MD, CEO & Director Julian Fowles Just Bought 1,306% More Shares In Karoon Energy Ltd (ASX:KAR)

Even if it's not a huge purchase, we think it was good to see that Julian Fowles, the MD, CEO & Director of Karoon Energy Ltd (ASX:KAR) recently shelled out AU$101k to buy stock, at AU$1.01 per share. Even though that isn't a massive buy, it did increase their holding by 1,306%, which is arguably a good sign.

View our latest analysis for Karoon Energy

Karoon Energy Insider Transactions Over The Last Year

In the last twelve months, the biggest single purchase by an insider was when Independent Non-Executive Chairman Bruce Phillips bought AU$489k worth of shares at a price of AU$0.39 per share. Although we like to see insider buying, we note that this large purchase was at significantly below the recent price of AU$1.08. While it does suggest insiders consider the stock undervalued at lower prices, this transaction doesn't tell us much about what they think of current prices.

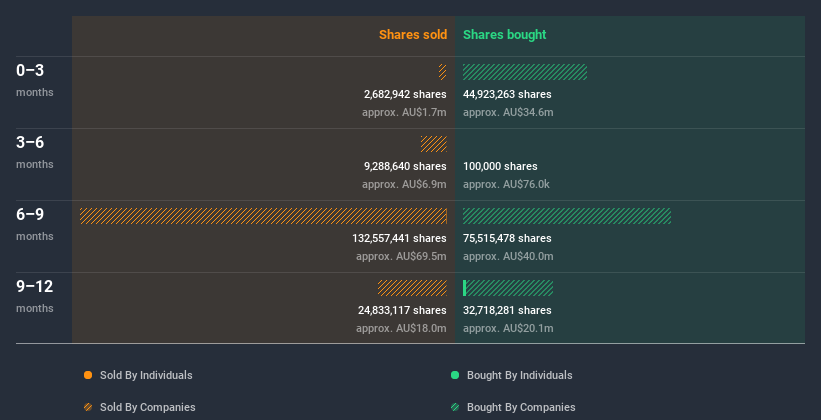

Over the last year, we can see that insiders have bought 1.71m shares worth AU$806k. But they sold 120.00k shares for AU$74k. Overall, Karoon Energy insiders were net buyers during the last year. The average buy price was around AU$0.47. To my mind it is good that insiders have invested their own money in the company. However, we do note that they were buying at significantly lower prices than today's share price. The chart below shows insider transactions (by companies and individuals) over the last year. By clicking on the graph below, you can see the precise details of each insider transaction!

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Insider Ownership of Karoon Energy

For a common shareholder, it is worth checking how many shares are held by company insiders. I reckon it's a good sign if insiders own a significant number of shares in the company. Karoon Energy insiders own about AU$33m worth of shares. That equates to 5.7% of the company. This level of insider ownership is good but just short of being particularly stand-out. It certainly does suggest a reasonable degree of alignment.

What Might The Insider Transactions At Karoon Energy Tell Us?

It's certainly positive to see the recent insider purchase. And an analysis of the transactions over the last year also gives us confidence. But we don't feel the same about the fact the company is making losses. When combined with notable insider ownership, these factors suggest Karoon Energy insiders are well aligned, and that they may think the share price is too low. So while it's helpful to know what insiders are doing in terms of buying or selling, it's also helpful to know the risks that a particular company is facing. To help with this, we've discovered 3 warning signs (1 doesn't sit too well with us!) that you ought to be aware of before buying any shares in Karoon Energy.

Of course Karoon Energy may not be the best stock to buy. So you may wish to see this free collection of high quality companies.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

Yahoo Finance

Yahoo Finance