How Much Did United Therapeutics'(NASDAQ:UTHR) Shareholders Earn From Share Price Movements Over The Last Five Years?

The main aim of stock picking is to find the market-beating stocks. But every investor is virtually certain to have both over-performing and under-performing stocks. So we wouldn't blame long term United Therapeutics Corporation (NASDAQ:UTHR) shareholders for doubting their decision to hold, with the stock down 25% over a half decade. Shareholders have had an even rougher run lately, with the share price down 10% in the last 90 days.

See our latest analysis for United Therapeutics

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

United Therapeutics became profitable within the last five years. That would generally be considered a positive, so we are surprised to see the share price is down. Other metrics may better explain the share price move.

In contrast to the share price, revenue has actually increased by 0.5% a year in the five year period. A more detailed examination of the revenue and earnings may or may not explain why the share price languishes; there could be an opportunity.

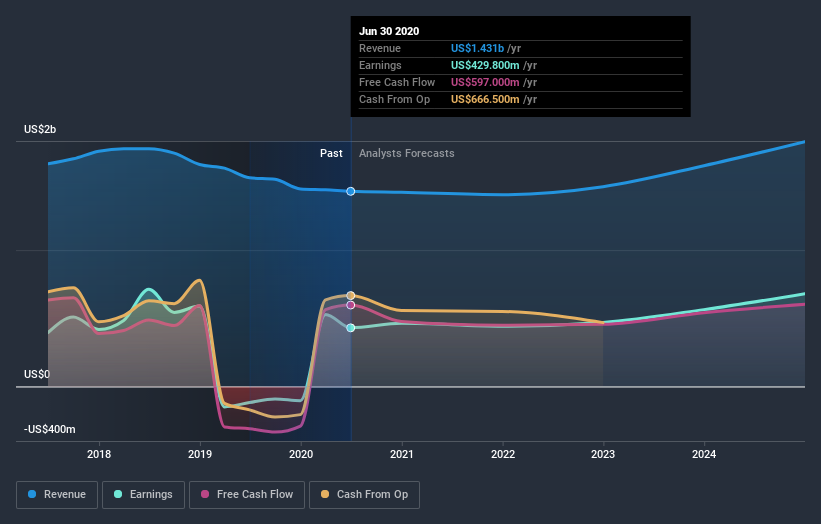

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

United Therapeutics is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. You can see what analysts are predicting for United Therapeutics in this interactive graph of future profit estimates.

A Different Perspective

It's good to see that United Therapeutics has rewarded shareholders with a total shareholder return of 23% in the last twelve months. That certainly beats the loss of about 4.5% per year over the last half decade. This makes us a little wary, but the business might have turned around its fortunes. Most investors take the time to check the data on insider transactions. You can click here to see if insiders have been buying or selling.

Of course United Therapeutics may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

Yahoo Finance

Yahoo Finance