MetLife (MET) Q3 Earnings Miss, Revenues Beat Estimates

MetLife, Inc.’s MET third-quarter 2019 operating earnings of $1.27 per share missed the Zacks Consensus Estimate by 9.93%. The bottom line declined 8% year over year. Earnings suffered from increase in expenses, which offset revenue growth.

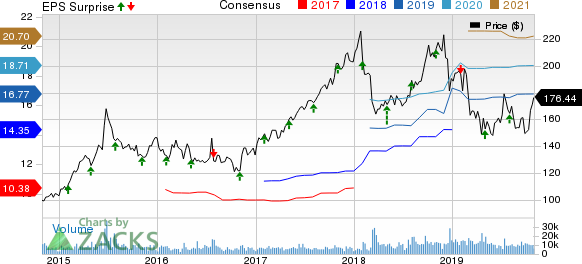

Cigna Corporation Price, Consensus and EPS Surprise

Cigna Corporation price-consensus-eps-surprise-chart | Cigna Corporation Quote

Behind the Headlines

The company generated operating revenues of $16.9 billion, up 3% year over year, and surpassed the Zacks Consensus Estimate by 3.4%.

Adjusted premiums, fees & other revenues, excluding pension risk transfer, grew 2% year over year to $11.2 billion. Net investment income of $4.6 billion increased 3% year over year.

Total expenses of $15.9 million were up 4.6% year over year due to higher policyholder benefits and claims, and other expenses.

Book value per share was $48.56, up 13% year over year.

Tangible return on equity was 16.4%, down 220 basis points year over year.

Quarterly Segment Details

United States

Adjusted earnings in this segment declined 11% year over year to $707 million due to unfavorable underwriting. Adjusted premiums, fees & other revenues were $6.1 billion, up 4% year over year.

Asia

Operating earnings of $349 million increased 33% year over year, driven by volume growth and favorable variable investment income. Adjusted premiums, fees & other revenues were $2.1 billion, down 3% on a constant-currency basis.

Latin America

Operating earnings were $155 million, down 4% year over year. Adjusted premiums, fees & other revenues were $967 million, up 8%, primarily driven by growth across the region.

Europe, the Middle East, and Africa (EMEA)

Operating earnings from EMEA decreased 2% year over year to $53 million, due to less favorable underwriting and higher taxes.

Adjusted premiums, fees & other revenues were $656 million, up 6% year over year on a constant-currency basis.

MetLife Holdings

Adjusted operating earnings from MetLife Holdings came in at $149 million, down 54% year over year.

Operating premiums, fees & other revenues were $1.3 billion, down 3% year over year.

Zacks Rank & Other Releases

MetLife currently has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here. Some other insurers that have recently reported earnings this season are W.R. Berkley Corp. WRB, The Progressive Corp. PGR and Chubb Ltd. CB, each beating their estimate by 26.5%, 6.8% and 2.3%, respectively.

Free: Zacks’ Single Best Stock Set to Double

Today you are invited to download our just-released Special Report that reveals 5 stocks with the most potential to gain +100% or more in 2020. From those 5, Zacks Director of Research, Sheraz Mian hand-picks one to have the most explosive upside of all.

This pioneering tech ticker had soared to all-time highs and then subsided to a price that is irresistible. Now a pending acquisition could super-charge the company’s drive past competitors in the development of true Artificial Intelligence. The earlier you get in to this stock, the greater your potential gain.

Download Free Report Now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

MetLife, Inc. (MET) : Free Stock Analysis Report

Chubb Limited (CB) : Free Stock Analysis Report

The Progressive Corporation (PGR) : Free Stock Analysis Report

W.R. Berkley Corporation (WRB) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance