Huge sign the property market is heating up again

Australia’s housing market looks set to perk up from the pandemic-induced slump very soon, new data has revealed.

Mortgage approvals actually hit pre-pandemic levels during July, Finder analysis of ABS housing finance data has shown, with owner-occupier purchases reaching 1.2 billion between June and July.

Approved mortgages rose from 25,713 in June to 28,322 in July, one of the biggest monthly increases since the pandemic hit.

“Judging by the surge in activity, plenty of Aussies are fired up about property again,” said Finder insights manager Graham Cooke.

“The housing market is also benefiting from the pent-up demand released with the restarting of auctions and inspections in several places.

“The full economic impact of COVID-19 has yet to be realised, but Aussies are unshakable in their love of housing.”

Australia’s property scene is about to see the release of a lot of pent-up demand, Cooke added.

“There are hundreds of Aussies with a deposit saved, watching properties and the housing market and ready to strike.

“It’s important for house hunters to get the most bang for their buck, so look at interest rates and loan features before putting in an offer,” Cooke said

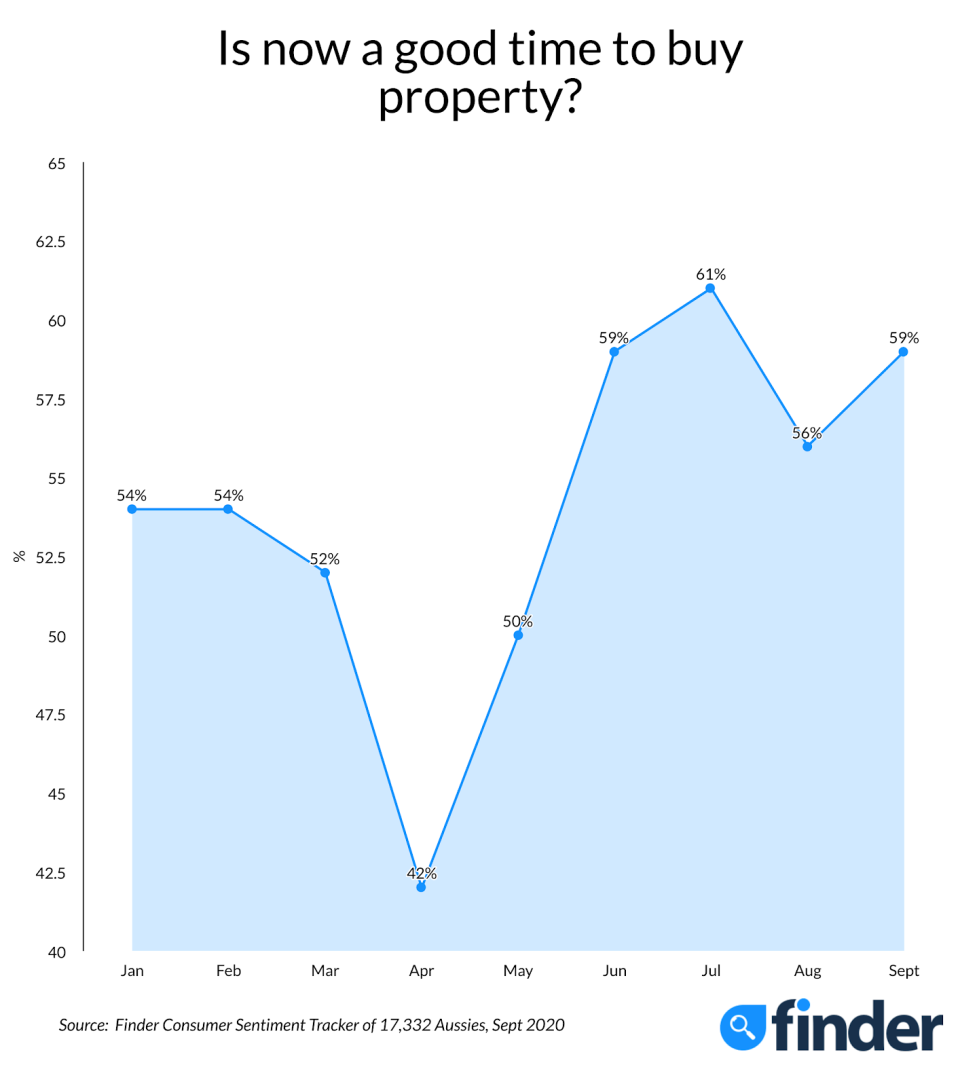

According to Finder’s Consumer Sentiment Tracker, sentiment around buying a house reached an all-time low in April but rose again in July.

Does this mean house prices will rise?

According to CoreLogic head of residential research Eliza Owen, all signs point to yes.

“Generally, we would expect that easier access to credit creates more competition, which is likely to have an inflationary impact on dwelling values,” Owen told Yahoo Finance.

And if the RBA does indeed cut rates again as widely speculated, even more house hunters will enter the market, she added.

“Between the potential for a further cash rate reduction, and federal government announcements to relax lending policies, we would expect to see added demand, which would have an upside impact on dwelling markets either late this year, or early next year.”

Earlier this week, Treasurer Josh Frydenberg said he was repealing the responsible lending laws that had been in place since 2009.

AMP Capital chief economist Shane Oliver told Yahoo Finance that the mortgage approval surge did mean more buyers on the market – but the figures also signal a “catch-up” to a slump during April.

“Despite that surge into July auction clearance rates and sales have yet to recover to precovid levels. And the hit to the economy has been masked by income support measures which are now starting to wind down at the same time that the number of immigrants has crashed,” he said.

“So I suspect it’s a mixed bag and we will see more weakness in Melbourne and to a less extent in Sydney.

“Adelaide, Brisbane, Canberra and Perth look reasonably supported though as they never had a preceding boom and are less dependent on immigrants.”

What to do if you want to buy a property

If you’re looking at snapping up a home, Cooke recommended saving up as much as possible for your deposit.

“A good savings history will also tell a potential lender that you're likely to be able to keep up with regular repayments. If you're a first home buyer, you may be entitled to the First Home Owners Grant (FHOG) which can form part of your deposit,” he said.

He also said Aussies should sort out their debts before they apply for mortgages as debts count against your borrowing power.

“You don't need to instantly pay off all your debts (you don't want to deplete your deposit savings) but making regular repayments to reduce them is essential,” he said.

Cutting back on unnecessary spending will also help, as well as talking to multiple lenders to understand your options.

Make your money work with Yahoo Finance’s daily newsletter. Sign up here and stay on top of the latest money, economy, property and work news.

Follow Yahoo Finance Australia on Facebook, Twitter, Instagram and LinkedIn.

Yahoo Finance

Yahoo Finance