MediaAlpha Inc (MAX) Q1 2024 Earnings: Surpasses Revenue Forecasts Despite Net Loss

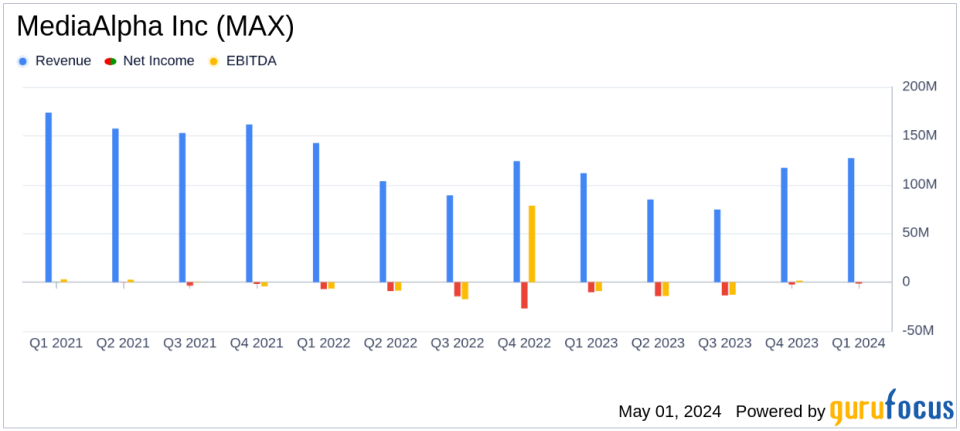

Revenue: Reported at $126.6 million, a 13% increase year-over-year, surpassing the estimate of $109.35 million.

Net Loss: Improved to $(1.5) million from $(14.6) million in the previous year, significantly better than the estimated loss of $6.23 million.

Earnings Per Share (EPS): Reported at $(0.02), an improvement from $(0.23) year-over-year, falling short of the estimated $(0.10).

Gross Margin: Increased to 18.7% from 16.5% in the first quarter of 2023, indicating improved profitability.

Transaction Value: Grew by 13% year-over-year to $219.1 million, with notable growth in Property & Casualty and Health verticals.

Adjusted EBITDA: More than doubled to $14.4 million from $7.3 million in the prior year, reflecting stronger operational efficiency.

Future Outlook: Expects significant growth in Transaction Value and Revenue for Q2 2024, projecting a year-over-year increase of up to 132% and 77% respectively at the midpoint of guidance ranges.

On May 1, 2024, MediaAlpha Inc (NYSE:MAX) released its first quarter financial results for the year, detailing a notable performance that exceeded market expectations in several key areas. The company announced these results through its 8-K filing, showcasing a robust increase in revenue and transaction value, particularly in its Property & Casualty (P&C) insurance vertical.

MediaAlpha Inc operates a technology platform that enhances the efficiency of insurance marketing by connecting carriers and consumers directly. The platform supports various insurance sectors, including property and casualty, health, and life insurance, primarily in the United States. It generates revenue through fees collected for each consumer referral on its platform.

Financial Performance Highlights

For Q1 2024, MediaAlpha reported a revenue of $126.6 million, a 13% increase from the previous year, surpassing the analyst's estimate of $109.35 million. The transaction value also saw a similar increase of 13% year-over-year, amounting to $219.1 million. This growth was significantly influenced by a 15% increase in the P&C sector, which aligns with the company's strategic focus and the rebounding auto insurance market.

Despite these gains, the company reported a net loss of $1.5 million, which is an improvement compared to a net loss of $14.6 million in the first quarter of 2023. This loss was significantly lower than the anticipated net loss of $6.23 million by analysts. The gross margin improved to 18.7%, up from 16.5% in the prior year, and the contribution margin increased to 21.9% from 19.2%.

Operational and Strategic Developments

MediaAlpha's CEO, Steve Yi, highlighted the substantial growth in the P&C vertical, driven by increased carrier marketing expenditures as the industry recovers from previous underwriting losses. The company's strategic positioning and operational efficiency have poised it well to capitalize on these market dynamics.

Looking ahead, MediaAlpha provided an optimistic financial outlook for Q2 2024, projecting a significant increase in transaction value and revenue in the P&C vertical, expected to grow between 60% to 70% compared to Q1 2024. This forecast underscores the company's confidence in maintaining its growth trajectory and strengthening its market position.

Challenges and Market Position

Despite the positive trends, MediaAlpha faces challenges, including market volatility and competitive pressures in the digital insurance marketplace. However, the company's robust platform and strategic focus on high-growth insurance verticals provide a competitive edge. The improved financial metrics, such as gross margin and contribution margin, reflect operational efficiencies and a strong value proposition to its partners.

Investor and Analyst Perspectives

Investors and analysts might view MediaAlpha's latest financial results as a strong indicator of the company's resilience and potential for sustained growth. The substantial reduction in net loss and the optimistic revenue forecast for the coming quarter are particularly noteworthy, suggesting a positive outlook for the company's operational and financial health.

For detailed financial figures and future projections, interested parties are encouraged to view the full earnings report and listen to the earnings call, available on the MediaAlpha Investor Relations website.

Overall, MediaAlpha's Q1 2024 performance reflects a company that is effectively navigating a complex market landscape, making strategic adjustments, and positioning itself for future profitability and growth.

Explore the complete 8-K earnings release (here) from MediaAlpha Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance