McCormick (MKC) Stock Up More Than 15% in 6 Months: Here's Why

McCormick & Company MKC is well-positioned on the back of growth endeavors, including strategic buyouts and effective cost-saving plans. The global leader in flavor capitalizes on healthy and flavorful cooking, increased digital engagement and purpose-minded practices. The robust recovery in the away-from-home demand bodes well.

Courtesy of such upsides, McCormick’s first-quarter fiscal 2022 sales increased 3% year over year and beat the Zacks Consensus Estimate. Sales from FONA (acquired in December 2020) contributed 1% to the top line. Sales growth reflects strength in its global flavor portfolio and effective pricing actions. Sales in the Flavor Solutions segment increased by 12% on the solid performance of packaged food and beverage customers and robust demand from the restaurant and other foodservice customers.

For fiscal 2022, McCormick expects to achieve sales growth of 3-5% year over year. Management anticipates sales to be driven by new products, brand marketing, category management and differentiated customer engagement. The company’s pricing actions and cost savings are likely to offset projected inflationary pressures. Adjusted earnings per share (EPS) are expected to be $3.17-$3.22, up from $3.05 reported in fiscal 2021, reflecting solid operating growth.

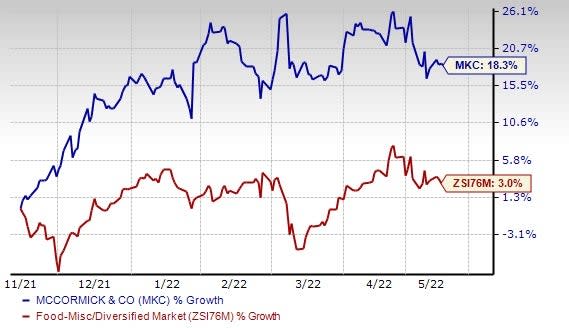

The Zacks Rank #2 (Buy) stock has increased 18.3% in the past six months compared with the industry’s 3% growth. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Image Source: Zacks Investment Research

Acquisitions: Key Driver

McCormick increased its presence through acquisitions to enhance its portfolio. In Dec 2020, McCormick bought a 100% stake in FONA International, LLC and some of its affiliates. FONA’s diverse portfolio helps McCormick bolster its value-add offerings and expand the flavor solutions segment into attractive categories. In November 2020, McCormick completed the acquisition of the parent company of Cholula Hot Sauce — a premium Mexico-based hot sauce brand. McCormick believes that the buyout of Cholula accelerates its growth potential across the condiment platform and widens the product portfolio in the hot sauce category.

Other Growth Efforts

McCormick regularly enhances products through innovation to stay competitive and tap the evolving demand for new flavors, spices and herbs. Aided by a sturdy brand image, McCormick enjoys strong retail acceptance for its new products. The company is on track to augment robust marketing support for its products. New product launches are an important part of the company’s growth. The company is optimistic about its robust pipeline of innovation in 2022. Management is leveraging its broad technology platform to develop clean label, organic and better-for-you solutions amid rising consumer’s health consciousness. The company remains well aligned with consumer demand for flavorful healthy eating and has developed a range of natural and organic offerings. In this regard, the company’s Flavor Real platform offers organic, non-GMO and gluten-free products. The acquisition of FONA has bolstered the company’s clean and natural platform.

Apart from this, McCormick focuses on saving costs and enhancing productivity through its ongoing Comprehensive Continuous Improvement (CCI) program. Started in 2009, McCormick’s CCI program helped the company to reduce costs and enhance productivity. It has used CCI savings to increase investments, thereby leading to higher sales and profits. Management expects to achieve CCI-led cost savings of nearly $85 million in 2022. We believe that, such cost savings along with the aforementioned upsides are likely to continue enhancing the company’s growth prospects in the future.

3 Hot Food Stocks

Some better-ranked stocks are Pilgrim’s Pride PPC, Sysco Corporation SYY and Medifast MED.

Pilgrim’s Pride, which produces, processes, markets and distributes fresh, frozen, and value-added chicken and pork products, sports a Zacks Rank #1. PPC has a trailing four-quarter earnings surprise of 31.4%, on average.

The Zacks Consensus Estimate for Pilgrim’s Pride’s current financial year EPS suggests growth of 42.1% from the year-ago reported number.

Sysco, which engages in the marketing and distribution of various food and related products, carries a Zacks Rank #2. SYY has a trailing four-quarter earnings surprise of 9.1%, on average.

The Zacks Consensus Estimate for Sysco’s current financial year sales and EPS suggests growth of 31.3% and 117.4%, respectively, from the year-ago reported number.

Medifast, which manufactures and distributes weight loss, weight management, healthy living products and other consumable health and nutritional products, currently carries a Zacks Rank #2. MED has a trailing four-quarter earnings surprise of 12.9%, on average.

The Zacks Consensus Estimate for Medifast’ current financial year sales and EPS suggests growth of 18.9% and 11.5%, respectively, from the year-ago reported figure.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

McCormick & Company, Incorporated (MKC) : Free Stock Analysis Report

Sysco Corporation (SYY) : Free Stock Analysis Report

Pilgrim's Pride Corporation (PPC) : Free Stock Analysis Report

MEDIFAST INC (MED) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance