MKS Instruments' (MKSI) Q3 Earnings Beat, Revenues Miss

MKS Instruments MKSI reported third-quarter 2019 adjusted earnings of $1.12 per share, which beat the Zacks Consensus Estimate by a whopping 26 cents but slumped 40.4% year over year.

Revenues of $462.5 million lagged the consensus mark of $471 million and declined 5.1% year over year.

Products revenues (83.5% of total revenues) were $386.2 million, down 9.4% from the year-ago quarter. Services revenues (16.5%) increased 25.3% year over year to $76.3 million.

Quarter Details

Revenues from the semiconductor market (48.2% of total revenues) decreased 14.1% year over year to $222.9 million.

Revenues from advanced markets (51.8% of total revenues) were $239.5 million, up 5.2% from the year-ago quarter.

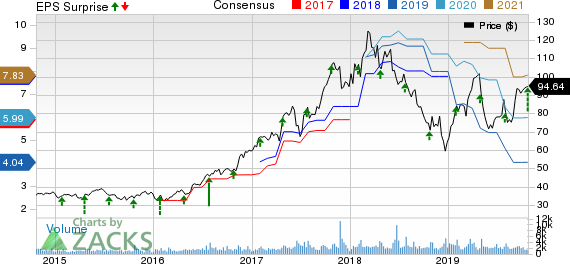

MKS Instruments, Inc. Price, Consensus and EPS Surprise

MKS Instruments, Inc. price-consensus-eps-surprise-chart | MKS Instruments, Inc. Quote

Segment-wise, Vacuum and Analysis (52% of total revenues) revenues were $240.7 million, down 15.9% year over year.

Light and Motion division revenues (37.3% of total revenues) were $172.6 million, down 14.2% year over year.

Equipment & Solutions segment revenues (12.1% of total revenues) were $55.9 million.

Operating Details

In the third quarter, MKS Instruments’ adjusted gross margin contracted 330 basis points (bps) on a year-over-year basis to 44.3%.

Adjusted EBITDA decreased 31.2% year over year to $98.2 million. Adjusted EBITDA margin was 21.2%, significantly down from 29.3% reported in the year-ago quarter.

Research & development and sales, general & administrative expenses, as a percentage of revenues, expanded 240 bps and 320 bps, respectively.

MKS Instruments reported non-GAAP operating income of $81.3 million, down 37% year over year. Adjusted operating margin was 17.6%, significantly down from 26.5% reported in the year-ago quarter.

Balance Sheet & Cash Flow

As of Sep 30, 2019, MKS Instruments had cash and short-term investments of $475 million compared with $460 million as of Jun 30, 2019.

Term-loan debt outstanding was $895 million after a payment of $50 million made during the third quarter of 2019.

MKS Instruments also paid out dividends worth $10.9 million or 20 cents per diluted share during the reported quarter.

Q4 Guidance

For the fourth quarter of 2019, MKS Instruments anticipates revenues between $445 million and $495 million. The Zacks Consensus Estimate is currently pegged at $451.4 million, indicating a decline of 2% from the figure reported in the year-ago quarter.

Non-GAAP earnings are expected between 85 cents and $1.19 per share. The consensus mark for earnings is currently pegged at 95 cents, suggesting a decline of 38.3% from the figure reported in the year-ago quarter.

Zacks Rank & Other Stocks to Consider

Currently, MKS Instruments sports a Zacks Rank #1 (Strong Buy).

NIC EGOV, Stoneridge SRI and Vonage Holdings VG are similar-ranked stocks in the broader computer and technology sector. You can see the complete list of today’s Zacks #1 Rank stocks here.

While NIC and Stoneridge are set to report quarterly results on Oct 30 and 31, respectively, Vonage Holdings is set to report on Nov 6.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2018, while the S&P 500 gained +15.8%, five of our screens returned +38.0%, +61.3%, +61.6%, +68.1%, and +98.3%.

This outperformance has not just been a recent phenomenon. From 2000 – 2018, while the S&P averaged +4.8% per year, our top strategies averaged up to +56.2% per year.

See their latest picks free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

MKS Instruments, Inc. (MKSI) : Free Stock Analysis Report

NIC Inc. (EGOV) : Free Stock Analysis Report

Vonage Holdings Corp. (VG) : Free Stock Analysis Report

Stoneridge, Inc. (SRI) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance