Mastercard Inc (MA) Q1 2024 Earnings: Navigating Analyst Expectations with Strong Revenue and ...

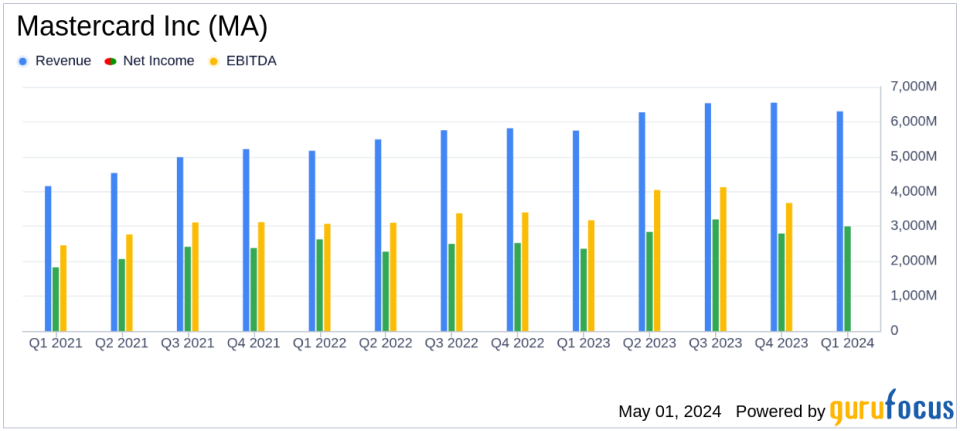

Reported Net Income: $3.0 billion, a 28% increase year-over-year, slightly below the estimate of $3.030 billion.

Diluted EPS: $3.22, up 30% from the previous year, falling short of the estimated $3.24.

Net Revenue: $6.3 billion, marking a 10% increase from the previous year, aligning closely with the estimate of $6.338 billion.

Operating Margin: Improved to 56.8% from 54.6% last year, reflecting better operational efficiency.

Adjusted Net Income: Adjusted to $3.1 billion, a 16% increase year-over-year, showcasing strong underlying business performance.

Adjusted Diluted EPS: Reached $3.31, an 18% increase compared to the prior year, indicating robust profit growth per share.

Share Repurchase: Repurchased 4.4 million shares at a cost of $2.0 billion, demonstrating ongoing commitment to returning value to shareholders.

On May 1, 2024, Mastercard Inc (NYSE:MA) disclosed its first quarter financial outcomes through its 8-K filing, revealing a robust performance with net income of $3.0 billion and diluted earnings per share (EPS) of $3.22. These figures closely align with analyst expectations which projected an EPS of $3.24 and a net income of $3.030 billion. The global payment giant also reported a significant 10% increase in net revenue, reaching $6.3 billion for the quarter.

Mastercard, a leading technology company in the global payments industry, continues to thrive by leveraging its extensive network that processed approximately $9 trillion in transaction volume in 2023. Operating across more than 200 countries and dealing in over 150 currencies, the company benefits from a diverse and expansive market presence.

Quarterly Financial Highlights

The reported quarter saw a 10% increase in net revenue year-over-year, amounting to $6.3 billion, which was supported by an 11% growth on a currency-neutral basis. This revenue boost is attributed to significant expansions in gross dollar volume and purchase volume, which both saw an increase of 10% and 11% respectively, on a local currency basis.

Operating income for the quarter was $3.6 billion, marking a 15% increase from the previous year, with an operating margin improvement from 54.6% to 56.8%. The effective income tax rate was reduced to 15.4% from 17.2% in the previous year, contributing to the net income growth of 28% to reach $3.0 billion.

Strategic Moves and Market Dynamics

CEO Michael Miebach highlighted the continuous growth in revenue and earnings, driven by healthy consumer spending and strong growth in cross-border volume, which surged by 18% year-over-year. Mastercard's strategic focus on scaling innovative technologies like tokenization has been pivotal in enhancing the security and simplicity of payments, factors that are increasingly influencing consumer and partner choices.

The company also reported a 16% increase in value-added services and solutions net revenue, reflecting strong demand for Mastercard's consulting, marketing services, loyalty solutions, and fraud and security capabilities. This segment's growth, however, was slightly tempered by slower growth in other solutions.

Operational and Financial Challenges

Despite the positive growth metrics, Mastercard faced increased operating expenses, which rose by 5% primarily due to higher general and administrative costs. Adjusted operating expenses also saw a 9% increase on a currency-neutral basis. Additionally, the company continues to navigate a complex regulatory environment and competitive pressures in the global payments landscape.

Mastercard's commitment to returning capital to shareholders remained strong, with $2.0 billion spent on repurchasing 4.4 million shares and $616 million paid in dividends during the quarter. The company's proactive capital management strategies are crucial in maintaining investor confidence and supporting share price stability.

Outlook and Forward Movements

Looking ahead, Mastercard is poised to continue its growth trajectory, supported by strategic investments in technology and a robust operational framework. The company's performance is indicative of its resilient business model and ability to adapt to changing market dynamics, ensuring sustained growth and profitability in the competitive payments industry.

For detailed financial figures and further information, stakeholders and interested parties are encouraged to review the full earnings report and join the financial results conference call hosted by Mastercard.

Explore the complete 8-K earnings release (here) from Mastercard Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance