MPLX LP (MPLX) Q4 Earnings Miss Estimates, Revenues Beat

MPLX LP MPLX reported fourth-quarter earnings of 63 cents per unit, missing the Zacks Consensus Estimate by a penny. The bottom line, however, improved from the year-ago comparable quarter’s loss of 58 cents per unit.

Revenues of $2,249 million declined from fourth-quarter 2019 sales of $2,316 million. However, the top line beat the Zacks Consensus Estimate of $2,095 million.

The partnership’s improvement in year-over-year earnings was aided by favorable average tariff rates from the crude oil and product pipelines. This was partially offset by lower terminal throughput volumes.

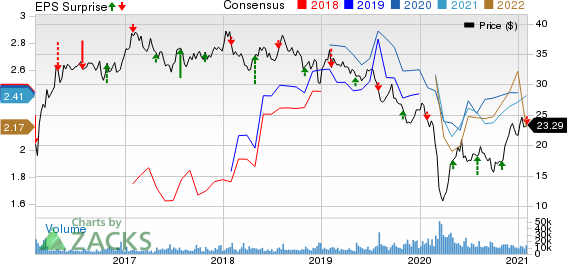

MPLX LP Price, Consensus and EPS Surprise

MPLX LP price-consensus-eps-surprise-chart | MPLX LP Quote

Segmental Highlights

MPLX’s adjusted EBITDA from the Logistics and Storage segment increased from $853 million a year ago to $884 million. Favorable average tariff rates from the crude oil and product pipelines aided the segment, partially offset by lower terminal throughput.

Adjusted EBITDA from the Gathering and Processing segment was recorded at $471 million, up from $466 million in the prior-year quarter. The outperformance was driven by higher fractionated volumes of C2 and NGLs.

Costs and Expenses

Total costs and expenses for the quarter were recorded at $1,329 million, down from the year-ago level of $2,662 million. Expenses related to operations declined to $519 million from $625 million in the prior-year quarter.

Cash Flow

Distributable cash flow attributable to MPLX in fourth-quarter 2020 was $1,155 million, providing 1.58X distribution coverage, up from $1,045 million in the year-ago quarter. Distribution per unit was 68.75 cents for the reported quarter, flat with the year-ago quarter.

Net cash flow from operating activities for the quarter under review increased to $1,185 million from $1,092 million recorded in the corresponding period of 2019.

Balance Sheet

As of Dec 31, 2020, the partnership’s cash and cash equivalents were $15 million. Its total long-term debt amounted to $20.1 billion, while debt to capitalization was 60.7%.

Outlook

The partnership foresees capital investment of $800 million for growth projects in 2021 that will probably generate best returns and will add to cashflows.

Zacks Rank & Key Picks

MPLX currently carries a Zacks Rank #3 (Hold). Meanwhile, some better-ranked players in the energy space include Matador Resources Company MTDR, DCP Midstream, LP DCP and Diamondback Energy, Inc. FANG. While Diamondback carries a Zacks Rank #2 (Buy), Matador and DCP Midstream sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Matador is likely to see earnings growth of 201.3% in 2021.

DCP Midstream has seen upward estimate revisions for 2021 earnings in the past 30 days.

Diamondback is likely to see earnings growth of 55% in 2021.

These Stocks Are Poised to Soar Past the Pandemic

The COVID-19 outbreak has shifted consumer behavior dramatically, and a handful of high-tech companies have stepped up to keep America running. Right now, investors in these companies have a shot at serious profits. For example, Zoom jumped 108.5% in less than 4 months while most other stocks were sinking.

Our research shows that 5 cutting-edge stocks could skyrocket from the exponential increase in demand for “stay at home” technologies. This could be one of the biggest buying opportunities of this decade, especially for those who get in early.

See the 5 high-tech stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Matador Resources Company (MTDR) : Free Stock Analysis Report

DCP Midstream Partners, LP (DCP) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance