How Much Did Virgin Money UK's(LON:VMUK) Shareholders Earn From Share Price Movements Over The Last Three Years?

While not a mind-blowing move, it is good to see that the Virgin Money UK PLC (LON:VMUK) share price has gained 22% in the last three months. But over the last three years we've seen a quite serious decline. In that time, the share price dropped 69%. So it's good to see it climbing back up. After all, could be that the fall was overdone.

Check out our latest analysis for Virgin Money UK

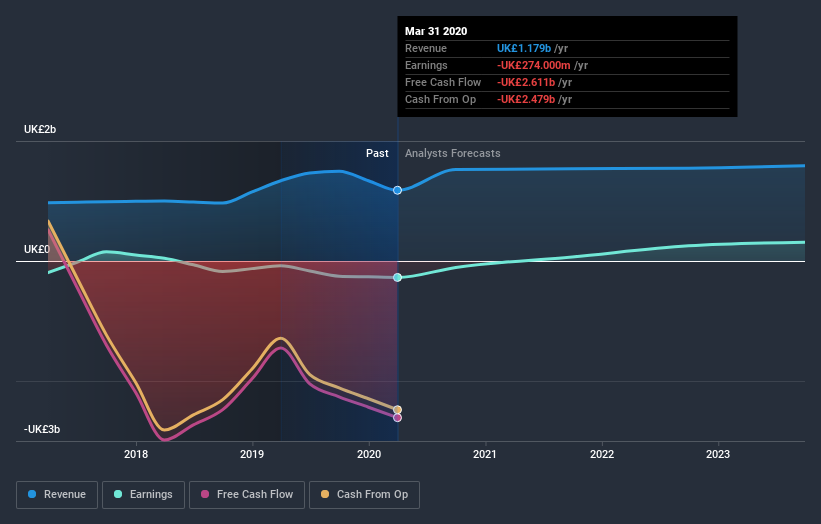

Given that Virgin Money UK didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually expect strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

Over three years, Virgin Money UK grew revenue at 14% per year. That's a fairly respectable growth rate. So some shareholders would be frustrated with the compound loss of 19% per year. To be frank we're surprised to see revenue growth and share price growth diverge so strongly. It would be well worth taking a closer look at the company, to determine growth trends (and balance sheet strength).

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

Virgin Money UK is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. So we recommend checking out this free report showing consensus forecasts

A Different Perspective

The last twelve months weren't great for Virgin Money UK shares, which performed worse than the market, costing holders 39%. Meanwhile, the broader market slid about 7.9%, likely weighing on the stock. Shareholders have lost 19% per year over the last three years, so the share price drop has become steeper, over the last year; a potential symptom of as yet unsolved challenges. Although Baron Rothschild famously said to "buy when there's blood in the streets, even if the blood is your own", he also focusses on high quality stocks with solid prospects. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For instance, we've identified 1 warning sign for Virgin Money UK that you should be aware of.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

Yahoo Finance

Yahoo Finance