Molina Healthcare (MOH) Beats on Q1 Earnings, Ups '23 EPS View

Molina Healthcare, Inc. MOH reported first-quarter 2023 adjusted earnings per share (EPS) of $5.81, which beat the Zacks Consensus Estimate by 13.3% and our estimate of $5.14. The bottom line improved 18.6% year over year.

Total revenues of $8,149 million improved 4.9% year over year in the quarter under review. However, the top line missed the consensus mark by 1% and our estimate of $8,218.2 million.

It reported strong first-quarter earnings thanks to growing premiums, increased membership and new state contract wins. Yet, the positives were partially offset by an elevated expense level.

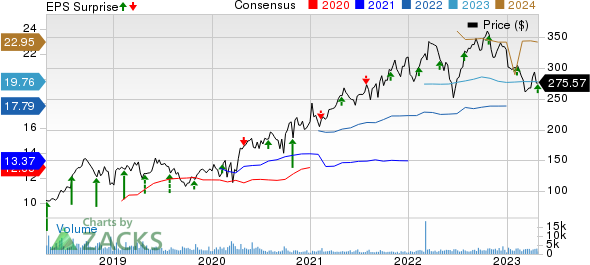

Molina Healthcare, Inc Price, Consensus and EPS Surprise

Molina Healthcare, Inc price-consensus-eps-surprise-chart | Molina Healthcare, Inc Quote

Quarterly Operational Update

Premium revenues of Molina Healthcare were $7,885 million, which rose 4.7% year over year, resulting from acquisitions and organic membership growth in its Medicaid and Medicare businesses. The figure fell behind the Zacks Consensus Estimate of $8,000 million and our estimate of $7,956 million.

Total operating expenses of $7,694 million climbed 4% year over year in the first quarter due to higher medical care costs, general and administrative expenses, and depreciation and amortization expenses. Our estimate for the metric was $7,812.6 million.

Interest expenses of $28 million remained flat year over year in the first quarter, lower than our estimate of $29.7 million.

MOH reported a net income of $321 million, which soared 24.4% year over year in the quarter under review.

The consolidated medical care ratio (medical costs as a percentage of premium revenues) or MCR came in at 87.1%, which remained consistent with the prior year’s figure, reflecting strong management of medical costs.

Adjusted general and administrative expense ratio deteriorated 10 bps year over year to 7.2%, reflecting increased business implementation spending in the quarter, ahead of contract wins.

As of Mar 31, total membership increased 4% year over year to roughly 5.3 million members. Strength across the Medicaid and Medicare businesses resulted in the upside partially offset by a weak Marketplace business. The reported figure beat the consensus mark by 2.4% and our estimate of 5 million.

Financial Update (as of Mar 31)

Molina Healthcare exited the first quarter with cash and cash equivalents of $4,554 million, which climbed from $4,006 million at 2022-end. Total assets of $13,371 million improved from $12,314 million at 2022-end.

Long-term debt of $2,177 million inched up from $2,176 million at 2022-end.

Total stockholders’ equity of $3,288 million rose 10.9% from the figure at 2022-end.

During the first quarter of 2023, MOH’s net cash provided by operating activities was $916 million. The figure skyrocketed nearly three-fold year over year due to the difference in timings of government payables and receivables, and also as a result of growth in operations.

2023 Guidance

The company raised the guidance for adjusted EPS, which is estimated to be a minimum of $20.25, implying a rise of around 13% from the 2022 reported figure of $17.92

The company had previously guided premium revenues to be roughly $32 billion, indicating an improvement of 4% from the 2022 reported figure of $30.9 billion.

Molina Healthcare total revenues were estimated to be $33 billion in 2023, suggesting 3.1% growth from the 2022 figure of $32 billion.

GAAP net income was earlier predicted to be $1.1 billion, which indicates a surge of 36% from the 2022 figure of $792 million.

Total membership at 2023-end was estimated at 5.1 million, down 3.8% from the 2022-end figure.

Consolidated MCR was expected at 88%, which remains in line with the 2022 figure.

Zacks Rank

Molina Healthcare currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Other Releases

Of the companies in the Medical – HMO space, that have reported their first-quarter results so far, the bottom lines of Humana Inc. HUM and UnitedHealth Group Incorporated UNH beat the Zacks Consensus Estimate, while the same for Centene Corporation CNC missed.

Humana reported first-quarter 2023 adjusted EPS of $9.38, which beat the Zacks Consensus Estimate by 1.4% but missed our estimate of $9.78. The bottom line climbed 16.7% year over year.

HUM’s quarterly results benefited from growing premiums coupled with solid segmental performances. Favorable trends of inpatient utilization added to the positives. However, the upside was partly hurt by an elevated operating expense level.

UnitedHealth Group has reported first-quarter 2023 adjusted earnings of $6.26 per share, which beat the Zacks Consensus Estimate of $6.24 and our estimate of $6.17. The bottom line improved from $5.49 reported a year ago.

UNH’s quarterly performance was driven by sustained membership growth in its UnitedHealthcare business. Strong expansion in value-based arrangements at the Optum Health segment also contributed to the upside. However, the upside was partly offset by elevated operating costs.

Centene Corporation reported first-quarter 2023 adjusted EPS of $2.11, which lagged the Zacks Consensus Estimate by 5.4%. Nevertheless, the bottom line advanced 15.3% year over year.

Revenues of CNC amounted to $38,889 million, which improved 4.6% year over year. The top line outpaced the consensus mark by 7.1%.

The quarterly results took a hit from escalating medical costs. Nevertheless, the downside was partly offset by a growing premium base stemming from solid membership growth within most of its business lines and numerous contract wins.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

UnitedHealth Group Incorporated (UNH) : Free Stock Analysis Report

Humana Inc. (HUM) : Free Stock Analysis Report

Molina Healthcare, Inc (MOH) : Free Stock Analysis Report

Centene Corporation (CNC) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance