MS Global Franchise Portfolio's Strategic Moves: A Deep Dive into Philip Morris International's ...

Insights from the First Quarter of 2024 N-PORT Filing

MS Global Franchise Portfolio (Trades, Portfolio), managed by Morgan Stanley Institutional Fund, recently disclosed its investment activities for the first quarter of 2024. Established on November 28, 2001, the fund is renowned for its rigorous, bottom-up stock selection process. The investment team prioritizes companies with strong, sustainable financial metrics, particularly those demonstrating high unlevered return on invested capital (ROIC). This approach focuses on identifying businesses with robust franchise qualities, including recurring revenues and high gross margins, which are essential for generating strong free cash flow.

Summary of New Buys

During the quarter, MS Global Franchise Portfolio (Trades, Portfolio) expanded its holdings by adding four new stocks. Noteworthy new acquisitions include:

UnitedHealth Group Inc (NYSE:UNH) with 183,189 shares, making up 3.1% of the portfolio and valued at $90.62 million.

Constellation Brands Inc (NYSE:STZ), comprising 112,914 shares or approximately 1.05% of the portfolio, with a total value of $30.69 million.

Haleon PLC (LSE:HLN), adding 4,983,985 shares, accounting for 0.71% of the portfolio, valued at 20.89 million.

Key Position Increases

The portfolio also saw significant increases in several existing positions:

Coca-Cola Co (NYSE:KO) saw an addition of 336,256 shares, bringing the total to 1,410,372 shares. This adjustment represents a 31.31% increase in share count, impacting the portfolio by 0.7%, with a total value of $86.29 million.

Aon PLC (NYSE:AON) increased by 54,823 shares, resulting in a total of 297,413 shares. This adjustment marks a 22.6% increase in share count, valued at $99.25 million.

Summary of Sold Out Positions

The fund completely exited its position in:

Nike Inc (NYSE:NKE), selling all 166,735 shares, which had a -0.63% impact on the portfolio.

Key Position Reductions

Significant reductions were made in several holdings, including:

Philip Morris International Inc (NYSE:PM), with a reduction of 991,448 shares, resulting in a -52.75% decrease and a -3.25% impact on the portfolio. The stock traded at an average price of $92.21 during the quarter and has returned 12.09% over the past three months and 7.19% year-to-date.

Danaher Corp (NYSE:DHR) saw a reduction of 200,194 shares, marking a -39.4% decrease and a -1.62% impact on the portfolio. The stock's average trading price was $244.03 during the quarter, with a return of 1.32% over the past three months and 10.87% year-to-date.

Portfolio Overview

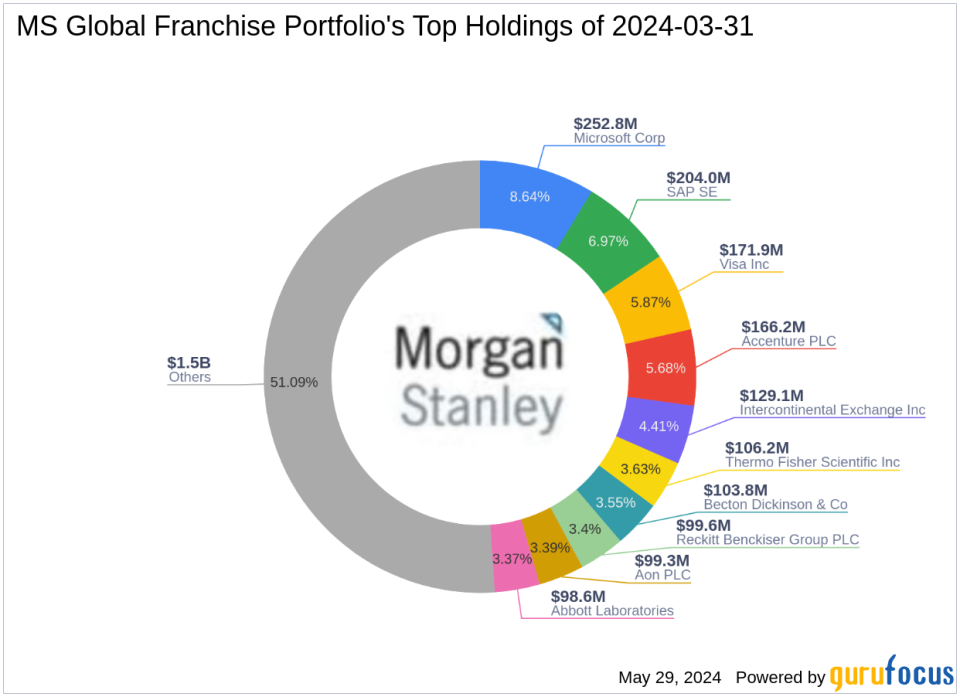

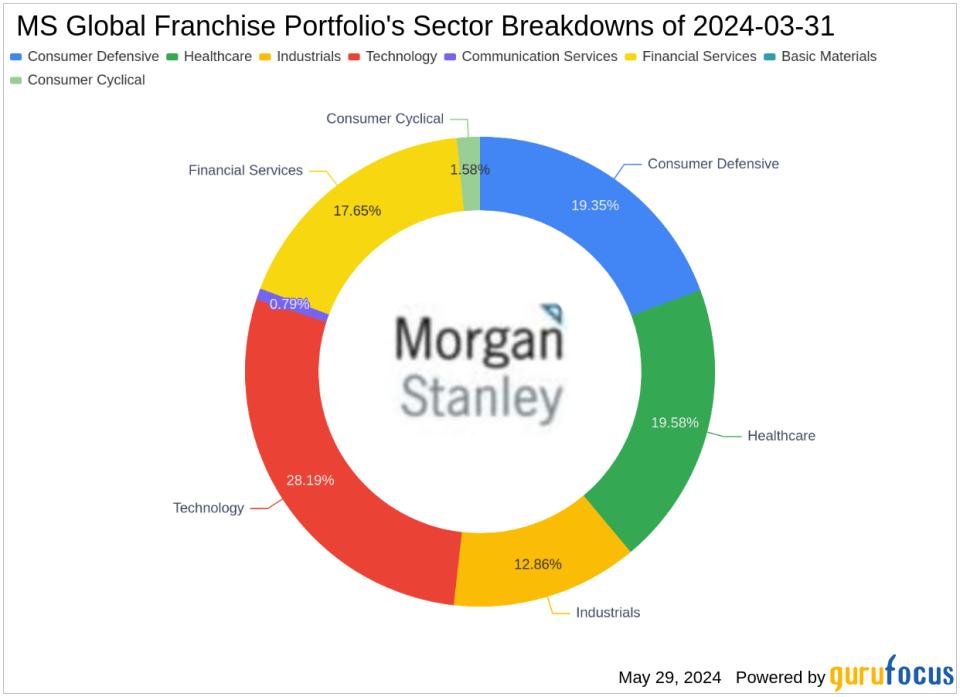

As of the first quarter of 2024, MS Global Franchise Portfolio (Trades, Portfolio)'s portfolio included 40 stocks. The top holdings were 8.64% in Microsoft Corp (NASDAQ:MSFT), 6.97% in SAP SE (XTER:SAP), 5.87% in Visa Inc (NYSE:V), 5.68% in Accenture PLC (NYSE:ACN), and 4.41% in Intercontinental Exchange Inc (NYSE:ICE). The holdings are predominantly concentrated in seven industries: Technology, Healthcare, Consumer Defensive, Financial Services, Industrials, Consumer Cyclical, and Communication Services.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance