Modern Fast Food Q1 Earnings: Wingstop (NASDAQ:WING) Simply the Best

As the Q1 earnings season wraps, let's dig into this quarter's best and worst performers in the modern fast food industry, including Wingstop (NASDAQ:WING) and its peers.

Modern fast food is a relatively newer category representing a middle ground between traditional fast food and sit-down restaurants. These establishments feature an expanded menu selection priced above traditional fast food options, often incorporating fresher and cleaner ingredients to serve customers prioritizing quality. These eateries are capitalizing on the perception that your drive-through burger and fries joint is detrimental to your health because of inferior ingredients.

The 6 modern fast food stocks we track reported a very strong Q1; on average, revenues beat analyst consensus estimates by 2.3%. Valuation multiples for many growth stocks have not yet reverted to their early 2021 highs, but the market was optimistic at the end of 2023 due to cooling inflation. The start of 2024 has been a different story as mixed signals have led to market volatility, but modern fast food stocks have shown resilience, with share prices up 8.8% on average since the previous earnings results.

Best Q1: Wingstop (NASDAQ:WING)

The passion project of two chicken wing aficionados in Texas, Wingstop (NASDAQ:WING) is a popular fast-food chain known for its flavorful and crispy chicken wings offered in a variety of sauces and seasonings.

Wingstop reported revenues of $145.8 million, up 34.1% year on year, topping analysts' expectations by 7.2%. It was a stunning quarter for the company, with an impressive beat of analysts' gross margin estimates and a solid beat of analysts' earnings estimates.

"Our fiscal first quarter 2024 showcased the momentum behind the Wingstop brand and the continued strength of our strategies, delivering 21.6% domestic same-store sales growth driven almost entirely by transaction growth," said Michael Skipworth, President & Chief Executive Officer.

Wingstop scored the biggest analyst estimates beat and fastest revenue growth of the whole group. The stock is up 11.5% since the results and currently trades at $429.22.

Read why we think that Wingstop is one of the best modern fast food stocks, our full report is free.

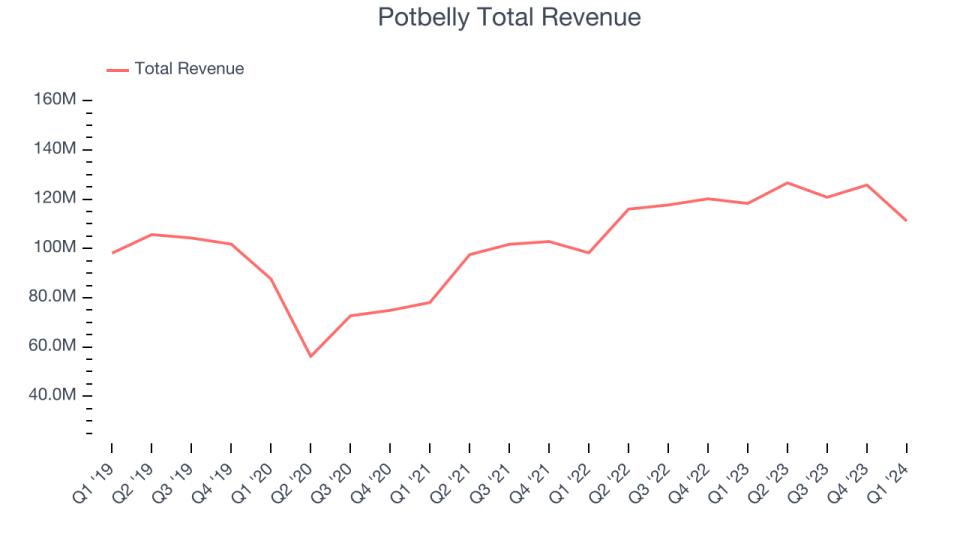

Potbelly (NASDAQ:PBPB)

With a unique origin story where the company actually started as an antique shop, Potbelly (NASDAQ:PBPB) today is a chain known for its toasty sandwiches.

Potbelly reported revenues of $111.2 million, down 6% year on year, outperforming analysts' expectations by 1.5%. It was a stunning quarter for the company, with an impressive beat of analysts' earnings and gross margin estimates.

Potbelly had the slowest revenue growth among its peers. The stock is down 24.2% since the results and currently trades at $7.52.

Is now the time to buy Potbelly? Access our full analysis of the earnings results here, it's free.

Slowest Q1: Sweetgreen (NYSE:SG)

Founded in 2007 by three Georgetown University alum, Sweetgreen (NYSE:SG) is a casual quick service chain known for its healthy salads and bowls.

Sweetgreen reported revenues of $157.9 million, up 26.2% year on year, exceeding analysts' expectations by 3.9%. It was a solid quarter for the company, with an impressive beat of analysts' gross margin estimates and full-year revenue guidance topping analysts' expectations.

Sweetgreen delivered the highest full-year guidance raise in the group. The stock is up 33.4% since the results and currently trades at $31.44.

Read our full analysis of Sweetgreen's results here.

Noodles (NASDAQ:NDLS)

Offering pasta, mac and cheese, pad thai, and more, Noodles & Company (NASDAQ:NDLS) is a casual restaurant chain that serves all manner of noodles from around the world.

Noodles reported revenues of $121.4 million, down 3.7% year on year, inline with analysts' expectations. It was a strong quarter for the company, with an impressive beat of analysts' gross margin estimates and a solid beat of analysts' earnings estimates.

Noodles had the weakest full-year guidance update among its peers. The stock is up 26.4% since the results and currently trades at $2.2.

Read our full, actionable report on Noodles here, it's free.

Shake Shack (NYSE:SHAK)

Started as a hot dog cart in New York City's Madison Square Park, Shake Shack (NYSE:SHAK) is a fast-food restaurant known for its burgers and milkshakes.

Shake Shack reported revenues of $290.5 million, up 14.7% year on year, falling short of analysts' expectations by 0.2%. It was a very strong quarter for the company, with an impressive beat of analysts' gross margin estimates and a solid beat of analysts' earnings estimates.

Shake Shack had the weakest performance against analyst estimates among its peers. The stock is down 12.1% since the results and currently trades at $90.81.

Read our full, actionable report on Shake Shack here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

Yahoo Finance

Yahoo Finance