Most Shareholders Will Probably Find That The Compensation For Nelnet, Inc.'s (NYSE:NNI) CEO Is Reasonable

Key Insights

Nelnet's Annual General Meeting to take place on 16th of May

CEO Jeff Noordhoek's total compensation includes salary of US$854.5k

The total compensation is 73% less than the average for the industry

Nelnet's total shareholder return over the past three years was 37% while its EPS was down 35% over the past three years

Performance at Nelnet, Inc. (NYSE:NNI) has been rather uninspiring recently and shareholders may be wondering how CEO Jeff Noordhoek plans to fix this. One way they can exercise their influence on management is through voting on resolutions, such as executive remuneration at the next AGM, coming up on 16th of May. It has been shown that setting appropriate executive remuneration incentivises the management to act in the interests of shareholders. We have prepared some analysis below to show that CEO compensation looks to be reasonable.

See our latest analysis for Nelnet

Comparing Nelnet, Inc.'s CEO Compensation With The Industry

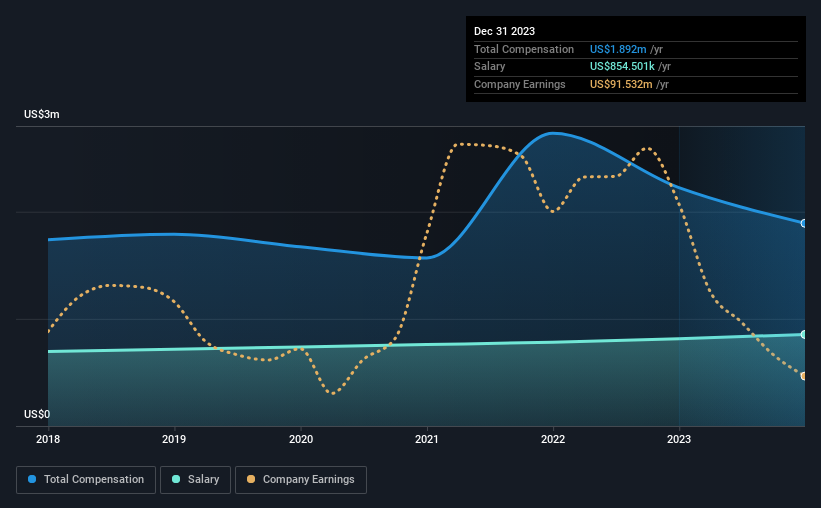

According to our data, Nelnet, Inc. has a market capitalization of US$3.6b, and paid its CEO total annual compensation worth US$1.9m over the year to December 2023. We note that's a decrease of 15% compared to last year. While we always look at total compensation first, our analysis shows that the salary component is less, at US$855k.

On comparing similar companies from the American Consumer Finance industry with market caps ranging from US$2.0b to US$6.4b, we found that the median CEO total compensation was US$7.1m. This suggests that Jeff Noordhoek is paid below the industry median. Furthermore, Jeff Noordhoek directly owns US$54m worth of shares in the company, implying that they are deeply invested in the company's success.

Component | 2023 | 2022 | Proportion (2023) |

Salary | US$855k | US$814k | 45% |

Other | US$1.0m | US$1.4m | 55% |

Total Compensation | US$1.9m | US$2.2m | 100% |

Talking in terms of the industry, salary represented approximately 17% of total compensation out of all the companies we analyzed, while other remuneration made up 83% of the pie. According to our research, Nelnet has allocated a higher percentage of pay to salary in comparison to the wider industry. It's important to note that a slant towards non-salary compensation suggests that total pay is tied to the company's performance.

A Look at Nelnet, Inc.'s Growth Numbers

Over the last three years, Nelnet, Inc. has shrunk its earnings per share by 35% per year. In the last year, its revenue is down 22%.

Overall this is not a very positive result for shareholders. And the impression is worse when you consider revenue is down year-on-year. It's hard to argue the company is firing on all cylinders, so shareholders might be averse to high CEO remuneration. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Nelnet, Inc. Been A Good Investment?

We think that the total shareholder return of 37%, over three years, would leave most Nelnet, Inc. shareholders smiling. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

To Conclude...

Despite the strong returns on shareholders' investments, the fact that earnings have failed to grow makes us skeptical about the stock keeping up its current momentum. These concerns could be addressed to the board and shareholders should revisit their investment thesis to see if it still makes sense.

We can learn a lot about a company by studying its CEO compensation trends, along with looking at other aspects of the business. That's why we did our research, and identified 3 warning signs for Nelnet (of which 1 is concerning!) that you should know about in order to have a holistic understanding of the stock.

Switching gears from Nelnet, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Finance

Yahoo Finance