McCormick (MKC) Down More Than 15% in 3 Months: Here's Why

McCormick & Company MKC is grappling with escalated cost inflation, which has been marring its margin performance for a while. The global leader in flavor is battling supply chain-related issues.

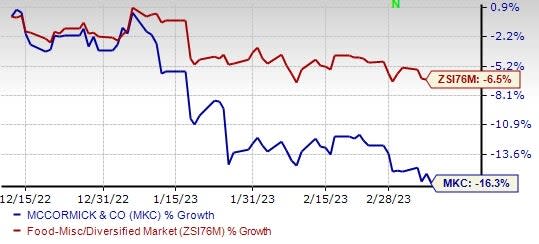

The factors mentioned above affected McCormick’s fourth-quarter fiscal 2022 results, with the top and the bottom line declining year over year and missing the Zacks Consensus Estimate. Shares of the Zacks Rank #4 (Sell) company have slumped 16.3% in the past three months compared with the industry’s 6.5% decline.

Let’s delve deeper.

Image Source: Zacks Investment Research

Dismal Q4 Trends

In the fourth quarter of fiscal 2022, Quarterly adjusted earnings of 73 cents per share declined from 84 cents in the year-ago quarter. The company’s sales of $1,695.7 million declined 2%. Results were impacted by the Kitchen Basics divestiture, reduced consumption in China due to the pandemic and cost inflation, among other factors.

In the fiscal fourth quarter, McCormick’s Consumer sales went down 8% to $1,037.8 million, and constant currency (cc) sales fell 4% due to soft volumes and mix. These were somewhat compensated by pricing actions across all three regions. The volume decline included the adverse impacts of the Kitchen Basics divestiture, reduced consumption in China due to the pandemic and the exit of a low-margin business across India and the Consumer business in Russia.

Margin Pressure

McCormick has been grappling with cost inflation for a while now. During fourth-quarter fiscal 2022, the company’s adjusted gross profit margin contracted 410 basis points to 36.8% due to escalated cost inflation, higher other supply-chain expenses and an adverse product mix. During the fiscal fourth quarter, operating income was $264 million, down from the $276 million reported in the year-ago quarter. The downside was caused by gross margin contraction, mainly in the Flavor Solutions unit. The adjusted operating income fell from $309 million to $278 million.

Supply Chain Bottlenecks

During the fourth quarter of fiscal 2022, McCormick continued to witness supply chain-related issues. In its last earnings call, management highlighted that it witnessed reduced operating leverage in the Consumer segment during the quarter. In the Flavor unit, the company has been witnessing dual running costs in the Flavor Solutions segment as it transitions production to the new UK Peterborough production unit. In addition, McCormick continues to incur escalated costs to meet the high demand in various parts of the business.

Wrapping Up

McCormick is on track to capitalize on a sustained shift to cooking more at home, higher digital engagement, clean and flavorful eating and trusted brands. The company regularly enhances products through innovation to remain competitive and tap the evolving demand. Management is on track with cost savings and enhancing productivity.

That being said, let’s see if these upsides can help McCormick counter the aforementioned hurdles.

Looking for Better-Ranked Food Bets? Check These Out.

Some top-ranked stocks are Post Holding POST, Lamb Weston LW and Mondelez International, Inc. MDLZ.

Post Holdings, which is a consumer-packaged goods company, sports a Zacks Rank #1 (Strong Buy) at present. Post Holdings has a trailing four-quarter earnings surprise of 34.8%, on average. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for POST’s current financial year’s sales and earnings suggest growth of 1.6% and 111.3%, respectively, from the year-ago reported numbers.

Lamb Weston, which is a frozen potato product company, currently carries a Zacks Rank #2 (Buy). LW has a trailing four-quarter earnings surprise of 52.6%, on average.

The Zacks Consensus Estimate for Lamb Weston’s current fiscal-year sales and earnings suggests an increase of 19.3% and 89.9%, respectively, from the year-ago reported number.

Mondelez International, which manufactures, markets, and sells snack food and beverage products, carries a Zacks Rank 2. MDLZ has a trailing four-quarter earnings surprise of 7.5%, on average.

The Zacks Consensus Estimate for Mondelez’s current financial year sales and earnings suggests growth of 9% and 7.5%, respectively, from the corresponding year-ago reported figures.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

McCormick & Company, Incorporated (MKC) : Free Stock Analysis Report

Mondelez International, Inc. (MDLZ) : Free Stock Analysis Report

Post Holdings, Inc. (POST) : Free Stock Analysis Report

Lamb Weston (LW) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance