McDonald's (MCD) Stock Down on Q3 Earnings & Revenues Miss

McDonald's Corporation MCD reported third-quarter 2019 results, wherein both earnings and revenues missed the Zacks Consensus Estimate. Following the results, the company’s shares are down 3.5% in pre-market trading session.

Adjusted earnings came in at $2.11 per share, which missed the consensus mark of $2.20. The bottom line also witnessed a decline of 2% from the prior-year quarter figure. Meanwhile, foreign currency translation had a negative impact of 3 cents per share on earnings in the quarter under review.

Revenues & Comps Discussion

In the third quarter, revenues of $5,340.6 million lagged the Zacks Consensus Estimate of $5,478 million. However, the figure improved 1% year over year. This uptrend can primarily attributed to increase in revenues from franchised restaurants. Moreover, on a constant-currency basis, the top line increased 3% on a year-over-year basis.

At company-operated restaurants, revenues declined 4% year over year to $2,416.6 million. However, the same at franchise-operated restaurants improved 5% to $3,014 million.

Global comps improved 5.9% driven by positive comparable sales across all segments. Notably, this marked the 17th consecutive quarter of positive comparable sales. In the second quarter of 2019, comps were up 5.7%.

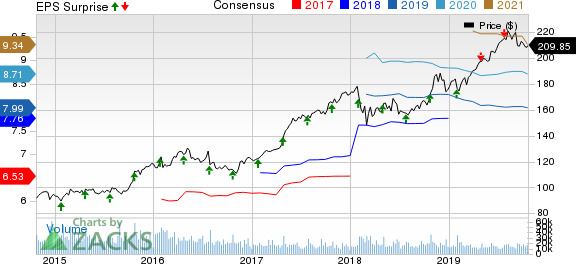

McDonald's Corporation Price, Consensus and EPS Surprise

McDonald's Corporation price-consensus-eps-surprise-chart | McDonald's Corporation Quote

Solid Comps Across Segments

U.S.: Comps at this segment grew 4.8% in the third quarter, lower than a 5.7% rise in the prior quarter. Deployment of Experience of the Future and strength in core menu items and successful national and local deal offerings drove the segment’s comps.

International Operated Markets: Comps at this segment rose 5.6% year over year, lower than prior quarter’s rise of 6.6%.

International Developmental Licensed Segment: The segment’s comparable sales increased 8.1% during the third quarter. In the preceding quarter, the segment’s comps rose 7.9%.

Other Information

McDonald's returned $2.4 billion to shareholders via stock repurchase and dividends. The company has returned $22.5 billion from its target of $25 million for the three-year period ending 2019.

Zacks Rank & Key Picks

McDonald's carries a Zacks Rank #3 (Hold).

Some better-ranked stocks worth considering in the same space include Brinker International, Inc. EAT, Chipotle Mexican Grill, Inc. CMG and Cracker Barrel Old Country Store, Inc. CBRL. All these stocks carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Brinker International’s earnings have surpassed the Zacks Consensus Estimate in three of the trailing four quarters, with average being 4.4%.

Chipotle Mexican Grill and Cracker Barrel Old Country Store has an impressive long-term earnings growth rate of 18.4% and 10%, respectively.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers “Most Likely for Early Price Pops.”

Since 1988, the full list has beaten the market more than 2X over with an average gain of +24.50% per year. So be sure to give these hand-picked 7 your immediate attention.

See them now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

McDonald's Corporation (MCD) : Free Stock Analysis Report

Cracker Barrel Old Country Store, Inc. (CBRL) : Free Stock Analysis Report

Chipotle Mexican Grill, Inc. (CMG) : Free Stock Analysis Report

Brinker International, Inc. (EAT) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance