MGM Resorts' (MGM) BetMGM Announces Business Update

MGM Resorts International MGM and Entain Plc’s joint venture — BetMGM — provided business update and outlook for 2022.

BetMGM has a long-term growth target of 20% to 25% in U.S. sports betting and iGaming. Currently, the company is on track to achieve its target. The company is currently live in 19 jurisdictions.

In 2022, BetMGM anticipates net revenues from operations to be more than $1.3 billion. The company expects to achieve positive EBITDA in 2023. To drive growth, the company continues to invest in additional markets. MGM Resorts and Entain anticipate investing approximately $450 million in 2022.

BetMGM: A Major Growth Driver

BetMGM recently announced the launch of Borgata Bingo online in New Jersey. This marks the first bingo product built wholly for BetMGM by Entain. Borgata Bingo will provide players access to the first 75-ball real money online bingo product in the United States.

BetMGM is a major casino operator in New Jersey with a 30% gross gaming revenue (GGR) market share in October. The company has an estimated 32% national GGR market share across its live markets — New Jersey, West Virginia, Pennsylvania and Michigan.

BetMGM operations contributed $227 million to net revenues in the third quarter, up 17% sequentially. The operation results are encouraging compared with total net revenues of $178 million in 2020. In the third quarter, 16% of BetMGM's fresh players were from MGM and 42% of MGM M life sign-ups came from BetMGM. Considering the positive momentum in markets and its unique and unparalleled online and offline offerings, the company remains optimistic about long-term growth with revenue expectations of more than $1 billion in 2022. Over the long term, BetMGM’s EBITDA margins are expected to be 30-35%. MGM Resorts’ BetMGM recently announced that it has partnered with Gila River Hotels & Casinos and the Arizona Cardinals to expand its retail and online sports betting.

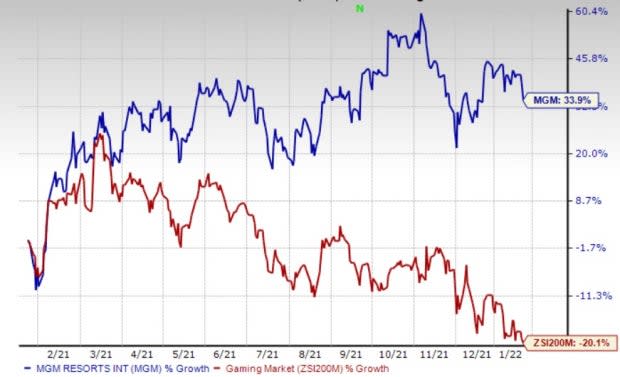

Coming to the price performance, shares of MGM Resorts have appreciated 33.9% in the past year against the industry’s decline of 20.1%. MGM Resorts carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Image Source: Zacks Investment Research

Key Picks

Some better-ranked stocks from the Zacks Consumer Discretionary sector include Guess, Inc. GES, Crocs, Inc. CROX and RCI Hospitality Holdings, Inc. RICK.

Guess sports a Zacks Rank #1. The company has a trailing four-quarter earnings surprise of 97%, on average. Shares of Guess have increased 8.4% in the past three months.

The Zacks Consensus Estimate for GES’s 2022 sales and EPS suggests growth of 38.6% and 4,342.9%, respectively, from the year-ago period’s levels.

Crocs flaunts a Zacks Rank #1. The company has a trailing four-quarter earnings surprise of 41.6%, on average. Shares of Crocs have appreciated 53.9% in the past year.

The Zacks Consensus Estimate for CROX’s 2022 sales and EPS indicates a rise of 48.8% and 25.8%, respectively, from the year-ago period’s levels.

RCI Hospitality sports a Zacks Rank #1. The company has a trailing four-quarter earnings surprise of 67.7%, on average. Shares of RCI Hospitality have surged 82.9% in the past year.

The Zacks Consensus Estimate for RICK’s 2022 sales and EPS suggests growth of 34.9% and 22.1%, respectively, from the year-ago period’s levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

MGM Resorts International (MGM) : Free Stock Analysis Report

Guess, Inc. (GES) : Free Stock Analysis Report

Crocs, Inc. (CROX) : Free Stock Analysis Report

RCI Hospitality Holdings, Inc. (RICK) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance