How Much Is Immunodiagnostic Systems Holdings PLC (LON:IDH) Paying Its CEO?

This article will reflect on the compensation paid to Jaap Stuut who has served as CEO of Immunodiagnostic Systems Holdings PLC (LON:IDH) since 2017. This analysis will also look to assess whether the CEO is appropriately paid, considering recent earnings growth and investor returns for Immunodiagnostic Systems Holdings.

See our latest analysis for Immunodiagnostic Systems Holdings

Comparing Immunodiagnostic Systems Holdings PLC's CEO Compensation With the industry

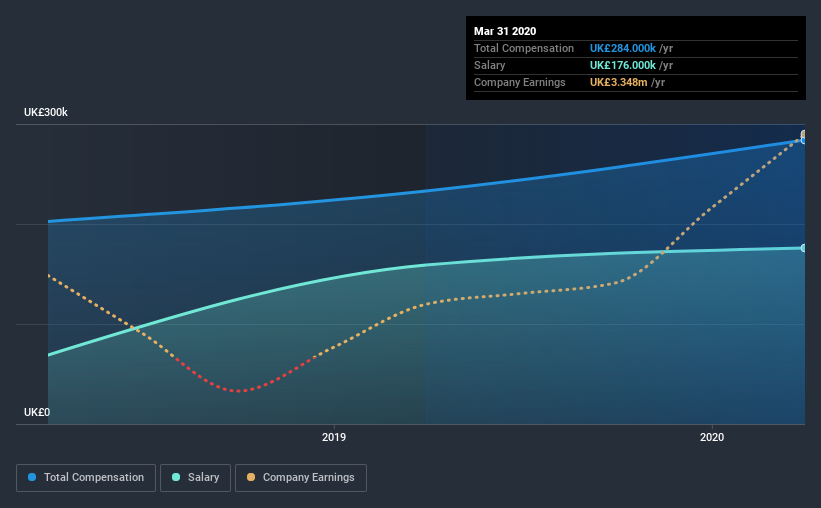

According to our data, Immunodiagnostic Systems Holdings PLC has a market capitalization of UK£59m, and paid its CEO total annual compensation worth UK£284k over the year to March 2020. That's a notable increase of 22% on last year. We note that the salary portion, which stands at UK£176.0k constitutes the majority of total compensation received by the CEO.

On comparing similar-sized companies in the industry with market capitalizations below UK£152m, we found that the median total CEO compensation was UK£240k. From this we gather that Jaap Stuut is paid around the median for CEOs in the industry.

Component | 2020 | 2019 | Proportion (2020) |

Salary | UK£176k | UK£159k | 62% |

Other | UK£108k | UK£74k | 38% |

Total Compensation | UK£284k | UK£233k | 100% |

On an industry level, roughly 62% of total compensation represents salary and 38% is other remuneration. Immunodiagnostic Systems Holdings is largely mirroring the industry average when it comes to the share a salary enjoys in overall compensation. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

Immunodiagnostic Systems Holdings PLC's Growth

Immunodiagnostic Systems Holdings PLC has seen its earnings per share (EPS) increase by 4.4% a year over the past three years. In the last year, its revenue is up 2.2%.

We're not particularly impressed by the revenue growth, but the modest improvement in EPS is good. So there are some positives here, but not enough to earn high praise. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has Immunodiagnostic Systems Holdings PLC Been A Good Investment?

With a three year total loss of 29% for the shareholders, Immunodiagnostic Systems Holdings PLC would certainly have some dissatisfied shareholders. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

To Conclude...

As previously discussed, Jaap is compensated close to the median for companies of its size, and which belong to the same industry. Meanwhile, Immunodiagnostic Systems Holdings is suffering from adverse shareholder returns and althoughEPS have grown over the past three years, they have not been extraordinary. Although we wouldn't say CEO compensation is exceptionally high, it isn't very low either. Shareholders might want to see substantial improvements in returns before agreeing that Jaap deserves a raise.

CEO compensation is a crucial aspect to keep your eyes on but investors also need to keep their eyes open for other issues related to business performance. That's why we did some digging and identified 4 warning signs for Immunodiagnostic Systems Holdings that investors should think about before committing capital to this stock.

Switching gears from Immunodiagnostic Systems Holdings, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

Yahoo Finance

Yahoo Finance