McCormick (MKC) Stock Up as Q3 Earnings & Sales Rise Y/Y

McCormick & Company, Incorporated MKC posted third-quarter fiscal 2019 results, wherein earnings marked its third consecutive beat, while both top and bottom lines improved year over year. While earnings gained from improved sales and adjusted operating income, sales were aided by strength in the Consumer Business segment. Management narrowed its sales and adjusted operating income guidance, while raised guidance for the bottom line.

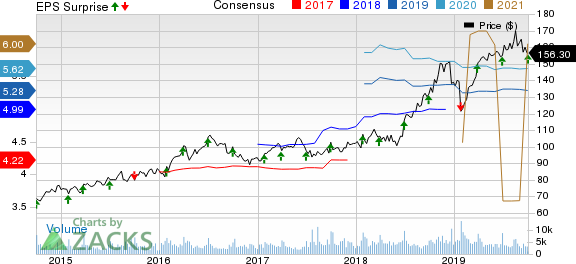

Notably, shares of the company gained 2.1% during the pre-market trading session. In fact, this Zacks Rank #3 (Hold) stock has gained 13% in the year-to-date period compared with the industry’s growth of 18.2%.

Quarter in Detail

Adjusted earnings of $1.46 per share improved 14% on a year-over-year basis and surpassed the Zacks Consensus Estimate of $1.29. The bottom-line growth was backed by increased adjusted operating income and reduced adjusted tax rate. However, foreign currency rates had an adverse impact on the bottom line.

This global leader of flavors and spices generated sales of $ 1,329.2 million that inched up close to 1% year over year, including currency headwinds of roughly 1%. The top line was mainly driven by growth at the Consumer Business segment. However, sales fell short of the Zacks Consensus Estimate of $1,336 million.

Gross margin expanded 100 basis points (bps) to 40.6% on the back of favorable mix and savings from the Comprehensive Continuous Improvement (CCI) program.

Adjusted operating income increased about 9% to $261 million, while it rose 10% at cc. Further, the adjusted operating margin expanded 160 bps to 19.7%. The upside can be accountable to savings from the CCI program, and improved sales and mix. This was somewhat countered by increased business transformation and brand marketing costs.

Segment Details

Consumer Business: Sales grew 3% to $794.2 million and rose 4% at cc on improvements in the Asia Pacific and the Americas regions. This, in turn, was driven by product introductions, enhanced distribution, and robust marketing and promotional plans. Sales in the Americas rose 4% at cc. This was mainly driven by volume growth and improved product mix. Sales in the Asia-Pacific region grew 15% at cc, mainly owing to solid performance in China. In the EMEA region, sales dipped 2% at cc due to unfavorable weather in Europe, adverse pricing and soft sales of private-label products.

Flavor Solutions: Sales in the segment dropped 2% from the prior-year quarter’s figure to $535 million. At cc, sales remained flat year over year as improved performance in EMEA was negated by weakness in Americas and the Asia Pacific. Sales in the EMEA region improved 4% at cc, driven by volume growth and favorable product mix. Sales in the Americas fell 2% at cc due to warehouse transition actions and adverse timing of product launches and promotions. Sales in the Asia-Pacific region edged down by 1% at cc due to unfavorable promotional timings and low-margin business exits.

Financial Update

McCormick exited the quarter with cash and cash equivalents of $162.9 million, long-term debt of $3,843.1 million and shareholders’ equity of $3,480.6 million. For the first nine months of fiscal 2019, net cash provided by operating activities was $494.6 million.

McCormick’s net debt-to-adjusted EBITDA ratio stood at 3.7x at the end of the reported quarter.

Fiscal 2019 Guidance

McCormick is pleased with its solid third-quarter show, marked by improved sales and margins. The company anticipates fiscal 2019 to be another strong year, courtesy of its robust brand portfolio, prudent strategies and concentration on profit generation.

Management revised its outlook for fiscal 2019. The company now expects sales growth of 1-2% (up 3-4% at cc) compared with the previous guidance of 1-3% (up 3-5% at cc). It expects to achieve top-line growth completely on an organic basis, as it anticipates no benefits from acquisitions. That said, sales are likely to be driven by efforts like product launches, and expanded distribution and marketing. Also, strong pricing is expected to drive sales and counter elevated costs.

Incidentally, the company anticipates to achieve cost savings of almost $110 million in fiscal 2019, which will be utilized for enhancing margins, sponsoring growth-oriented investments and offsetting high costs.

Moreover, McCormick now projects adjusted operating income to grow 6-7% (8-9% at cc), while it was earlier expected to rise 6-8% (8-10% at cc).

Adjusted earnings for fiscal 2019 are now projected to be $5.3-$5.35 per share, up from the previous guidance of $5.2-$5.3. The bottom line is expected to grow 9-10% at cc compared with 7-9% projected earlier. The consensus mark is currently pegged at $5.28.

Don’t Miss These Solid Food Stocks

MEDIFAST MED, with a Zacks Rank #2 (Buy), has delivered positive earnings surprise in the trailing three quarters. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Nomad Foods NOMD, with a Zacks Rank #2, has a long-term earnings per share growth rate of 9%.

J&J Snack Foods JJSF, with a Zacks Rank #2, has an impressive earnings surprise record.

Free: Zacks’ Single Best Stock Set to Double

Today you are invited to download our just-released Special Report that reveals 5 stocks with the most potential to gain +100% or more in 2020. From those 5, Zacks Director of Research, Sheraz Mian hand-picks one to have the most explosive upside of all.

This pioneering tech ticker had soared to all-time highs and then subsided to a price that is irresistible. Now a pending acquisition could super-charge the company’s drive past competitors in the development of true Artificial Intelligence. The earlier you get in to this stock, the greater your potential gain.

Download Free Report Now >>

Click to get this free report McCormick & Company, Incorporated (MKC) : Free Stock Analysis Report J & J Snack Foods Corp. (JJSF) : Free Stock Analysis Report MEDIFAST INC (MED) : Free Stock Analysis Report Nomad Foods Limited (NOMD) : Free Stock Analysis Report To read this article on Zacks.com click here. Zacks Investment Research

Yahoo Finance

Yahoo Finance