MTG or ACT: Which Multiline Insurance Stock is Better-Positioned?

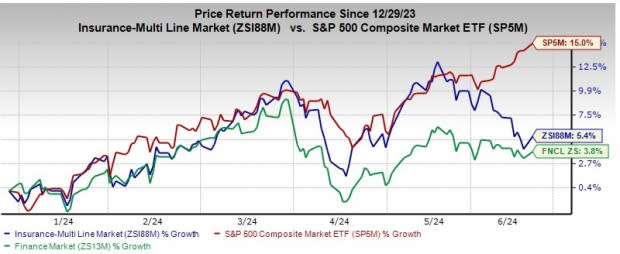

Better pricing, prudent underwriting, increased exposure and faster economic recovery should help Multiline insurers to grow. The industry has risen 5.4% year to date compared with the Finance sector’s increase of 3.8%. The Zacks S&P 500 composite has witnessed an increase of 15% in the said time frame. Product diversification helps insurance industry players lower concentration risk and improve retention ratio.

Image Source: Zacks Investment Research

Accelerated digitalization will help the industry function smoothly. An improving rate environment should drive investment income higher as insurers are beneficiaries of a better rate environment.

Here we focus on two multiline insurers, namely MGIC Investment Corporation MTG and Enact Holdings, Inc. ACT.

MGIC Investment, with a market capitalization of $5.6 billion, provides private mortgage insurance, other mortgage credit risk management solutions and ancillary services to lenders and government-sponsored entities in the United States. Enact Holdings, with a market capitalization of $4.7 billion, operates as a private mortgage insurance company in the United States. The company also offers private mortgage insurance products, contract underwriting services for mortgage lenders and mortgage-related reinsurance products. MTG and ACT carry a Zacks Rank #3 (Hold) each at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Multiline insurers benefit from a diversified portfolio that lowers concentration risk. While higher demand for protection products benefits sales and premiums of life insurance operations, better pricing and increased exposure to intangibles and cyber threats support premium growth of non-life insurance operations.

Also, per Deloitte Insights, the transition to green energy and related insurance products, as well as exposure to intangible assets, offers growth opportunities. Per a report in Carrier Management, AM Best expects profitable commercial lines and improving personal lines in 2024.

Insurers invest a portion of their premium income. Therefore, the higher the rates, the better the investment results. Despite different opinions, the Fed has refrained from cutting rates so far. With a large invested asset base, investment income should remain healthy even if the Fed cuts rates later this year.

Multiline insurers are investing heavily in technology to improve scale and efficiencies. This should help them generate higher margins and improve profitability.

These positives together help insurers build solid policyholders’ surplus that helps the industry absorb losses. The solid capital level of the multiline insurers will fuel merger and acquisition activities to ramp up growth, and aid these insurers in engaging in shareholder-friendly moves.

Let’s delve deeper into specific parameters to ascertain which multi-line insurer is better-positioned at the moment.

Price Performance

Shares of MGIC Investment have climbed 9% year to date, outperforming the industry’s growth of 5.4% and Enact Holdings’ rise of 4.3%.

Image Source: Zacks Investment Research

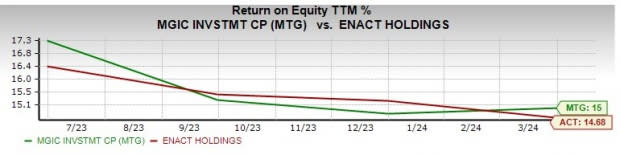

Return on Equity (ROE)

MGIC Investment, with a ROE of 15%, exceeds Enact Holdings’ ROE of 14.6% and the industry average of 14.1%.

Image Source: Zacks Investment Research

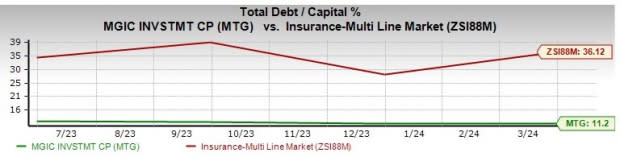

Debt-to-Capital

MGIC Investment’s debt-to-capital ratio of 11.2 is lower than the industry average of 36.1 and Enact Holdings’ reading of 13.6. Therefore, MTG has an advantage over ACT on this front.

Image Source: Zacks Investment Research

Earnings Surprise History

MTG outpaced expectations in each of the last seven reported quarters. Enact Holdings surpassed estimates in six of the last seven reported quarters.

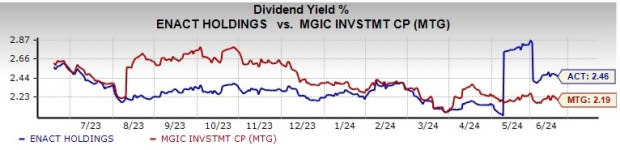

Dividend Yield

Enact Holdings’ dividend yield of 2.46% is better than MGIC Investment’s dividend yield of 2.19%. Thus, AXS has an advantage over ACT on this front.

Image Source: Zacks Investment Research

VGM Score

VGM Score rates each stock on its combined weighted styles, helping to identify those with the most attractive value, best growth and most promising momentum. MGIC Investment has a VGM Score of B, while Enact Holdings has a VGM Score of C. Thus, MTG is better placed.

Revenue Estimates

The Zacks Consensus Estimate for Enact Holdings' and MGIC Investment 's 2024 revenues implies a year-over-year increase of 7.4% and 4.6%, respectively.

Therefore, ACT is at an advantage on this front.

Net Margin

MGIC Investment’s net margin for the trailing 12 months was 62.8%, higher than ACT’s reading of 55.8%.

To Conclude

Our comparative analysis shows that MGIC Investment is better positioned than Enact Holdings with respect to price, return on equity, leverage, earnings surprise history, VGM Score and net margin. ACT outpaces MTG in terms of dividend yield and revenue estimates. With the scale majorly tilted toward MGIC Investment, the stock appears to be better poised.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

MGIC Investment Corporation (MTG) : Free Stock Analysis Report

Enact Holdings, Inc. (ACT) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance