Vaccine news helps stocks. What’s the money lesson?

Two weeks ago I interviewed the MD of Webjet, John Gusic, to try and work out what needed to happen to help his share price start regaining its old elevated level.

He said open borders locally and a vaccine internationally would be great for his business. This week his share price spiked over 18 per cent following a very positive vaccine story.

Yep, the news about Pfizer and its 90 per cent effective vaccine for the coronavirus has sparked a surge in some share prices, while others that have been darlings of the market have sold off. There’s a really important lesson here for stock players.

The current winners are linked to the vaccine, which is likely to help economies reopen towards normalcy in 2021. The losers, which were former winners, were those businesses that did well because of what’s now called the “stay at home trade”.

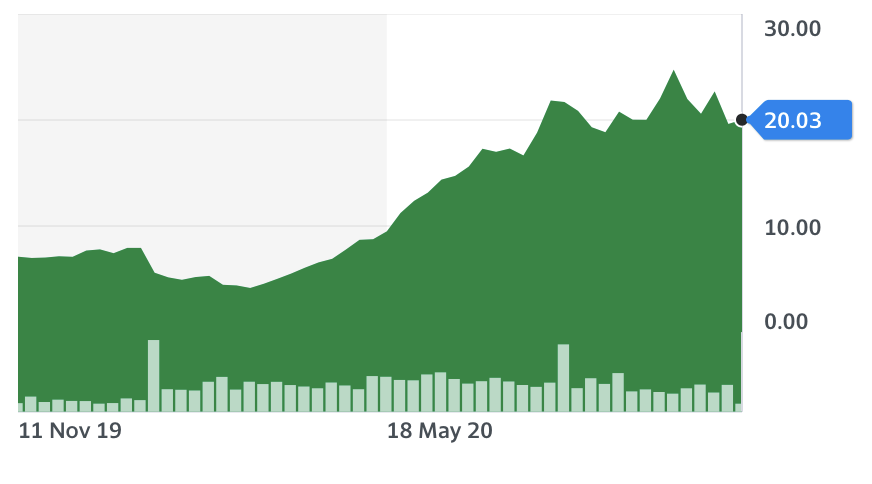

Let’s look at a stock such as kogan.com.au before the virus came to town and after (between late March and recently), as it tells a story that a budding stock player should understand.

The chart below shows the online retailer’s share price was falling and really was in the doldrums before late February brought us the news from the WHO that this virus was a pandemic.

Like all stocks, kogan.com fell but not so steeply as others because fund managers (professional players) realised that online businesses were going to be directly helped by workers being told to stay and work from home.

Kogan.com

From 9 March to last week, the share price went from $4.16 to $24.75. But now because the vaccine says a lot of us working from home will soon be going back to work in our offices, kogan.com will lose some business.

The share price has dropped to $20, which means the market says the business is now 23 per cent less valuable.

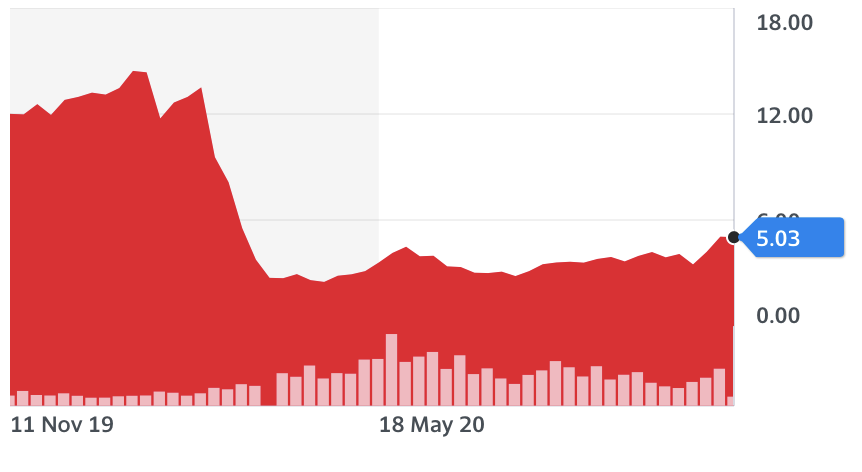

On the flip-side, let’s look at Webjet’s share price. The first chart shows a great one-month story, all linked to the vaccine and the reopening trade. Since 2 November, the gain is 44 per cent. Those buying before the vaccine news gave the share price another lift might have been professionals who thought eventually news like Pfizer’s was due sooner rather than later.

And some might have seen my interviews with John Gusic, Webjet’s CEO, or accessed others with similar insights.

Webjet one month

This one-year chart of Webjet shows what potential lies out there, but it could take time for it to happen.

Webjet one year

In January, Webjet was a $14 stock. If it can one day fly to those levels again, it will give those investing today a 180 per cent pay-off!

This isn’t advice but simply educational lessons about investing. And here they are in a nutshell:

• Buy good companies when the market is panicking.

• The charts can give you good reason to buy, sell or wait — look at them closely.

• Be careful buying at the top of the market or when the share price has spiked quickly.

• Be on the lookout for lots of information that will help you invest wisely.

• Don’t try and get rich quickly. Aim to get rich slowly, but sometimes it will come faster than you expect.

It’s why stock markets can be exciting.

Want to make next year your best yet? Join us for an Hour of Power at 10am AEDT Tuesday 24 November to discover 21 ways to make your money work for you in 2021. Registrations are now open.

Yahoo Finance

Yahoo Finance