MetLife (MET) Unit to Manage 3M's $2.5B Pension Obligations

MetLife, Inc.’s MET unit, Metropolitan Tower Life Insurance Company, recently inked a deal with the American multinational conglomerate, 3M. As a result, the MetLife subsidiary will assume defined benefit pension obligations of around $2.5 billion and deliver annuity benefits to roughly 23,000 retirees and beneficiaries of the 3M Employee Retirement Income Plan.

A group annuity contract was bought from Metropolitan Tower Life this month. However, the monthly pension benefits received by retirees, their spouses and beneficiaries under 3M’s U.S. defined benefit pension plan will not undergo any alteration as a result of the latest agreement.

Only the monthly payment responsibilities will shift from the 3M’s defined benefit plan to the MetLife unit, which will commence paying and administering the retirement benefits of the abovementioned 23,000 retirees and beneficiaries from the very beginning of October 2024.

The latest move reinforces MetLife’s well-established risk management capabilities on the back of which it continues to get selected by companies to offer a regular stream of lifetime income to retirees, their spouses and beneficiaries, and provide them with a secure financial future.

Based on its pension risk transfer expertise, the MetLife unit continues to get deals similar to the latest one. An aging U.S. population implies an increasing number of persons attaining retirement age, which, in turn, is likely to provide the perfect ground for MET to capitalize on a growing pension risk transfer market.

In return for assuming full or a portion of pension liabilities under defined benefit plans, the insurer is usually entitled to a lump-sum premium payment. Growth in premiums, which remain the most significant contributor to an insurer’s top line, bodes well.

It is through the U.S.-based Retirement Income and Solutions (RIS) segment that MetLife distributes an array of life and annuity-based insurance and investment products to offer funding and financing solutions in a bid to equip institutional customers to alleviate and manage liabilities primarily linked with their employee benefit programs. Therefore, the move to assume the pension obligations of 3M may serve as a means to drive the performance of the RIS segment. Adjusted premiums, fees and other revenues of the unit advanced 25% year over year in the first quarter.

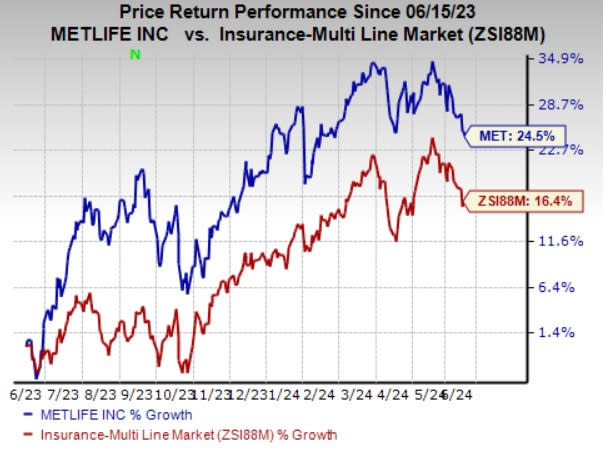

Shares of MetLife have gained 24.5% in the past year compared with the industry’s 16.4% growth. MET currently carries a Zacks Rank #3 (Hold).

Image Source: Zacks Investment Research

Stocks to Consider

Some better-ranked stocks in the insurance space are Palomar Holdings, Inc. PLMR, Reinsurance Group of America, Incorporated RGA and Skyward Specialty Insurance Group, Inc. SKWD. While Palomar sports a Zacks Rank #1 (Strong Buy), Reinsurance Group and Skyward Specialty carry a Zacks Rank #2 (Buy) each at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Palomar’s earnings surpassed estimates in each of the last four quarters, the average surprise being 15.10%. The Zacks Consensus Estimate for PLMR’s 2024 earnings indicates an improvement of 26% from the year-ago reported figure while the same for revenues implies growth of 32.5%. The consensus mark for PLMR’s earnings has moved 4% north in the past 30 days.

The bottom line of Reinsurance Group outpaced earnings estimates in each of the last four quarters, the average surprise being 19.48%. The Zacks Consensus Estimate for RGA’s 2024 earnings indicates an improvement of 3.9% from the year-ago reported figure while the same for revenues implies growth of 7.2%. The consensus mark for RGA’s earnings has moved 0.9% north in the past 30 days.

Skyward Specialty’s earnings surpassed estimates in each of the trailing four quarters, the average surprise being 30.45%. The Zacks Consensus Estimate for SKWD’s 2024 earnings indicates a rise of 31.8% year over year while the same for revenues implies an improvement of 25.8%. The consensus mark for SKWD’s earnings has moved 5.3% north in the past 60 days.

Shares of Palomar, Reinsurance Group and Skyward Specialty have gained 43.5%, 39.5% and 36.3%, respectively, in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

MetLife, Inc. (MET) : Free Stock Analysis Report

Reinsurance Group of America, Incorporated (RGA) : Free Stock Analysis Report

Palomar Holdings, Inc. (PLMR) : Free Stock Analysis Report

Skyward Specialty Insurance Group, Inc. (SKWD) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance