Mastercard's (NYSE:MA) investors will be pleased with their solid 106% return over the last five years

The most you can lose on any stock (assuming you don't use leverage) is 100% of your money. But when you pick a company that is really flourishing, you can make more than 100%. For instance, the price of Mastercard Incorporated (NYSE:MA) stock is up an impressive 101% over the last five years.

So let's assess the underlying fundamentals over the last 5 years and see if they've moved in lock-step with shareholder returns.

View our latest analysis for Mastercard

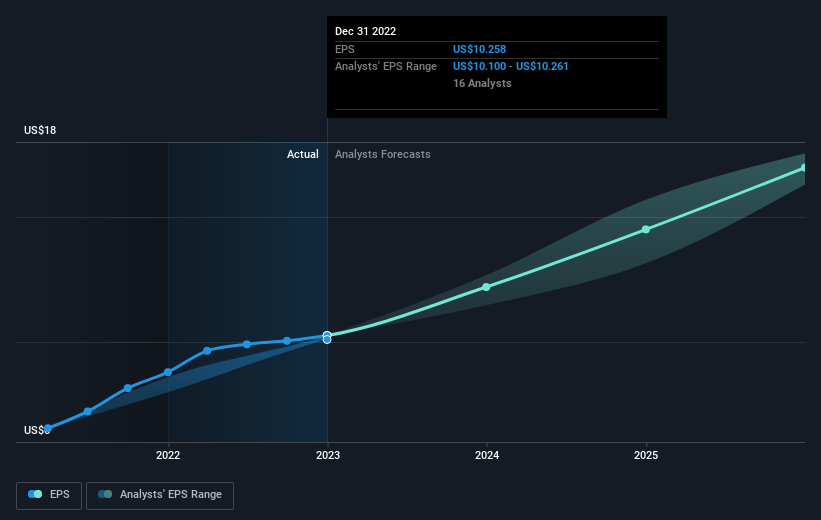

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

Over half a decade, Mastercard managed to grow its earnings per share at 23% a year. The EPS growth is more impressive than the yearly share price gain of 15% over the same period. So one could conclude that the broader market has become more cautious towards the stock.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

We know that Mastercard has improved its bottom line lately, but is it going to grow revenue? Check if analysts think Mastercard will grow revenue in the future.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. As it happens, Mastercard's TSR for the last 5 years was 106%, which exceeds the share price return mentioned earlier. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

It's nice to see that Mastercard shareholders have received a total shareholder return of 1.4% over the last year. Of course, that includes the dividend. However, that falls short of the 16% TSR per annum it has made for shareholders, each year, over five years. The pessimistic view would be that be that the stock has its best days behind it, but on the other hand the price might simply be moderating while the business itself continues to execute. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Take risks, for example - Mastercard has 1 warning sign we think you should be aware of.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here

Yahoo Finance

Yahoo Finance