DOUBLED: Sign Aussie homeowners are in trouble

The number of Australian homeowners struggling to cover their home loan has more than doubled since June as new mortgage rules leave borrowers in a bind.

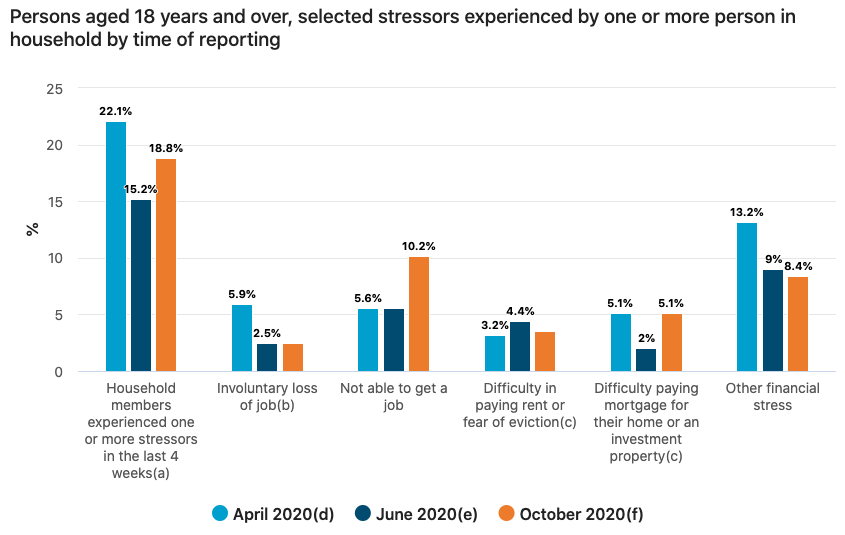

New data from the Australian Bureau of Statistics found 11 per cent of Australians who own a property had trouble paying their mortgage on their home or investment property in October, up from 5 per cent in June.

That’s just over 5 per cent across all households, which includes renters.

Around $133 billion of home loans were on temporary deferrals as of 30 September, or around 7.4 per cent of all loans. However the number of home loans being deferred has fallen by 70 per cent since its peak, according to the Australian Banking Association.

It comes after fresh analysis in Mozo’s Mortgage Prisoner’s report found that while 88 per cent of borrowers would like to refinance, 45 per cent are stuck due to fallen earnings.

The analysis of 3,270 borrowers found the average mortgage holder could save $78,000 over the life of their loan by securing a better interest rate.

“The majority of mortgage holders (64 per cent) feel their mortgage is incredibly high,” said Mozo director Kirsty Lamont.

She said borrowers were also eyeing the property market with concern.

“For mortgage holders seriously concerned about making repayments, it’s only natural that they’d be nervously eyeing the housing market and hoping things don’t slide. The double whammy of foreclosure and plummeting home value is a real concern for many,” she said.

Mozo defined mortgage prisoners as borrowers who – despite having met every repayment – are unable to get a better deal due to new affordability tests that make them unsuitable borrowers for other lenders.

It found that 29 per cent of borrowers who deferred had lost their job and 16 per cent had had their pay cut.

“The flow on effect is many owner occupier borrowers are now finding themselves falling into the ‘mortgage prisoner’ category. The sad reality is borrowers who need competitive mortgage rates to stay financially afloat are most likely to be mortgage prisoners.”

Australians’ financial challenges

On top of the mortgage challenges, the ABS data found 10 per cent of Australians reported problems in finding a job, up from 6 per cent in June.

Across both the June and October periods, 4 per cent of people surveyed revealed difficulty paying the rent or fears of eviction and 3 per cent reported involuntary job loss.

But Australians are taking steps to mitigate some of the financial pain, with one-in-seven homeowners having had their mortgage repayments deferred or reduced and one-in-13 renters having had their rent reduced or deferred. And across both groups, 5 per cent have had a bill or rate payment deferred or reduced.

Struggling Australians have also dipped into their superannuation, with one-in-eight raiding their retirement savings.

Nearly a quarter of those said they drew down on their super to cover mortgage or rent repayments, but the most common use of the super was to cover household bills and groceries.

Want to make next year your best yet? Join us for an Hour of Power at 10am AEDT Tuesday 24 November to discover 21 ways to make your money work for you in 2021. Registrations are now open.

Yahoo Finance

Yahoo Finance