Matador (MTDR) Beats on Q2 Earnings, Ups FY19 Oil Volumes

Matador Resources Company MTDR reported second-quarter 2019 adjusted earnings of 30 cents per share, beating the Zacks Consensus Estimate of 19 cents. However, the bottom line declined from the year-ago figure of 41 cents.

Meanwhile, revenues of $242 million improved from the year-ago level of $211 million and beat the Zacks Consensus Estimate of $210 million as well.

Better-than-expected results were supported by higher production volumes and lower lease operating costs, partially offset by weak commodity price realizations.

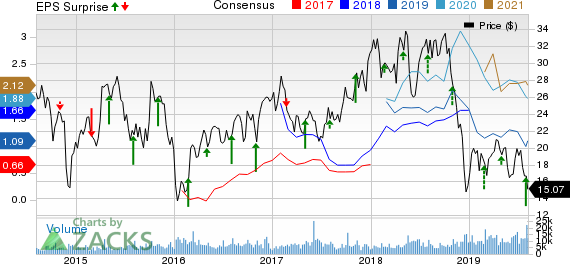

Matador Resources Company Price, Consensus and EPS Surprise

Matador Resources Company price-consensus-eps-surprise-chart | Matador Resources Company Quote

Production Rises

During second-quarter 2019, total production volumes averaged 5,577 thousand barrels of oil equivalent (MBOE) (comprising almost 60% oil), higher than 4,817 MBOE a year ago.

The average production volumes of oil were 36,767 barrels per day (Bbls/d), up from 29,740Bbls/d in second-quarter 2018. Natural gas production came in at 147.1 million cubic feet per day (MMcf/d), up from 139.2 MMcf/d a year ago. Record operation of six drilling rigs in the Delaware Basin aided the quarterly volumes of Matador.

Price Realization Falls

Realized price for oil (including derivatives) was recorded at $56.86 per barrel, down from $60.52 in the year-ago quarter. Also, natural gas price of $1.64 per thousand cubic feet was lower than $3.38 in the prior-year quarter.

Operating Expenses

The company’s production taxes, transportation and processing costs declined to $3.86 per BOE from $4.17 in the year-ago quarter. Further, lease operating costs decreased from $5.19 per BOE in second-quarter 2018 to $4.72. However, plant and other midstream services operating expenses rose to $1.51 per BOE in the quarter from the year-earlier number of $1.18.

Balance Sheet

As of Jun 30, 2019, Matador had cash and restricted cash of $84.8 million. Long-term debt totaled $1,483.6 million, which includes $205 million of borrowing under its credit agreement. Its debt-to-capitalization ratio is 44.6 %.

Capital Spending

The company spent $174 million through the second quarter of 2019. Matador allocated $159 million of the total amount to drill, equip and complete wells and $15 million toward midstream operations.

Guidance

Matador has updated its full-year guidance and expects oil production to increase to 13.3-13.45 million barrels from 12.9-13.3 million. Moreover, it anticipates full-year natural gas production to be in the range of 56-58 billion cubic feet (Bcf) higher than the prior projected band of 55-57 Bcf. And the total oil equivalent production is estimated to grow to 22.6-23.1 million BOE from 22-22.8 million BOE.

Zacks Rank & Key Picks

Matador carries a Zacks Rank #3 (Hold). Better-ranked players in the energy space include Transportadora De Gas Sa Ord B TGS, World Fuel Services Corporation INT and Oasis Midstream Partners LP OMP. While Transportadora and World Fuel Services sport a Zacks Rank #1 (Strong Buy), Oasis Midstream Partners holds a Zacks Rank #2 (Buy).

You can see the complete list of today’s Zacks #1 Rank stocks here.

Transportadora earnings beat the Zacks Consensus Estimate in the trailing four quarters.

World Fuel Services earnings beat the Zacks Consensus Estimate in the last four quarters.

Oasis Midstream Partners earnings beat the Zacks Consensus Estimate in two of the preceding four quarters.

Biggest Tech Breakthrough in a Generation

Be among the early investors in the new type of device that experts say could impact society as much as the discovery of electricity. Current technology will soon be outdated and replaced by these new devices. In the process, it’s expected to create 22 million jobs and generate $12.3 trillion in activity.

A select few stocks could skyrocket the most as rollout accelerates for this new tech. Early investors could see gains similar to buying Microsoft in the 1990s. Zacks’ just-released special report reveals 7 stocks to watch. The report is only available for a limited time.

See 7 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

World Fuel Services Corporation (INT) : Free Stock Analysis Report

Transportadora De Gas Sa Ord B (TGS) : Free Stock Analysis Report

Matador Resources Company (MTDR) : Free Stock Analysis Report

Oasis Midstream Partners LP (OMP) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance