This Metal Keeps the EV Industry Running

One of the most fascinating stories being told over the last several years is the uprising of electric vehicles (EVs).

After taking a glance under the hood, it’s easy to see why investors are so hyper-focused on the industry; the growth potential is nearly unbelievable.

When thinking of the EV industry, Tesla TSLA undoubtedly comes to the front of many minds, and for very valid reasons – the company is the undisputed leader in the realm, far ahead of any other competitor.

However, Tesla shares don’t fit the investing style of many investors, as large price swings occur.

Let’s take a step back and look at investing in the industry from a different angle.

A Different Approach

Many materials are needed to manufacture EVs, and companies don’t have in-house operations to provide every single one of these critical components (of course).

So, what materials does the EV industry rely on to facilitate production?

One material relied on heavily is lithium, a critical component of EV batteries.

Lithium is a non-ferrous metal, soft to the touch, and carries a white-silvery color. Due to its color and skyrocketing market value, many have coined it “white gold.”

And obviously, EVs need batteries to run.

This gives investors two options for EV exposure: buy shares of companies producing EVs, or buy shares of companies supplying materials related to EV production.

Two stocks – Sociedad Quimica Y Minera SQM and Albemarle ALB – would be excellent options for those who prefer exposure to the materials side.

Let’s take a closer look at each one.

Sociedad Quimica Y Minera

Sociedad Quimica Y Minera is one of the world's largest lithium producers, with one of the industry's least impactful water, carbon, and energy footprints.

Analysts have been bullish in their earnings outlook over the last several months, pushing the stock into a favorable Zacks Rank #2 (Buy).

Image Source: Zacks Investment Research

SQM’s lithium operations generated $1.8 billion in revenue in its latest quarter (Q2 2022), reflecting a steep 28% sequential increase and an almost unbelievable 1030% uptick from the year-ago quarter.

Year-over-year, SQM’s lithium sales volumes were up 41% on top of a triple-digit 701% price increase.

The boom in lithium has aided the company massively; earnings and revenue are forecasted to skyrocket by 530% and 260% Y/Y in FY22, respectively.

In addition, the company’s dividend metrics are nearly impossible to ignore; SQM’s annual dividend yields a sizable 5.2% paired with a rock-solid 4.4% five-year annualized dividend growth rate.

The company’s yield is notably higher than its Zacks Basic Materials average of an already steep 3.8%.

Image Source: Zacks Investment Research

Albemarle

Albemarle is a leading producer of highly-engineered specialty chemicals with three reportable segments: Lithium, Bromine, and Catalysts.

ALB sports the highly-coveted Zacks Rank #1 (Strong Buy), telling us it carries a favorable near-term earnings outlook.

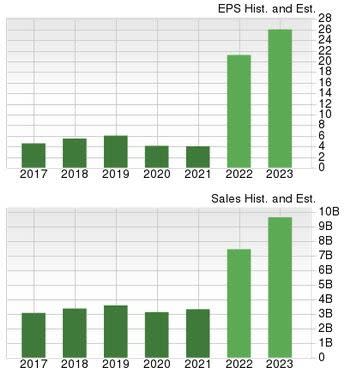

Image Source: Zacks Investment Research

In its latest quarter (Q2 2022), the company's Lithium segment saw net sales increase 178% year-over-year to $892 million, owing to favorable market pricing from contract renegotiations.

Like SQM, the surge in lithium prices has benefited Albemarle handsomely; the Zacks Consensus EPS Estimate of $21.28 for FY22 suggests Y/Y earnings growth of a triple-digit 425%.

And in FY23, estimates call for a further 24% expansion in the bottom line.

The earnings growth comes on top of forecasted revenue increases of 120% and 31% for FY22 and FY23, respectively.

Image Source: Zacks Investment Research

Further, ALB has a stellar earnings track record; the company has exceeded the Zacks Consensus EPS Estimate by double-digit percentages in three of its last four prints, with the average surprise being a sizable 24.2%.

Bottom Line

For those who find EV companies a bit too volatile for their liking but still want to invest in a booming industry, the approach of investing in companies that provide the necessary materials needed to keep EVs on the road is more than valid.

Lithium demand is here to stay for a long time, and companies with related operations have a tremendous opportunity to grow significantly.

Sociedad Quimica Y Minera SQM and Albemarle ALB are two titans in the lithium space, making them deserving of any investors’ attention that want to tap into the EV industry from a different angle.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Albemarle Corporation (ALB) : Free Stock Analysis Report

Sociedad Quimica y Minera S.A. (SQM) : Free Stock Analysis Report

Tesla, Inc. (TSLA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance