MoneyGram (MGI) Ties Up to Ease Remittance Receipts in Jamaica

MoneyGram International, Inc. MGI recently teamed up with the digital wallet app of Jamaica – Lynk which was introduced in December 2021 and is owned by the leading financial group of the country — National Commercial Bank Financial Group ("NCBFG").

The partnership makes way for MoneyGram to introduce the feature of receiving cross-border payments directly into smartphones for the rapidly expanding user base of Lynk. Jamaican consumers can start availing this speedier, seamless and secure digital alternative to receiving funds from their loved ones from all across the globe.

Inevidently, MoneyGram will be able to establish a strong foothold in the Caribbean country through its recent initiative of launching the first-ever international digital receive capabilities across Jamaica. Simultaneously, the tie-up with Lynk is likely to bolster the mobile wallet capabilities of MGI across several countries of the world that continues to witness significant remittance receipts. Also, the alliance complements its age-old endeavor of extending increased choice as well as flexibility to consumers around the globe.

MoneyGram seems prudent to partner with a mobile wallet app this time, considering the bundled benefits that such apps provide and the significant number of smartphone users in Jamaica. Also, the developer of Lynk oversees more than 60% of Jamaica’s payments market, which seems commendable. The app also exhibits potential, evidenced by the significant amount of transactions amounting to $9.8 million that the mobile wallet app witnessed in the very first year of its operations.

It was on the basis of such partnerships and substantial investments that MoneyGram could build a solid digital arm and global presence over the years. Several fintech consider MGI as one of the most trustworthy international money transfer organizations and remain intrigued to avail its vast global ecosystem to upgrade its service suite.

The growing adoption of digital means worldwide serves as a perfect ground for MoneyGram’s digital arm to capitalize on. Increased utilization of its money transfer services with partnerships similar to the latest one is likely to fetch higher money transfer revenues to the company, which accounts for a majority portion of its top line.

MGI does not let go of any opportunity to upgrade its money transfer platform and its acquisition deal with Chicago-based private equity firm Madison Dearborn Partners (“MDP”) bears testament to the same. The buyout is likely to close either within the first quarter of 2023 or by the early second quarter. The acquisition is likely to leverage the proven payments expertise of MDP in solidifying the cross-border capabilities and digital platform of MoneyGram.

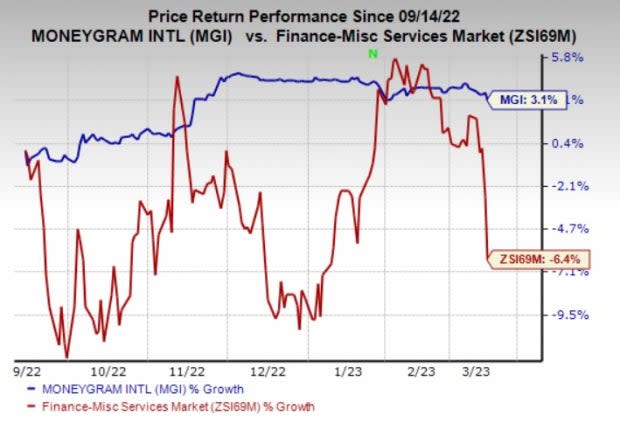

Shares of MoneyGram have gained 3.1% in the past six months against the industry’s 6.4% decline. MGI currently carries a Zacks Rank #2 (Buy).

Image Source: Zacks Investment Research

Other Stocks to Consider

Some other top-ranked stocks in the Finance space are Byline Bancorp, Inc. BY, Central Valley Community Bancorp CVCY and Hercules Capital, Inc. HTGC, each sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Byline Bancorp’s earnings surpassed estimates in each of the trailing four quarters, the average being 13.44%. The Zacks Consensus Estimate for BY’s 2023 earnings suggests an improvement of 8.9%, while the same for revenues suggests growth of 18.2% from the corresponding year-ago reported figures. The consensus mark for BY’s 2023 earnings has moved 2.4% north in the past 30 days.

The bottom line of Central Valley Community beat estimates in three of the trailing four quarters and missed the mark once, the average surprise being 3.82%. The Zacks Consensus Estimate for CVCY’s 2023 earnings suggests an improvement of 18.5%, while the same for revenues suggests growth of 13.2% from the corresponding year-ago reported figures. The consensus mark for CVCY’s 2023 earnings has moved 2.3% north in the past 30 days.

Hercules Capital’s earnings outpaced estimates in two of the last four quarters and missed the mark twice, the average surprise being 4.27%. The Zacks Consensus Estimate for HTGC’s 2023 earnings suggests an improvement of 25%, while the same for revenues suggests growth of 33.5% from the corresponding year-ago reported figures. The consensus mark for HTGC’s 2023 earnings has moved 5.7% north in the past 30 days.

Shares of Byline Bancorp and Central Valley Community have gained 3% and 27.8%, respectively, in the past six months. However, the Hercules Capital stock has lost 12.2% in the same time frame.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

MoneyGram International Inc. (MGI) : Free Stock Analysis Report

Hercules Capital, Inc. (HTGC) : Free Stock Analysis Report

Central Valley Community Bancorp (CVCY) : Free Stock Analysis Report

Byline Bancorp, Inc. (BY) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance