‘Touch and go’ for one-in-four when mortgage holidays end

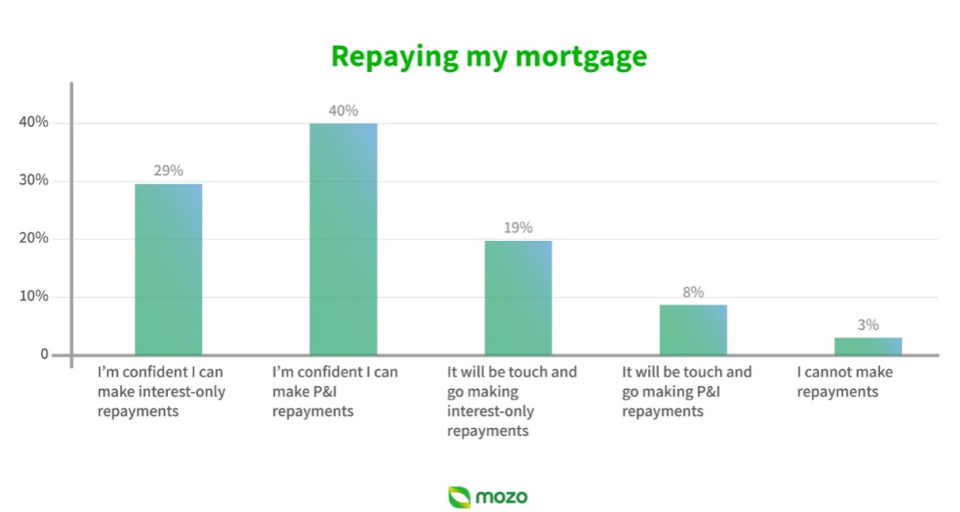

One-in-four mortgage holders on a repayment holiday say it will be ‘touch and go’ whether they can service their loan when mortgage repayments resume, finds new research given exclusively to Yahoo Finance by comparison house Mozo.

Worse, 3 per cent simply will not be able to service their loan, which Mozo says equates to nearly $7 billion in defaulted loans.

Data for August from regulator APRA show there are currently $229 billion in home, business and personal loans on repayment deferrals. This represents about 8.5 per cent of total outstanding loans across Australia.

Why so many? Mozo’s survey of more than 3000 property owners reveals 29 per cent have recently lost their job and 16 per cent have had a pay cut.

Surprisingly, 54 per cent of those on repayment holidays report being unaffected.

But unsurprisingly – given that women make up the majority of employees in the most-affected industries (such as retail, hospitality and tourism) – females are twice as worried as males that they’ll default on a mortgage.

Initially, lenders – in concert with the Australian Banking Association – offered six-month repayment holidays. They then put another four months on the table in far more limited circumstances.

By the end of September, the Australian Banking Association reports that 80,000 mortgage deferrers had been contacted by their lenders about restarting repayments.

Mozo director Kirsty Lamont says: “As the holiday period winds down, many mortgage holders find themselves having to make the weighty financial decision as to whether they can afford to service their loan or [need to] sell.”

And that feeds into the next stat…

An impossible choice for many mortgage holders

A whopping 62 per cent of mortgage holders on holidays are concerned about having to sell their home, or foreclosure, in the next year… a fact that highlights how many Australians feel vulnerable.

“People feel their footing is tenuous as the economic outlook for the next 12-18 months remains very much murky,” Ms Lamont says.

But with talk that the recession may be over just months after it began, and Victoria opening up again, there is some good news.

Four-in-10 Aussies who are currently on a mortgage holiday are confident they will even be able to afford higher principal-and-interest repayments when it ends. However, three-in-10 believe they may only be able to stretch to interest-only.

And that is going to be one of the big issues: will lenders allow interest-only, where income is an issue?

While Reserve Bank governor Dr Philip Lowe has said there is no reason homeowners couldn’t make repayments on an interest-only basis in these tight coronavirus times, previously such a thing was frowned on by the regulator.

What to do if you will struggle to pay

As counter-intuitive as it sounds, you should contact your lender if repayments could be beyond the pale.

And before it becomes an issue. This is the surest way to protect both your credit score and your house.

Lenders’ dedicated hardship departments may consider leniency such as:

Yes, switching your repayments to a cheaper interest-only basis for a period, say five years

Re-amortising your loan, which means spread it across a fresh 25 or 30 years and so reduce the monthly repayments

Temporarily reducing repayments, until you get back on your feet

You could also look to entirely refinance your loan with a cheaper lender, if you think you will get approved...remember it is about to become far easier to get approved, under a federal government move to boost the economy.

Just be aware that all the above options will ultimately increase the interest you pay.

But if you’re struggling today, that’s not the priority.

Nicole Pedersen-McKinnon is the author of How to Get Mortgage-Free Like Me, available at www.nicolessmartmoney.com. Follow Nicole on Facebook, Twitter and Instagram.

Yahoo Finance

Yahoo Finance