Masimo (MASI) Provides FY22 View, Preliminary FY21 Results Solid

Masimo Corporation MASI announced preliminary financial results for full-year 2021 on Jan 11. Following this release, shares of the company are down 0.5% till the last trading.

The company is scheduled to release the Q4 and 2021 results on Feb 15 after the closing bell.

Prelim FY21 in Detail

As per the preliminary report, full-year product revenues are likely to be $1,235-$1,240 million, up 8-8.4% on a reported basis from comparable figures in 2020. The Zacks Consensus Estimate of $1.23 billion lies below the preliminary figure.

At constant exchange rate (“CER”), full-year product revenues are likely to improve by 7.3-7.7%.

Masimo expects its full-year shipments of non-invasive technology boards and instruments to be around 288,000.

Per the company, the adjusted earnings per share (“EPS”) for 2021 are likely to be $3.88. The Zacks Consensus Estimate of $3.88 is in line with the preliminary figure.

FY22 Guidance

Masimo has initiated its financial outlook for full-year 2022.

The company expects its product revenues for the full year to be $1,350 million, reflecting reported growth of 8.9-9.3%. The Zacks Consensus Estimate of $1.34 billion lies below the company’s projections.

Masimo’s total product revenue projections also indicate growth of 9.4-9.9% at CER.

The company expects its adjusted EPS for 2022 to be $4.33. The Zacks Consensus Estimate of $4.33 lies in line with the company’s outlook.

Our Take

Masimo’s impressive preliminary full-year performance projections raise our optimism. The company had also announced Dual SET Pulse Oximetry for Root — a highly versatile patient monitoring and connectivity hub — in November 2021. The first application of Dual SET Oximetry is a significant advancement to Masimo SET-guided critical congenital heart disease (“CCHD”) screening, with the CE marking and European launch of the Masimo SET MOC-9 module and the addition of the Eve CCHD Newborn Screening Application for Root. Masimo had also announced a slew of favorable studies regarding its products during the fourth quarter as well as throughout the year. These activities raise optimism on the stock.

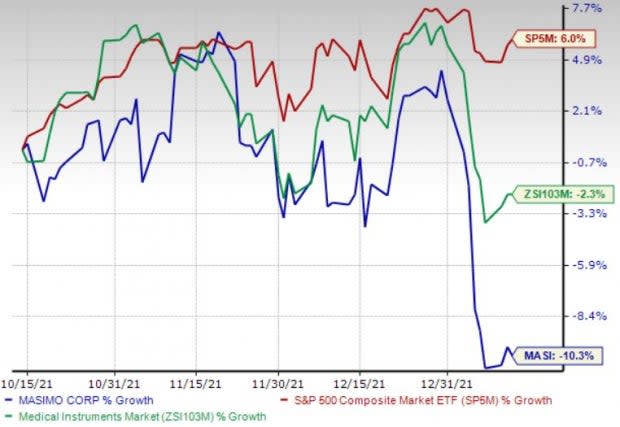

Price Performance

Shares of the company have lost 10.3% compared with the industry’s 2.4% fall over the past three months. The S&P 500 has gained 5.9% within the same time frame.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

Currently, Masimo carries a Zacks Rank #3 (Hold).

A few stocks from the broader medical space that investors can consider are AMN Healthcare Services AMN, Cerner Corporation CERN and Catalent, Inc. CTLT.

AMN Healthcare has an estimated long-term growth rate of 16.2%. AMN’s earnings surpassed estimates in the trailing four quarters, the average surprise being 19.51%. It currently flaunts a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

AMN Healthcare has gained 5.1% against the industry’s 19.3% fall over the past three months.

Cerner, carrying a Zacks Rank #2 (Buy), has an estimated long-term growth rate of 13.3%. CERN’s earnings surpassed estimates in three of the trailing four quarters, the average surprise being 3.21%.

Cerner has gained 28.6% against the industry’s 12.3% fall over the past three months.

Catalent has an estimated long-term growth rate of 16.9%. CTLT’s earnings surpassed estimates in the trailing four quarters, the average surprise being 9.88%. It currently sports a Zacks Rank #1.

Catalent has lost 10.5% compared with the industry’s 9.2% fall over the past three months.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Cerner Corporation (CERN) : Free Stock Analysis Report

Masimo Corporation (MASI) : Free Stock Analysis Report

AMN Healthcare Services Inc (AMN) : Free Stock Analysis Report

Catalent, Inc. (CTLT) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance