Medidata (MDSO) Earnings and Revenues Beat Estimates in Q2

Medidata Solutions, Inc. MDSO reported second-quarter 2019 adjusted earnings per share (EPS) of 48 cents, which surpassed the Zacks Consensus Estimate by 23.1%. The bottom line improved 11.6% from the year-ago figure.

Revenues of $180.5 million rose 15.7% year over year and edged past the consensus estimate of $180 million.

Per management, increased customer subscriptions drove the quarterly revenues.

For investors’ notice, the Zacks Rank #3 (Hold) company is getting acquired by French Technology stalwart Dassault Systèmes for a deal value of $5.8 billion. The acquisition is expected to close by the end of 2019.

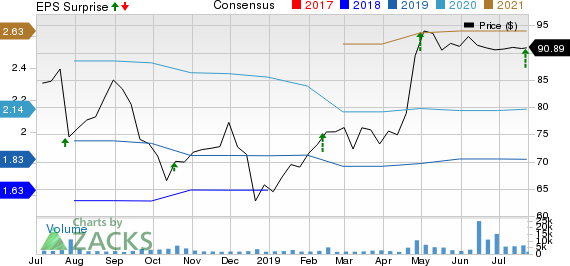

Medidata Solutions, Inc. Price, Consensus and EPS Surprise

Medidata Solutions, Inc. price-consensus-eps-surprise-chart | Medidata Solutions, Inc. Quote

Segment Details

Medidata reports through two major segments — Subscription and Professional Services.

Subscription revenues in the second quarter totaled $150 million, up 15% on a year-over-year basis.

Revenues at Professional services grossed $30.5 million, up 19.8% from the prior-year quarter.

Margins

In the second quarter, gross profit was $130.9 million, up 10.5% year over year. Though the gross margin was an impressive 72.5%, it contracted 340 basis points (bps).

Operating income in the second quarter was $1.9 million, significantly down from the year-ago quarter’s $12.8 million. Operating margin in the quarter was 1.1%, marking a substantial contraction from 8.2% in the year-ago quarter.

Adjusted operating income in the quarter was $41.3 million, up 13% year over year. This represents adjusted operating margin of 22.9%, down 60 bps.

Liquidity Position

The company exited the second quarter of 2019 with cash and marketable securities of $206 million, compared with $240.5 million at the end of 2018.

Summing Up

Medidata exited the second quarter on a strong note. It registered double-digit revenue growth on a year-over-year basis at both the Subscription and Professional segments. Customer subscription rose significantly in the quarter, which drove the top line. Focus on cloud-based services is worth a mention here. In fact, the company’s Medidata Cloud has witnessed developments in recent times. Management is optimistic about the SHYFT and Rave portfolios which also performed impressively in the quarter. However, the company did not issue any guidance since it is getting acquired by Dassault Systèmes. Meanwhile, the company’s declining gross and operating margins raise concern.

Key Picks

A few better-ranked stocks in the broader medical space are Hologic Inc. HOLX, DENTSPLY SIRONA Inc. XRAY and Teleflex Inc. TFX

Hologic is scheduled to release second-quarter 2019 results on Jul 31. The Zacks Consensus Estimate for the to-be-reported quarter’s adjusted EPS is pegged at 61 cents and the same for revenues stands at $834.6 million. The stock carries a Zacks Rank #2 (Buy).

DENTSPLY SIRONA is scheduled to release second-quarter 2019 results on Aug 2. The Zacks Consensus Estimate for second-quarter adjusted EPS and revenues is 62 cents and $1.03 billion, respectively. The stock sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Teleflex is expected to release second-quarter 2019 results on Aug 1. The Zacks Consensus Estimate for adjusted EPS for the to-be-reported quarter is $2.59 and the same for revenues is pegged at $636.7 million. The stock has a Zacks Rank of 2.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Medidata Solutions, Inc. (MDSO) : Free Stock Analysis Report

Teleflex Incorporated (TFX) : Free Stock Analysis Report

Hologic, Inc. (HOLX) : Free Stock Analysis Report

DENTSPLY SIRONA Inc. (XRAY) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance