Merck (MRK) Sues US Government to Halt Drug Price Negotiations

Earlier this week, Merck MRK sued the United States government, claiming that the “Drug Price Negotiation Program” for Medicare, issued under the Inflation Reduction Act, 2022 (“IRA”), violates the Fifth and First Amendments to the Constitution.

The company claims that the program helps the federal government to unilaterally impose its preferred price, which is below the market rates. This violates the Fifth Amendment, which states that the government has to pay ‘just compensation’ when it takes private property for public use.

The company also claims that the government is forcing drugmakers to convey that they agree to the price set by the government. In case they do not agree, they will be forced to pay higher taxes and monetary penalties. This violates the First Amendment's protections of free speech.

The lawsuit, which was filed in the district court at Columbia, claims that the negotiation program is a ‘sham’ as it neither involves genuine ‘negotiation’ nor real agreements. Merck also called the whole situation a way to ‘legitimize government extortion’.

Merck expects that its flagship medications, namely cancer drug Keytruda and diabetes drugs, Janumet and Januvia, are likely to be included in the government’s price negotiation plan in the next few years. Per an Bloomberg article, the negotiations for just Keytruda will trim 5% from the company's revenues in the first year of bargaining.

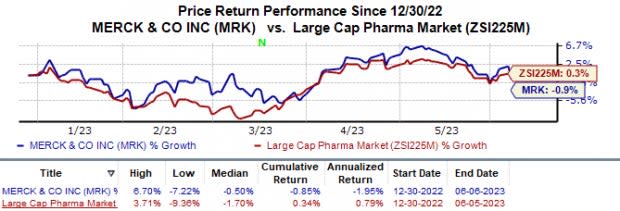

In the year so far, shares of Merck have dropped 0.9% against the industry‘s 0.3% rise.

Image Source: Zacks Investment Research

In the last year, the IRA allows Medicare to negotiate prices for a certain number of branded drugs. Per the Biden administration, Americans pay more for prescription medicines than any other country. The government is initiating such reforms to curb soaring drug prices and make them more affordable to the general public.

This lawsuit by Merck against the government could be one of the first but probably not the last as spokespersons for several large drugmakers have voiced against the government program.

Last month, Pfizer’s PFE chief executive officer (CEO) Albert Bourla called the program "negotiation with a gun to your head". In an interview with Reuters, the Pfizer CEO stated that negotiation is in fact a ‘price setting’. The Pfizer CEO also stated that he expects drugmakers to file lawsuits in an attempt to halt the government’s drug price plan.

In February, Novartis NVS CEO Vas Narasimhan also echoed similar words as Bourla. During one of Novartis’ conference calls, Narasimhan informed stakeholders that implementation of the negotiation program will put burden on a drugmaker’s research and development for new drugs, which generally take ample time and resources until the final product reaches the general population.

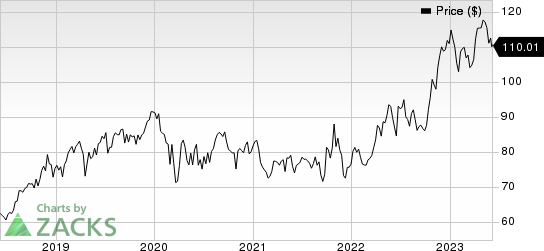

Merck & Co., Inc. Price

Merck & Co., Inc. price | Merck & Co., Inc. Quote

Zacks Rank & Key Picks

Merck carries a Zacks Rank #3 (Hold).A better-ranked stock in the overall healthcare sector is Novo Nordisk NVO, which sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past 60 days, the consensus estimate for Novo Nordisk’s 2023 and 2024 earnings per share has increased from $4.51 to $5.07 and $5.26 to $5.91, respectively. Shares of Novo Nordisk are up 18.8% in the year-to-date period.

Earnings of Novo Nordisk beat estimates in two of the last four quarters, met the mark one occasion while missing the mark on another. On an average, the company witnessed an average earnings surprise of 0.35%. In the last reported quarter, Novo Nordisk’s earnings met estimates.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Novartis AG (NVS) : Free Stock Analysis Report

Pfizer Inc. (PFE) : Free Stock Analysis Report

Novo Nordisk A/S (NVO) : Free Stock Analysis Report

Merck & Co., Inc. (MRK) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance