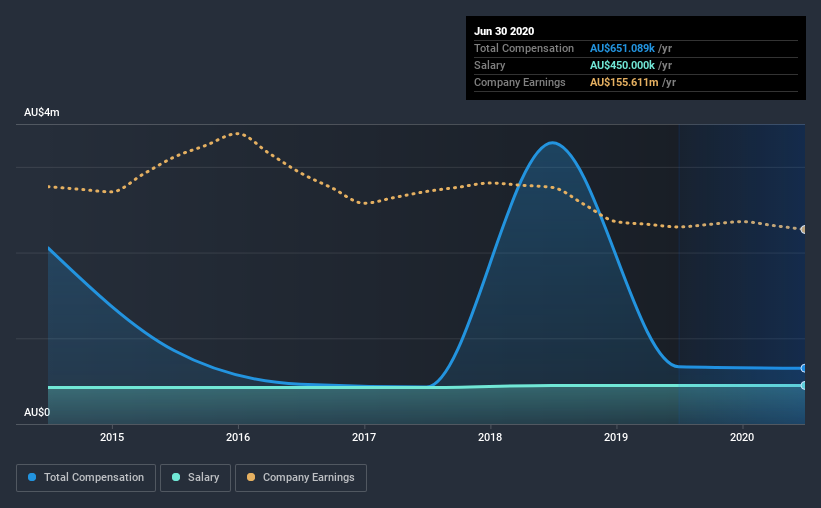

According to our data, Platinum Investment Management Limited has a market capitalization of AU$2.4b, and paid its CEO total annual compensation worth AU$651k over the year to June 2020. That's mostly flat as compared to the prior year's compensation. Notably, the salary which is AU$450.0k, represents most of the total compensation being paid.

For comparison, other companies in the same industry with market capitalizations ranging between AU$1.3b and AU$4.1b had a median total CEO compensation of AU$1.5m. Accordingly, Platinum Investment Management pays its CEO under the industry median. Furthermore, Andrew Clifford directly owns AU$154m worth of shares in the company, implying that they are deeply invested in the company's success.

Component | 2020 | 2019 | Proportion (2020) |

Salary | AU$450k | AU$450k | 69% |

Other | AU$201k | AU$218k | 31% |

Total Compensation | AU$651k | AU$668k | 100% |

Speaking on an industry level, nearly 68% of total compensation represents salary, while the remainder of 32% is other remuneration. Although there is a difference in how total compensation is set, Platinum Investment Management more or less reflects the market in terms of setting the salary. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

A Look at Platinum Investment Management Limited's Growth Numbers

Platinum Investment Management Limited has reduced its earnings per share by 5.5% a year over the last three years. Revenue was pretty flat on last year.

Few shareholders would be pleased to read that EPS have declined. And the flat revenue hardly impresses. So given this relatively weak performance, shareholders would probably not want to see high compensation for the CEO. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Platinum Investment Management Limited Been A Good Investment?

Given the total shareholder loss of 38% over three years, many shareholders in Platinum Investment Management Limited are probably rather dissatisfied, to say the least. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

To Conclude...

As previously discussed, Andrew is compensated less than what is normal for CEOs of companies of similar size, and which belong to the same industry. Over the last three years, shareholder returns have been downright disappointing, and EPSgrowth has been equally disappointing. It's tough to say that Andrew is earning a very high compensation, but shareholders will likely want to see healthier investor returns before agreeing that a raise is in order.

CEO compensation is an important area to keep your eyes on, but we've also need to pay attention to other attributes of the company. In our study, we found 3 warning signs for Platinum Investment Management you should be aware of, and 1 of them is significant.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

Yahoo Finance

Yahoo Finance