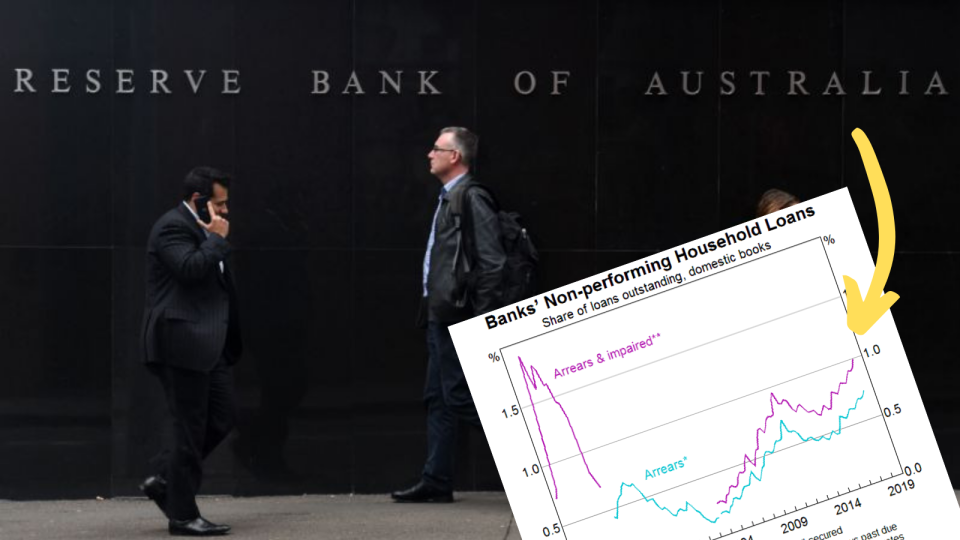

Aussie mortgage arrears rate at its highest since the GFC

The number of Australian home owners who aren’t making their mortgage repayments has been steadily rising since 2014.

And now it’s reached fever-pitch.

Reserve Bank of Australia head of financial stability Jonathan Kearns told Canberra today that mortgage arrears are back to levels we haven’t seen in nearly a decade.

“The share of banks' housing loans in arrears is now back around the level reached in 2010, the highest it has been for many years,” Kearns said in a speech at the 2019 Property Leaders’ Summit.

Related story: It’s time to end the “strong economy” propaganda

Related story: Maps: Where mortgage stress is worst in Australian capital cities

Related story: This is a MAJOR sign that the property market is about to hit rock bottom

What does this mean?

Rising rates of mortgage arrears often suggests an economy isn’t doing too well.

“In particular, borrowers can struggle to make their payments if their income falls. Weak conditions in housing markets make it hard for borrowers to get out of arrears by selling their property,” Kearns said.

“Conversely, large increases in interest rates, say to slow an overheating economy, can also contribute to rising arrears.”

But there are other factors at play, too, such as rising unemployment, wage growth (or lack thereof), rising costs of expenses, and even personal misfortune.

The changing of banks’ lending standards also play a part, too, as do rising house prices.

So should we be worried?

The Reserve Bank’s head of financial stability doesn’t seem to think so.

“Housing arrears have risen but by no means to a level that poses a risk to financial stability,” Kearns said.

So long as various economic elements pick back up, the rising rate of mortgage arrears shouldn’t be too big an issue.

“With overall strong lending standards, so long as unemployment remains low, arrears rates should not rise to levels that pose a risk to the financial system or cause great harm to the household sector,” Kearns said.

Make your money work with Yahoo Finance’s daily newsletter. Sign uphere and stay on top of the latest money, news and tech news.

Yahoo Finance

Yahoo Finance